As artificial intelligence (AI) has quickly become one of the most important themes in global markets, the speed of change and the scale of spending have led to growing concerns of a bubble forming.

It’s a familiar narrative, particularly for those who remember the late-1990s tech boom, when enthusiasm outpaced the underlying economics.

However, while it’s no doubt true that markets can overshoot in the short term, today’s AI buildout is being driven by rapidly falling costs, accelerating real-world use and revenue-generating business models.

The AI story is not one of speculation. It’s one of infrastructure, productivity and adoption, and the early evidence suggests the foundations for long-term growth are strengthening, not weakening.

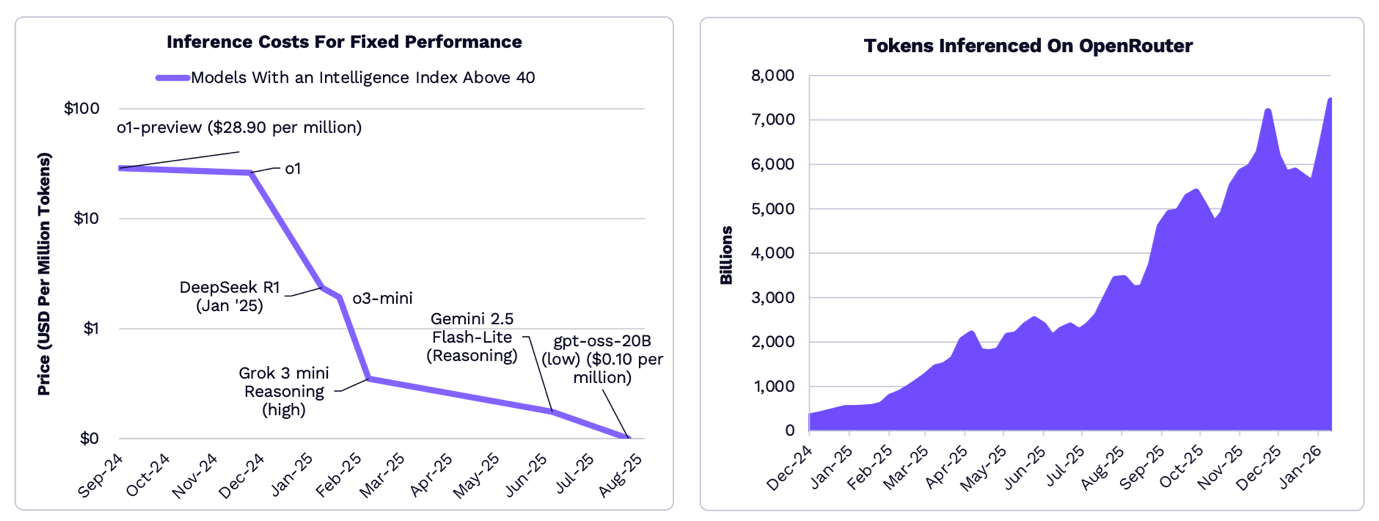

Costs are falling and demand is responding

Source: ARK Invest Big Ideas 2026

One of the simplest ways to judge whether a technology is moving from hype to real-world adoption is to track its cost curve. When costs fall consistently, new use cases become viable, products that once looked uneconomic start to work and demand broadens beyond early adopters.

That’s the pattern we’ve seen before in areas like energy storage. And AI appears to be following a similar trajectory at an even faster pace.

In the past year alone, some measures suggest inference costs have dropped by more than 99%. As a result, usage is scaling quickly. For example, OpenRouter, a unified application programming interface (API) for accessing large language models, has seen demand for compute rise roughly 25-fold since December 2024.

Taken together, that kind of cost deflation and demand growth typically signals a technology moving from experimentation toward broad deployment.

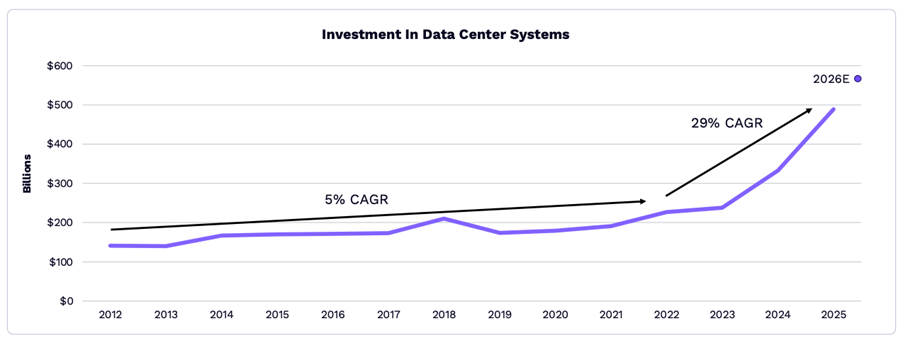

AI infrastructure spend is accelerating

Source: ARK Invest Big Ideas 2026

AI runs on accelerated computing; servers, networking and storage built to handle far more intensive workloads than traditional software.

For most of the decade before ChatGPT was introduced, global ‘data systems’ investment grew steadily in the $150bn–200bn range, compounding at roughly 5% per year. Over the past three to four years, though, that pace has shifted meaningfully higher, with spending reaching just under $500bn in 2025.

Gartner forecasts some $580bn in 2026 – and given that its one-year outlook has often proven conservative, the total could in fact be higher. Looking further out, our research shows AI infrastructure investment could exceed $1.4trn by 2030.

AI is moving into a sustained capex phase, rather than fading as a short-lived trend.

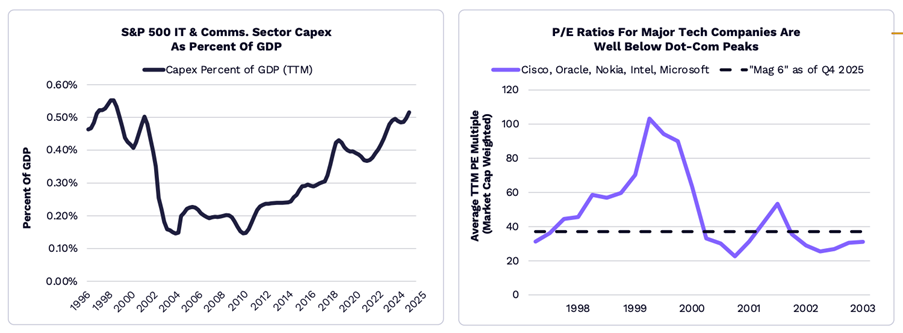

Big tech valuations remain well below Dot-Com peaks

Source: ARK Invest Big Ideas 2026

The left chart puts today’s AI infrastructure buildout in historical context. Annual spend on foundational computing has climbed back to around 0.5% of GDP in 2025; similar to levels last seen during the late-1990s tech and telecom boom. If forecasts are right, 2026 could push that to a new high.

But it’s also worth noting that spending bottomed after both the dot-com crash and the global financial crisis, then rose steadily as technology became a far larger part of daily life and economic activity. In that sense, higher capex intensity is not surprising.

The right chart adds a valuation check. The ‘Magnificent Six’, representative of tech today, trade at a price-to-earnings P/E ratio of just under 40x – closer to 1997 levels than the 100x-plus peak seen in 1999–2000.

And unlike that era, today’s leaders are highly profitable, with cloud businesses increasingly driven by recurring infrastructure and platform revenues.

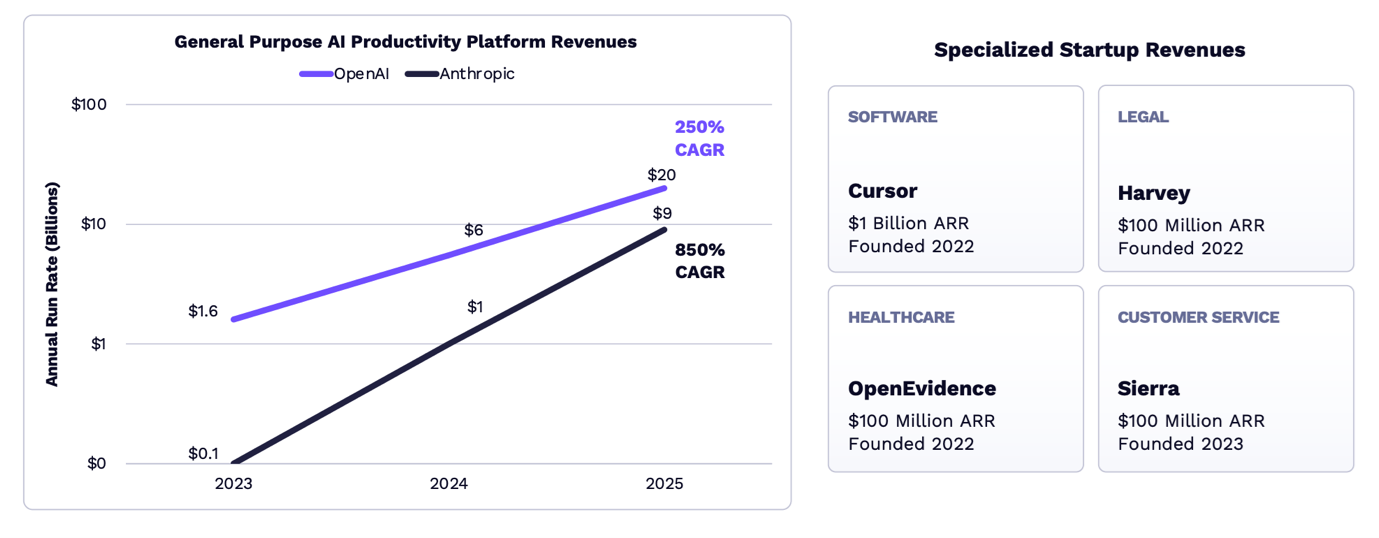

Revenues are growing

Source: ARK Invest Big Ideas 2026

A lot of the most important innovation in AI is happening in the private markets. In many cases, the technology is lowering the cost of building software and reshaping business models, putting pressure on public incumbents that rely on seat-based pricing.

The best examples are general-purpose AI providers like OpenAI and Anthropic, which are now generating revenue on a scale that rivals large public software companies.

OpenAI’s annualised run-rate revenue has surged at a cyclically adjusted growth rate (CAGR) of 250% since 2023. Anthropic has expanded even faster over the same period, with a CAGR of 850% putting its annual run-rate revenue higher than even Palantir.

At the same time, specialised AI startups are reaching meaningful scale at unprecedented speed. Harvey, OpenEvidence and Sierra are already reporting $100m-plus in annual recurring revenue, while Cursor is cited at around $1bn. In each instance, these remarkable figures have been achieved with far leaner teams than the cloud era typically required.

The implication is clear – AI is already being monetised, and it’s being monetised very efficiently.

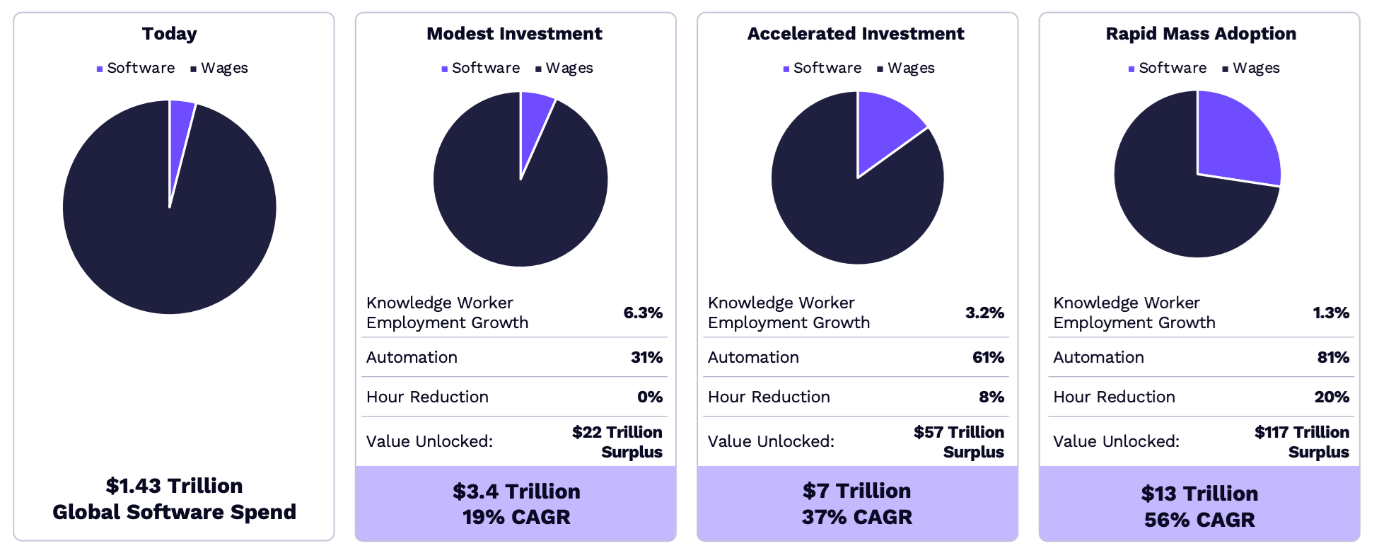

Productivity gains are a trillion-dollar opportunity

Source: ARK Invest Big Ideas 2026

One of the most important long-term cases for AI is higher productivity. As businesses increasingly augment knowledge workers with AI, we expect the pace of global software and computing spend to grow at a materially faster rate.

Today, global annual spend is roughly $1.4trn, having compounded at around 14% per year over the past decade. Our research suggests AI could lift that growth rate to 19%–56% annually over the next five years, as companies deploy AI to automate routine work, accelerate decision-making and increase output per employee.

While employment growth is likely to slow and average working hours decline, we believe the long-term unemployment rate is unlikely to increase.

In ARK’s framework, AI model and application builders capture roughly 10% of the value created, implying a potential trillion-dollar revenue opportunity as productivity gains compound across the economy.

Positioning for the future

These five charts point to a simple conclusion: AI is being adopted, monetised and scaled in the real economy. Volatility is inevitable, but the underlying foundations look very different from past tech bubbles and the data supports AI as a durable theme rather than a passing craze.

Thomas Hartman-Boyce is global head of investment solutions at ARK Invest. The views expressed above should not be taken as investment advice.