Equity long/short fund managers seek to deliver an absolute return above cash. They do this through buying (going long) companies where they think the share prices will rise and selling (going short) companies where they think the share prices will fall.

They typically do this through entering equity derivative positions with a network of brokers. These derivative agreements enable funds to either receive profits or pay losses on each position, based on the stock’s performance.

As the derivative agreements require the fund to only post a fraction of the overall exposure as collateral, equity long/short funds are able to keep the majority of their own assets invested in money markets, receiving close to the overnight interest rate.

It is thanks to this structure that the funds are typically able to earn money market, or near money market, returns, before then seeking alpha (excess returns) on top of this through their long and short positions. These return components often make equity long/short funds compelling replacements for cash or lower-risk bond holdings.

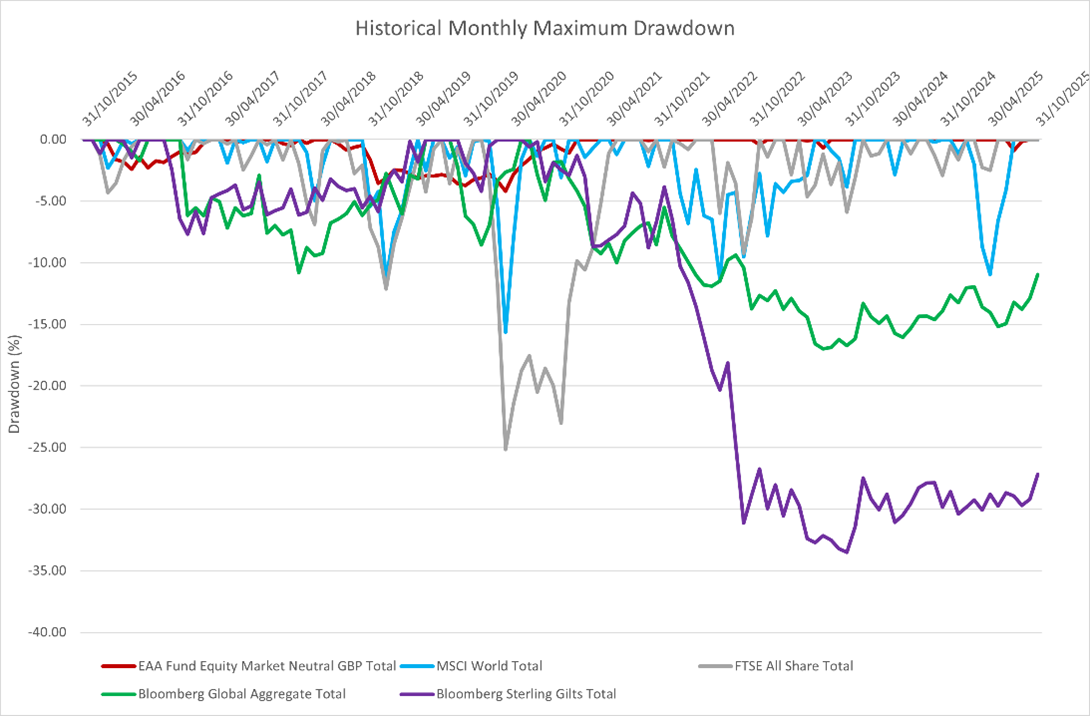

Drawdowns

As these funds are often held as a step out of cash, another important feature is that they minimise drawdowns (falls from a fund’s peak net asset value). The chart below shows the sector has done a good job of doing just this over the past 10 years.

Maximum drawdown of equity long/short sector versus equity and bond markets

Source: AJ Bell

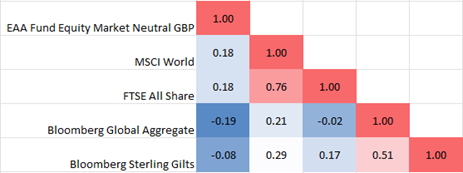

Correlations

Alongside the return element, another key feature investors look for in absolute return funds is minimal, if not negative, correlation to other markets (both equities and bonds).

This absence of correlation gives investors confidence that these funds can provide genuine diversification, and ideally even deliver positive returns, when conventional markets are selling off.

The chart below shows the low correlation the sector has delivered over the past 10 years.

10-year correlation of equity long/short sector versus equity and bond markets

Source: AJ Bell

To have a chance of being genuinely uncorrelated, equity long/short funds must have a low net exposure (long positions – short positions), ideally 0%. Where a fund has a high net exposure, of 20% or more, it will typically be correlated with equity markets and therefore move in the same direction, albeit to a lesser degree.

Funds with higher net exposure may perform better in equity bull markets but typically do not protect when equity markets sell off.

Alongside the overall net exposure, it is also worth considering a fund’s net exposure to specific factors (e.g. quality/growth/value), sectors (e.g. tech, healthcare, materials) and geographic regions.

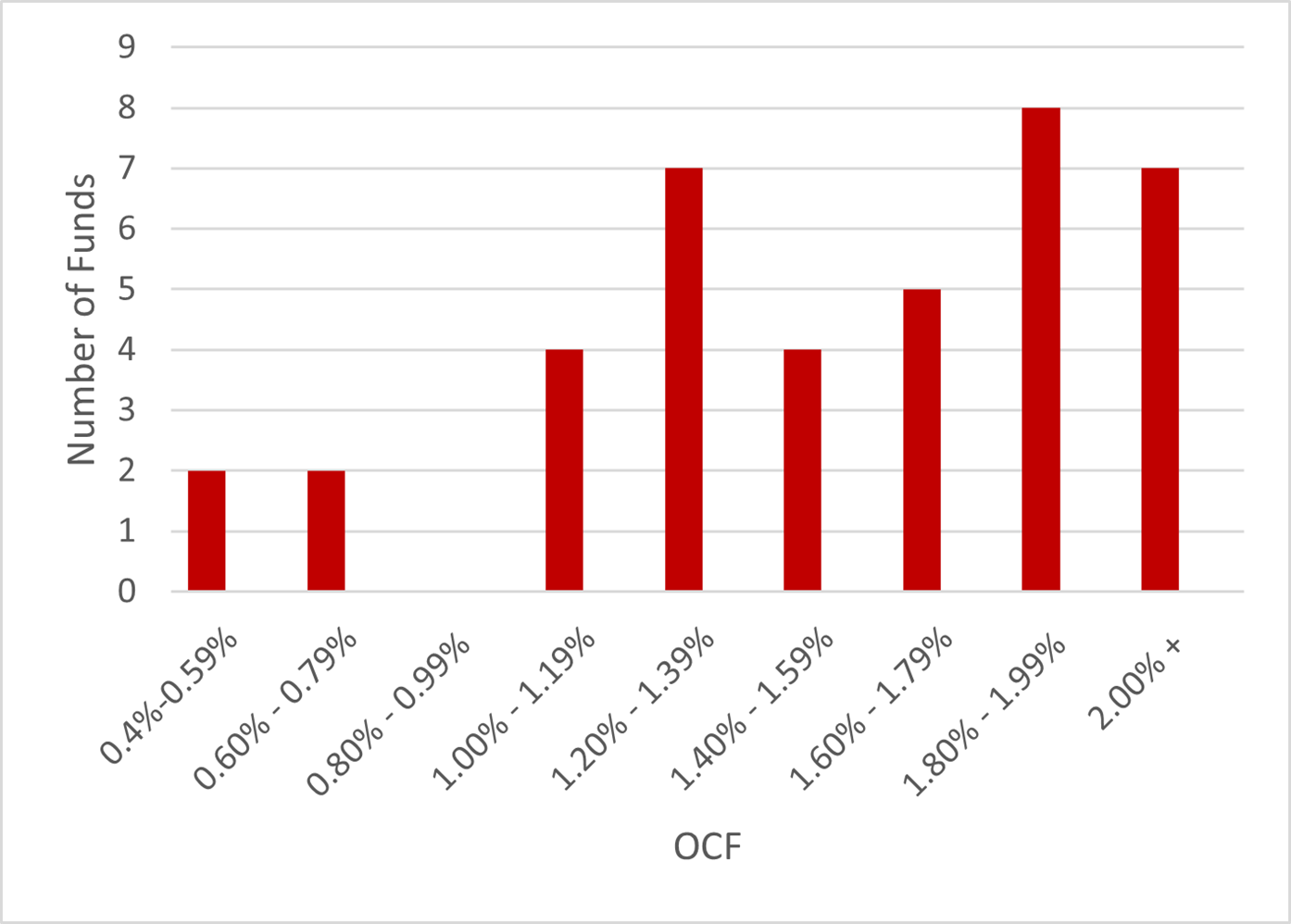

Cost

Successful long/shorting is a rare skill and, depending on the markets invested in, can be capacity constrained. Investors therefore need to be aware that fees are typically high.

OCF of funds in EEA Equity Market Neutral Category

Source: AJ Bell

Performance fees are also common within the sector, around 15-20%, and investors would be wise to ensure these performance fees are paid above a cash hurdle rate, rather than on the fund’s net asset value (NAV).

Funds to consider

Premier Miton Tellworth UK Select has been managed by Tellworth since 2019, with current managers John Warren and Johnnie Smith looking to maintain a factor-neutral profile by going long and short, UK large- and medium-sized companies.

They typically run the fund with a close to 0% net exposure and a gross exposure of 100-150%. In recent years they have increased the fund’s gross exposure as both their stock ideas and confidence in the process has increased.

The team believe that both long and short positions come down to having good opinions on companies. Their long book is typically made up of companies that have earnings momentum, are undervalued or are in a recovery phase. Their single stock short positions on the other hand look for the opposite factors.

The fund has a 15% performance fee for annual returns above both SONIA and a high watermark. However, transaction costs are typically kept low due to the heavy use of equity derivatives in the fund.

Jupiter Merian Global Equity Absolute Return has been managed by the same systematic team for almost two decades as part of Jupiter's wider franchise.

The investment process is informed by an in-house quantitative model, which determines how the portfolio should be weighted towards five investment factors (valuation, growth, quality, sentiment and trends). This is informed by uncertainty and optimism signals in the market.

It is then managed within strict risk parameters, 6% annual volatility, 200% gross exposure (100% long and 100% short) and 0% net exposure, as well as a neutral exposure to major geographic regions.

Manager Amadeo Alentorn and his team evaluate approximately 7,000 global stocks against these five categories and determine the most efficient return profile for around 400 long and 400 short positions based on which stocks screen the best, and the worst, across the categories.

The model continues to undergo constant enhancements, with arguably the most notable being the inclusion of more sentiment factors post 2020, as the model missed strong sentiment trends in markets, which led to large losses in the fund in the preceding years.

The fund carries a 20% performance fee for annual returns above both the Bank of England base rate and a high watermark.

Paul Angell is head of investment research at AJ Bell. The views expressed above should not be taken as investment advice.