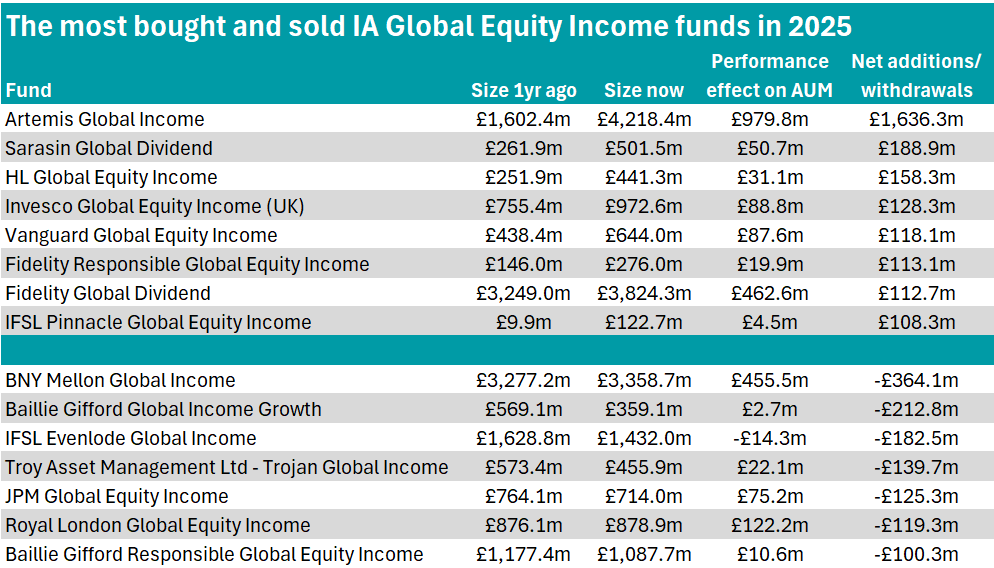

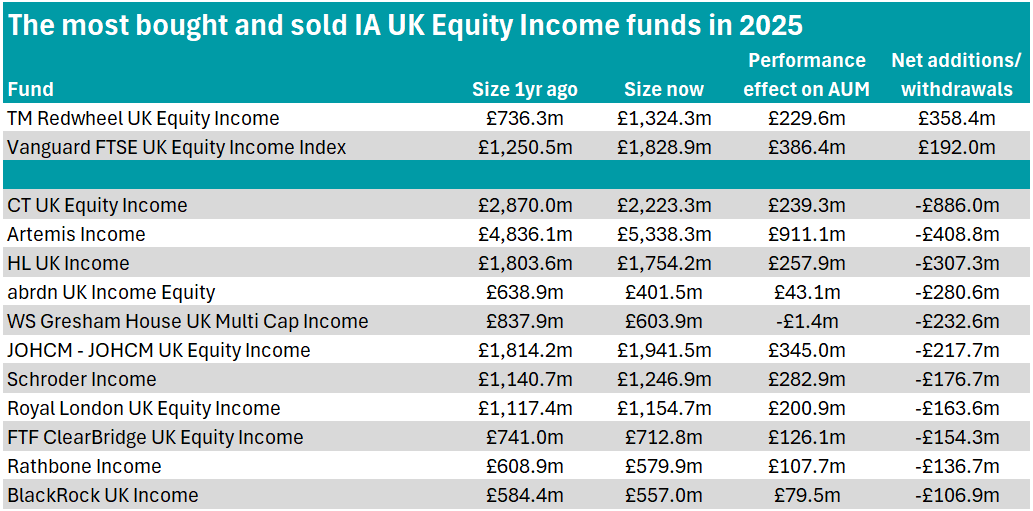

Artemis Global Income, Fidelity Global Dividend and TM Redwheel UK Equity Income were among the equity income funds attracting the most new money in 2025, while BNY Mellon Global Income, Baillie Gifford Global Income Growth and CT UK Equity Income struggled to retain investor assets.

Using the FE Analytics’ Market Movements tool, Trustnet has examined where investors moved their money across the unit trusts and OEICs in the IA Global Equity Income and IA UK Equity Income sectors in 2025, focusing on those which attracted or lost at least £100m.

IA Global Equity Income

The global sector saw several funds pull in substantial new money.

Source: FE Analytics. Market movements data for unit trusts and Oeics

Topping the table by some distance is Artemis Global Income, which grew from £1.6bn in 2024 to £4.2bn in 2025 – driven by almost £1bn in performance gains and a further £1.6bn in net new money from investors.

Co-managed by Jacob de Tusch-Lec and James Davidson, the all-cap strategy has been a standout performer in the sector, delivering top-quartile returns over one, three, five and 10 years, gaining 247.3% over a decade compared with the sector average of 151.6%.

Analysts at Titan Square Mile noted that part of the fund’s ongoing success is its avoidance of relying too heavily on traditional income stalwarts.

Fidelity had two funds in the sector which attracted more than £100m in net new money in 2025: Fidelity Responsible Global Equity Income and Fidelity Global Dividend.

The former grew from £146m in 2024 to £276m in last year, supported by £20m in performance gains and £113m in investor inflows.

Despite attracting net new money, the fund lagged many of its peers over the year, sitting in the third quartile with a one-year total return of 9.1%. Like many sustainability-focused strategies, however, its long-term record is significantly stronger and has outpaced Artemis Global Income over 10 years, gaining 256.8%.

Meanwhile, Fidelity Global Dividend increased its assets under management (AUM) from £3.2bn in 2024 to £3.8bn in 2025, driven by £463m in performance – the second-highest contribution after Artemis Global Income – alongside £112m in net new inflows.

However, not all global equity income funds enjoyed the same investor support.

On the other side of the ledger, BNY Mellon Global Income grew slightly to £3.4bn in 2025, with £456m added through performance. However, this was offset by £364m withdrawn by investors.

Meanwhile, Baillie Gifford Global Income Growth shrank from £569m in AUM in 2024 to £359m in 2025, as investors redeemed £213m.

Top holdings in the portfolio such as Apple, Microsoft and Taiwan Semiconductor Manufacturing Company did little to stem outflows, with the fund adding a muted £2.7m through performance, managing a 1.9% gain over one year – placing it in the sector’s fourth quartile for returns over the 12-month period.

IFSL Evenlode Global Income also fell from £1.6bn to £1.4bn last year, with its £14m in performance gains overshadowed by £183m in investor withdrawals.

Managed by Ben Peters and deputy manager Chris Elliott, the fund has struggled relative to its peers, sitting in the fourth quartile for returns over one, three, five and 10 years.

IA UK Equity Income

In contrast, only two funds in the IA UK Equity Income sector managed inflows over £100m in 2025.

Source: FE Analytics. Market movements data for unit trusts and OEICs

TM Redwheel UK Equity Income is at the top of the table, having increased its AUM to £1.3bn, supported by £230m in performance gains and £358m in investor flows.

The fund holds an FE fundinfo Crown Rating of five, with analysts at RSMR noting its ability to exploit “short-term market overreactions” that cause share prices to diverge from a company’s long-term worth – meaning managers Ian Lance and Nick Purves look to buy quality businesses at meaningful discounts.

Vanguard FTSE UK Equity Income Index added £500m in assets, with £386m coming from performance and £192m in net inflows. The passive strategy has proven to be a consistent outperformer, sitting in the top quartile for returns over one, three, five and 10 years.

However, several UK equity income funds saw money move in the opposite direction.

CT UK Equity Income fell from £2.9bn in 2024 to £2.2bn by the end of 2025, as its £239m in performance gains was outweighed by a significant £886m withdrawal by investors.

Due to the fund’s emphasis on value, it is typically expected to struggle in growth-oriented and momentum-driven markets, a challenge reflected in its fourth quartile position for one-year returns in the sector.

Despite adding not far from £1bn in performance gains to assets, Artemis Income suffered the second biggest withdrawal, with investors redeeming £409m.

It is managed by FE fundinfo Alpha Manager Adrian Frost, alongside Nick Shenton, Andy Marsh and Jamie Lindsay, and targets both income and capital growth over five years.

The fund remains highly regarded, with RSMR analysts praising its longstanding reputation, and sits firmly in the first quartile for returns in the sector over three, five and 10 years.

Finally, HL UK Income has had a sharp reversal of fortune from last year, with investors withdrawing more than the fund made – £307m and £258m respectively. The fund was one of the most bought in the sector last year and fund assets are hovering around the same £1.8bn mark.