Artificial intelligence (AI) remains the most powerful equity-market narrative of the decade. But the story has evolved. We are no longer in the phase where excitement is driven purely by possibility. AI has moved into its capital-intensive middle act – defined by heavy infrastructure spending, visible revenue growth and, increasingly, investor discipline.

That shift matters. It is starting to create clear winners and losers, and it changes how we should think about the familiar question: are we in a bubble?

The case for concern

The first point is concentration. Market leadership has rarely been so narrow. A small group of very large US technology companies – the AI “platform leaders” – has driven the majority of global equity returns over the past two years. The top 10 constituents of the S&P 500 now account for roughly 40% of the index, with technology dominating that group.

Concentration is not inherently a problem. But it does create fragility. When so much of the market’s performance depends on a handful of companies continuing to deliver exceptional growth, the tolerance for disappointment shrinks dramatically.

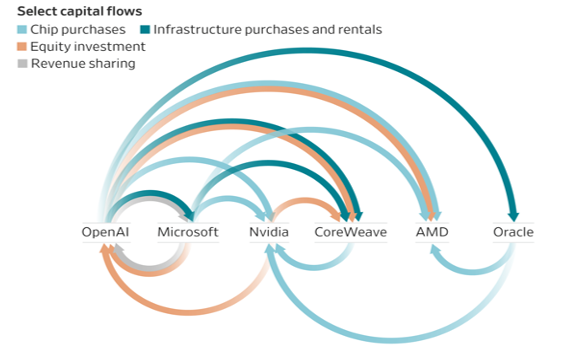

The second concern is interdependence. The AI ecosystem is very circular. Hyperscalers (Google, Amazon, Meta etc) fund AI labs (OpenAI, Anthropic); those labs generate enormous demand for cloud computing; hyperscalers then sell their cloud computing services back to the same labs; and chipmakers (Nvidia) scale production to meet hyperscaler orders. This works well on the way up. It also means a slowdown in one part of the chain can quickly propagate through the rest.

The interdependent AI ecosystem

Source: Wall Street Journal. Oct 2025

This is not theoretical. Four customers accounted for more than 60% of Nvidia’s recent revenues, and hyperscalers dominate global AI capital expenditure. A pause in spending by one large player would not stay isolated.

The third issue is funding. Early AI investment was largely self-financed from big tech’s free cash flow. As the build-out has accelerated – data centres, chips and power infrastructure – capital requirements have exploded, and debt is playing a growing role. That does not make the system unstable by default, but it does introduce fixed obligations that reduce flexibility if revenues disappoint.

Why this is not dot-com 2.0

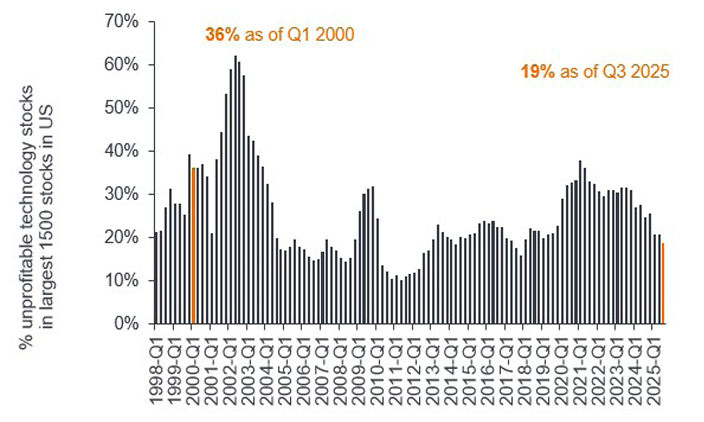

Despite these risks, we do not see a classic bubble in the dot-com sense. The key difference is that today’s AI leaders are highly profitable, dominant businesses with real revenues and strong cash generation. Companies such as Microsoft, Meta, and Nvidia are not promising growth; they are delivering it.

This distinction matters. In the late 1990s, valuation excess was built on hope. Today, elevated valuations are built on earnings. That does not remove downside risk, but it does change its likely form. A valuation adjustment driven by slower growth is more plausible than a wholesale collapse.

Recent market behaviour supports this view. Investors are no longer writing blank cheques. Meta’s sharply higher expected capital expenditure dented free cash flow projections and was met with an immediate double-digit share price fall. That is not euphoria. It is the market applying discipline.

Fewer tech companies are unprofitable versus dotcom era

Source: Janus Henderson, Bernstein, Sep 2025

Still early days

The final – and often overlooked – point is that AI adoption is still in its early stages. Productivity gains are real but uneven. The largest benefits are likely to accrue over time and across a much wider range of sectors than those currently dominating headlines.

A useful anecdote when thinking about the dot-com era is that the most enduring winner was not one of the companies dominating headlines at the time, but a relatively small online bookshop called Amazon. The lesson is not that infrastructure providers fail – many succeed – but that the biggest long-term beneficiaries are often those that apply the technology most effectively. AI has the potential to benefit almost every industry. The critical question is not who builds the tools, but who integrates them successfully into products, processes and decision-making. Today’s winners are not necessarily confined to chipmakers and cloud platforms.

So, will the bubble burst?

Our view is that AI leadership is more likely to broaden than to break. The boom is real, and so are the risks. This is not a story of irrational excess, but of a powerful theme entering a more demanding phase.

For investors, that means fewer free lunches – and more emphasis on diversification, valuation and discipline.

Greg Colley is an investment strategist at FE Investments. The views expressed above should not be taken as investment advice.