Emerging markets had a bruising start to the year, with the asset class selling off sharply in the spring as uncertainty around US trade policy hit risk appetite, but they recovered strongly in the months that followed, reinforcing for some managers a long-held view that the most uncomfortable assets are often the ones with the most attractive long-term opportunities.

At the heart of that argument is valuation. Stefan Magnusson, head of emerging markets investing at Orbis Investments, said investors’ reluctance to return to emerging markets reflects a misplaced faith in backwards-looking measures of risk.

“Traditional risk measures don’t paint a pretty picture for emerging markets,” he said. “Over the past 15 years, returns have severely lagged their developed-market peers and have also been more volatile. For a rational investor with a reasonable level of risk aversion, emerging markets have been an uncomfortable place to invest.”

That discomfort has driven investors towards the apparent safety of the US market, which gives a smoother ride when looking through the lens of backwards-looking risk measures.

“But at today’s prices, the deeper risk may not be in owning emerging markets but in avoiding them,” he said.

Valuations

On a cyclically adjusted basis, US equities trade at close to 38x earnings, near record levels, while emerging markets trade at around 16x, below their long-term average and at a discount of roughly 60%, Magnusson noted.

“When US shares have been valued at this multiple historically, they reliably returned just low single-digits nominally over the next decade,” he said. Emerging markets, by contrast, offer a much wider range of outcomes that “skews more positively”, with forward returns historically ranging from low single digits to more than 15% per annum.

Those starting points matter because they shape long-term outcomes far more reliably than near-term macroeconomic forecasts. Political instability, governance weaknesses and currency volatility in emerging markets are real, but “these risks are visible and, in many cases, already reflected in depressed prices”, said Magnusson.

By contrast, ballooning fiscal deficits, trade policy uncertainty and concentration risk in the US “appear to have had little to no impact on valuations”.

Magnusson supports broad emerging market exposure for diversification reasons but warned against assuming passive allocations solve the problem. China and Taiwan account for more than half of the MSCI Emerging Markets index, with around 11% in a single stock: TSMC.

“A passive approach misses the exceptional alpha opportunity in emerging markets,” he said, arguing that limited analyst coverage, inefficiencies and a higher proportion of long-term compounders create fertile ground for active managers willing to be selective.

China

But it’s not just valuations, with the underlying investment case in emerging markets also strengthening, according to John Citron, manager of the JPMorgan Emerging Markets Growth & Income fund.

“There are clear signs that the tide is turning,” he said, pointing to firmer earnings expectations and other macro trends such as a weaker US dollar and improving domestic demand.

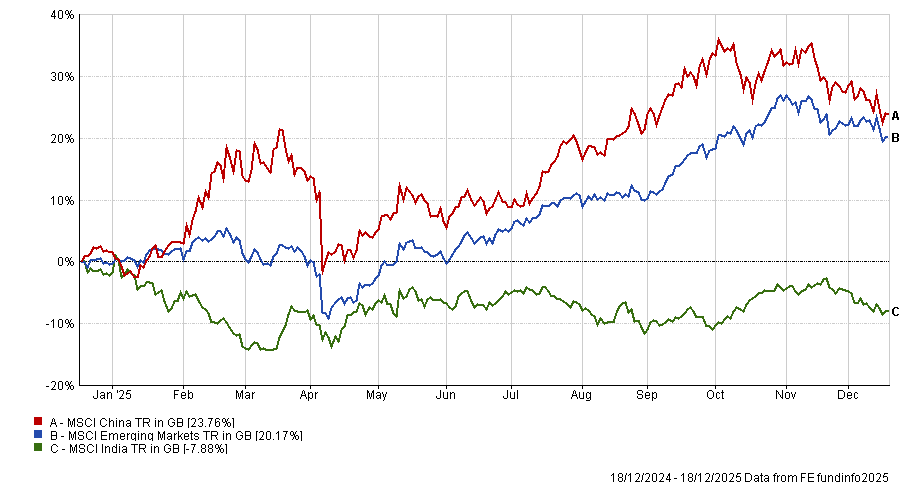

This year’s rebound (illustrated below) was supported by dollar weakness and a rotation away from the US, alongside improving sentiment in China as authorities moved to bolster consumer confidence and stabilise the property sector.

Performance of indices over 1yr

Source: FE Analytics

Technology has been central to that recovery, particularly the role emerging markets play in the global artificial-intelligence (AI) supply chain. Citron described this as a defining theme, adding that the AI revolution remains in its early stages.

Taiwan and Korea, he said, continue to play critical roles as suppliers of memory chips, advanced processors and data-centre hardware, with companies such as SK Hynix and TSMC already benefiting from accelerating demand.

Alongside technology, Citron said China’s policy shift has been key. Authorities’ efforts to stabilise the property sector and support consumers have helped sentiment, while US trade policy has prompted a wave of domestic investment as manufacturers seek to localise supply chains.

But not everyone within JP Morgan shared the same degree of optimism on China. Omar Negyal, portfolio manager of the JPMorgan Global Emerging Markets Income trust, said the rebound has left little room for disappointment.

After the rapid recovery, “expectations may have run ahead of reality”, he warned, especially in China and parts of the technology complex. While many emerging economies are in better fiscal health than in previous cycles, geopolitics, elections and the path of the US dollar will shape outcomes in 2026, according to the manager.

Volatility, however, isn’t a reason to retreat – it’s “a chance to find the next wave of long-term winners”, he said.

India

The other emerging-market heavyweight, India, has been on a disappointing path this year, as it’s been left out of the AI trade (so much so that some are calling it the best anti-AI play). Despite this, after several strong years, it remains expensive.

Magnusson warned that high-growth stories often disappoint equity investors when starting prices are elevated. “There is no reliable link between overall GDP growth and equity returns,” he said, arguing that India’s premium valuation leaves little margin for error.

That caution is shared by Chris Tennant, co-portfolio manager of Fidelity Emerging Markets. While he acknowledged India’s strong demographic tailwinds, he said the market is expensive and difficult for investors focused on both quality and valuation.

“The portfolio is currently underweight India and we have minimal exposure to the consumer,” he said.

“However, we do see opportunity within financials, where the financial ecosystem stands to benefit from per capita GDP growth in the coming years and there are good-quality businesses trading at more reasonable valuations.”

Other areas

In global emerging markets, Tennant has become increasingly constructive on electrification, where the shift in global power generation and the build-out of renewables are driving demand for copper.

“Copper supply remains constrained following a decade of underinvestment,” he said, adding that this year is likely the first in which mine supply declines.

He has also increased his exposure to gold, as “the historic relationship between gold and real rates has broken down”, with investors and central banks turning to gold as a store of value.

“Despite the price moves this year, gold miners continue to look attractively valued and generate high free cashflow,” he said, noting improved capital discipline across the sector.

In smaller emerging countries, banking sectors are often oligopolistic and generate strong returns on equity while trading near book value, the managed noted, which has resulted in “excellent value across much of the universe”, particularly in central and eastern Europe.

Financials and fintech companies are also attractive.

Fixed income

With the dollar having broken its long-term uptrend, the environment increasingly favours non-US assets, according to Abdallah Guezour, head of emerging market debt and commodities at Schroders.

“A recovery in portfolio flows to emerging market debt is underway,” he said. Combined with abundant global liquidity, this reinforces the appeal of emerging market debt, particularly in local currency markets.

Schroders continues to favour countries such as Brazil, Mexico, South Africa, India and parts of central Europe, where valuations remain compelling and policy flexibility is high.

The risks

Many emerging economies enter 2026 from a position of relative strength, but none of the managers denied the risks.

Charles Jillings, co-portfolio manager of Utilico Emerging Markets Trust, highlighted two key threats. First, a material slowdown in global growth.

“A weaker US economy would result in a fall in consumption, which would impact export-driven economies and markets, which in turn would impact commodity-driven countries due to less demand for resources,” he said.

The second risk is geopolitics, with a material increase in geopolitical tension potentially leading to “a sudden increase in oil prices, which would result in short-term inflationary pressures and place financial stress on energy-importing economies”.