After years of consolidation and trading sideways, the biotechnology sector could be poised for a breakout into the mainstream, according to managers of the £316m International Biotechnology Trust.

“From 2003 to 2006, the sector was very much out of favour and generalists weren’t investing, but behind the scenes the companies were still being really innovative – growing, and launching products – and a handful of companies became profitable,” explained Ailsa Craig, portfolio manager of the trust.

She said that in 2007 when the sector turned cash flow-positive, the price-to-earnings ratios (P/E), which were in single digits, started to expand. This was followed by double-digit earnings growth and P/E expansion, causing a strong rally in the biotech sector up until 2015.

In 2015 and heading into the 2016 US presidential election, the biotech sector sold off after Democratic presidential candidate Hilary Clinton tweeted about drug prices and has since tracked sideways.

“This is classic for biotech, things get overheated and overbought, but the converse is true,” Craig said.

Today, much like in the past, Craig believes that there is still a lot of innovation going on behind the scenes, with next generation biotech companies coming to market as they turn profitable.

“Naturally the profitable companies P/Es will likely increase, these companies are included in the P/E for the sector, and what we try and do is invest in those names,” she said.

“It really does remind us of the past when the sector is out of favour and generalists aren’t generally interested at the moment ahead of an election – for whatever reason – so we’re quite excited.”

P/E ratio of the Nasdaq biotech sector

Source: International Biotechnology Trust, SV Health Investors.

And news that the latest Nobel Prize will be awarded to two gene-editing scientists, has seen many gene editing stocks rally as investor excitement around biotech and healthcare companies increases.

However, healthcare as a sector, still only forms a relatively smaller part of many global portfolios.

According to data from FE Analytics, the average fund in the IA Global sector has a 13.15 per cent weighting to healthcare broadly versus a 26.09 per cent weighting to technology and a 17.51 per cent weighting to consumer products. As such, biotechnology companies aren’t often heavily seen in the top 10 of many global funds, with a few exceptions.

One exception is Illumina –a company that dominates the market for selling machines required by researchers to read and study genetic variations – and is held by the £4.3bn Baillie Gifford Long Term Global Growth fund – the top performing global fund year-to-date.

Whilst Illumina’s machines have helped potentially revolutionise healthcare with gene sequencing and editing, but not all investors are quite bullish on the company, which has had a volatile couple of years’ trading.

Performance of Illumina YTD

Source: Google Finance

The International Biotechnology Trust is one such investor, who has taken a relatively negative bet against Illumina, by not including it in their top-10 holdings.

Indeed, Illumina makes up a large proportion of the Nasdaq Biotechnology index, the benchmark for the trust and many others in the specialist IT biotech sector.

“We are not positive on Illumina, and we haven’t been for a while,” said Craig. “That differentiates us from competitors who have had larger positions over the years.”

Craig admitted that that the trust had owned a large stake of Illumina in the past but felt that the P/E multiple was “way too stretched for the growth prospects”.

“We traded out of Illumina and that’s kind of proven to be right,” said the manager. “The growth is slowing, its plateauing, and for the P/E that it is at the moment, we don't feel that it’s justified.”

“Having said that, gene sequencing is the future,” added Marek Poszepczynski, investment manager at the trust.

Poszepczynski said the risk lies in whether Illumina’s products will become a utility, much like processors in computers in the past.

“It was very innovative, but as everyone else catches up, prices come down,” he explained. “We believe it is the future, the question is if they will be alone, and for how long.”

The rare disease space has undoubtedly been transformed by innovation in gene editing, and it is one area the trust focuses on. This is because companies often address a very high unmet need with very little competition.

Rare diseases makes up 31 per cent of the trust’s portfolio and oncology makes up 27 per cent, resulting in more half of its portfolio invested into these two areas alone.

Poszepczynski said that this is because where biotechnology companies can address the highest unmet need and where there is the highest activity.

Craig added: “Prescription drug sales are expected to grow by over seven per cent CAGR [compound annual growth rate], but rare diseases are expected to grow at a higher rate at 10.5 per cent CAGR, so we’re trying to invest more in the areas of higher growth.

“People focus on rare diseases because the trials you have to do tend to be cheaper because they are smaller, so you have a lot of motivation to work in these disease areas.

“Because of the understanding of the biology behind these diseases – often it's a mutation – after sequencing the genome in 2000, you can get very accurate and well-designed trials that are probably going to succeed because they understand the disease.

She continued: “So, there’s a lot of innovation and growth in that area. You’ve seen quite a lot of rare disease companies being acquired by big pharma, and they are looking for the same sort of characteristics that we’re looking for.”

Notwithstanding the attention the sector is current enjoying, there is still value to be found and one company the managers are very bullish on is Horizon Therapeutics.

“A couple of years ago it was a generalist company which sold low margin products, so analysts put them into that bucket,” Poszepczynski said. “But they have strategically moved into the orphan space [rare diseases] actively, but very few have followed that company from the generalist space into the orphan space.

“Whereas we saw that move two years ago, so we thought this company would be re-valued because they had much higher margins in the orphan space and they have done a very good job at it.”

He said analysts have now re-assed the company and put them into the orphan bucket, causing the company to be re-valued as such.

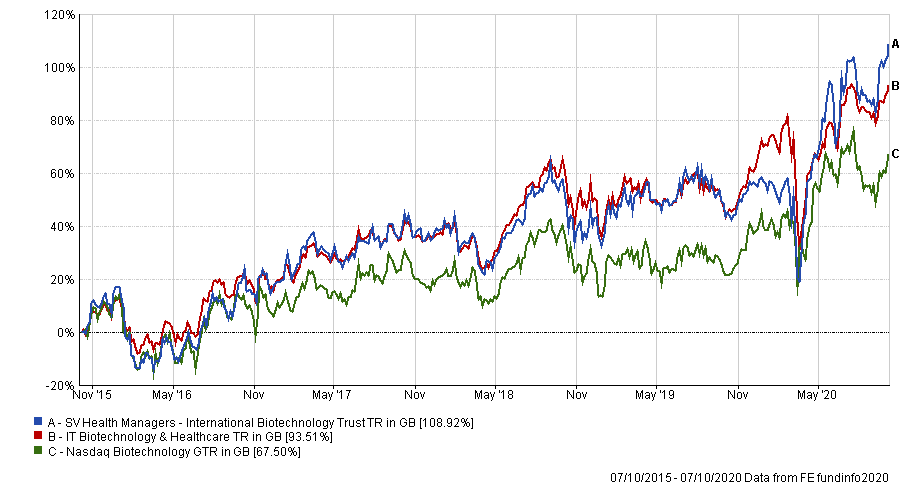

International Biotechnology Trust has delivered a total return of 108.92 per cent over the last five years, compared with a 93.51 per cent gain for the average trust in the seven-strong IT Biotechnology & Healthcare sector and the Nasdaq Biotechnology benchmark index’s 67.5 per cent.

Performance of the trust versus sector and benchmark over 5yrs

Source: FE Analytics

The trust is trading at a 0.5 per cent premium to net asset value (NAV), is 6 per cent geared, and yields 3 per cent as at 8 October 2020. It has an ongoing charge plus performance fee of 1.68 per cent, according to the Association of Investment Companies.

.PNG)