Coronavirus, the US presidential election and Brexit have made 2020 so far very difficult for investors to navigate, but some trusts – such as those focused on tech stocks and gold – have posted double-digit returns.

Over the first nine months of the year have been dominated by coronavirus, with markets selling off as the pandemic spread then rallying hard as massive amounts of stimulus were launched. More recently, investors have been watching as ‘second waves’ emerged while keeping an eye on the political situation in the UK and the US.

With this in mind, Trustnet has reviewed the Association of Investment Companies universe to see which trusts have been the winners and losers of the year so far.

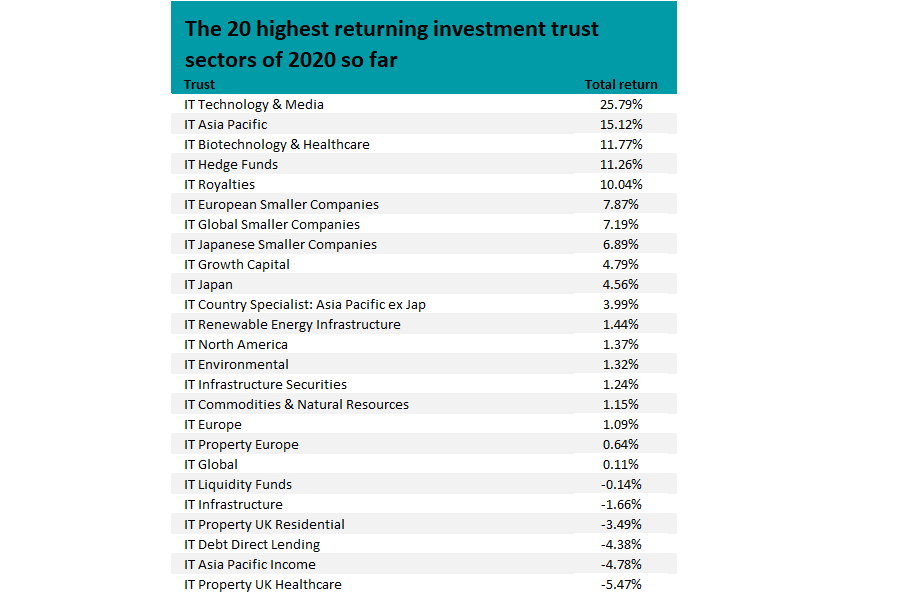

On a sector level, the IT Technology & Media peer group has been the best performer as its average member generated a 25.79 per cent total return over 2020 to the end of September.

This is in keeping with trends seen in the wider market, as tech stocks have been major beneficiaries of the coronavirus crisis and trends it has bolstered such as working from home.

There are only four trusts in the sector, however, and total returns have been polarised. While Allianz Technology is up 58.06 per cent and Polar Capital Technology rose 47.08 per cent, Augmentum Fintech only made 9.36 per cent and Sure Ventures has fallen 2.93 per cent.

Source: FE Analytics. Average returns over 2020 to 30 Sep

IT Asia Pacific was the second-best performing investment trust sector, reflecting the fact that Asia appears to have mounted a more effective response to coronavirus and has taken less of an economic hit.

Three more niche sectors – IT Biotechnology & Healthcare, IT Hedge Funds and IT Royalties – complete the top-five highest returning sectors.

However, 19 sectors out of the 50 in the Association of Investment Companies universe posted a positive return over 2020 up to the end of September.

In addition, 12 sectors are down more than 20 per cent, on average, over the same period. The worst has been IT Property Securities, which has lost 39.84 per cent, but average falls of more than 30 per cent were also seen in the IT Leasing, IT Latin America, IT UK Equity & Bond Income and IT European Emerging Markets sectors.

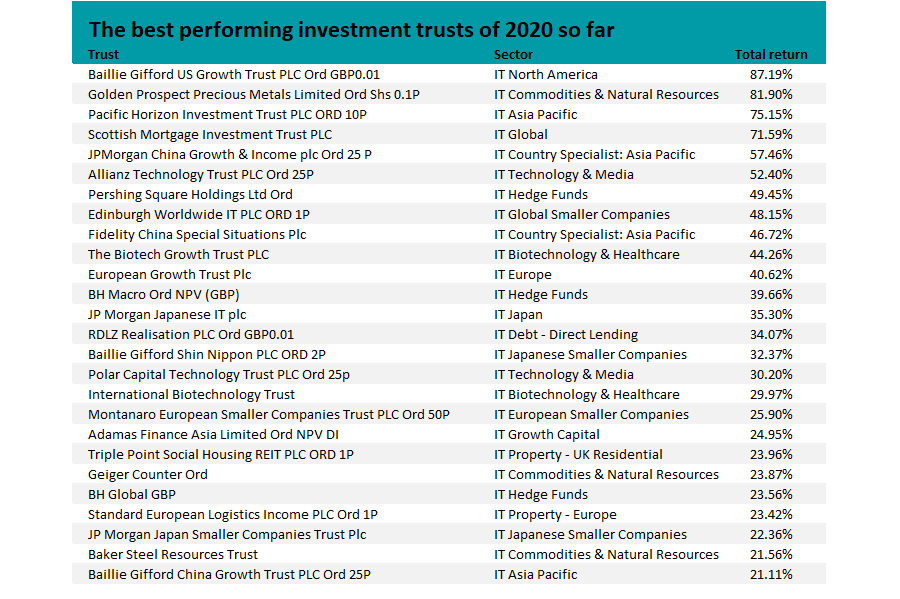

Turning to individual investment trusts, there are close to 30 that are up more than 20 per cent over the period under consideration. We’ve excluded the IT Unclassified and VCT sectors from this analysis.

Source: FE Analytics. Total returns over 2020 to 30 Sep

All 27 of these trusts are shown in the above table, which is topped by Baillie Gifford US Growth Trust and its 87.19 per cent total return.

Like all the strategies run by Baillie Gifford, managers Gary Robinson and Helen Xiong are growth investors who take a long-term view. The managers say they are aiming to outperform by “identifying the exceptional growth businesses in America and owning them for long enough that the advantages of their business models and cultural strengths become the dominant drivers of their valuations”.

The £731.2m trust only launched in March 2018 but since then has generated a total return of 161.69 per cent. In comparison, its average IT North America peer is up just 28.65 per cent.

Some 37.2 per cent of Baillie Gifford US Growth Trust’s portfolio is in consumer discretionary stocks, with another 25.6 per cent in information technology and 10.7 per cent. Its biggest positions include many of the so-called coronavirus winners, such as top holding Tesla, Amazon, Shopify, Netflix and Zoom Video Communications.

In the trust’s annual report (which covers the year to the end of May), chair Tom Burnet said: “At the time of writing, it seems likely that we are at the dawn of a significant global recession and ongoing market volatility is to be expected.

“In that context, it is comforting to note that, as long-term investors in exceptional growth companies, many of the organisations in which we are invested have thrived during the period. As the digital transformation that has been accelerated by the Covid-19 pandemic continues, the portfolio should be well positioned to benefit in the long term.”

However, Baillie Gifford US Growth Trust isn’t the only member of Baillie Gifford’s investment trust stable to be found at the top of the performance tables.

The group also runs Pacific Horizon, Scottish Mortgage, Edinburgh Worldwide, European Growth, Baillie Gifford Shin Nippon and Baillie Gifford China Growth – all of which are up more than 30 per cent over 2020 so far. Most of the firm’s trusts are in the top quartile of their respective sectors including Baillie Gifford UK Growth, which is the only one of the group’s trusts to make a loss this year (down 10.73 per cent).

Not every top-performing trust is run by Baillie Gifford though. The second highest-returning trust on the list is Golden Prospect Precious Metals, which is managed by New City Investment Managers’ Rob Crayfourd and Keith Watson.

The trust’s 81.9 per cent total return has been driven by safe haven flows towards gold as investors became concerned by the coronavirus pandemic and the ultra-low interest rates set by central banks around the world.

Crayfourd and Watson recently said: “As the managers of a precious metal fund we are, unsurprisingly, bullish on the underlying metal. The primary driver of the gold price is real yields, which is the return received from interest rates minus inflation. When real returns are low, gold has historically performed strongly.

“The fallout from Covid-19 has led to coordinated rate cuts globally, with an economic fallout that is yet to be fully understood. We see no evidence to suggest any risk of an increasing rate cycle in the near term.”

However, there have also been some heavy losses across the investment trust sectors and the below table shows all those that have fallen more than 40 per cent over 2020 so far.

Source: FE Analytics. Total returns over 2020 to 30 Sep

As can be seen, the heaviest losses have come from trusts in the IT Leasing sector with DP Aircraft and KKV Secured Loan dropping a respective 88.47 per cent and 78.20 per cent.

Several trusts that focus on UK equities can be seen on the list as well as those investing in commercial property, which has been hit hard as countries locked down their economies and encouraged workers to stay out of the office.