Scottish Mortgage is the world’s largest investment trust and this, combined some spectacular returns, means it is a mainstay of many investors’ portfolios. But which funds can be used to complement this popular strategy?

The £16bn Scottish Mortgage trust is currently the top performing trust of the IT Global sector across all time frames, making the peer group’s highest total returns over one, three, five, 10, 15 and 20 years as well as over shorter periods.

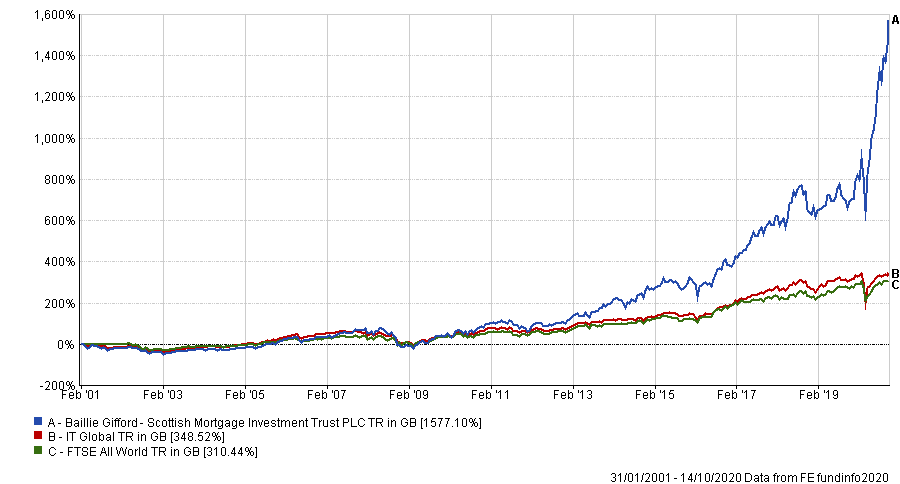

Over the past 15 years – which includes the global financial crisis and the coronavirus pandemic - the trust has made more than 1,500 per cent – compared with a gain of ‘just’ 275 per cent from its average peer.

Performance of Scottish Mortgage versus sector over 15yrs

Source: FE Analytics

Managed by James Anderson and deputy manager Tom Slater, Scottish Mortgage follows the growth investing style and has a preference of innovative businesses that are disrupting their industries, especially in the tech space.

The high-conviction strategy that invests in well-run businesses for the long term (at least five years) and its top holdings include Amazon, Alibaba, Tencent, Tesla, Spotify and Netflix.

With many investors holding, or at the very least aware of, Scottish Mortgage trust, below are four names to help fill in the gaps alongside it.

Schroder Global Recovery

First up is the £222.5m Schroder Global Recovery fund, co-managed by Andrew Lyddon, Nick Kirrage and Simon Adler.

Running a value style process with a major underweight to US technology, Schroder Global Recovery is completely polarised to Scottish Mortgage. This is exactly what makes it a complementary holding, according to AJ Bell’s Ryan Hughes.

“With Scottish Mortgage having a clear focus on growth investing, the obvious point to look for a complementary holding is with a value manager,” he said. “Value investing is horribly out of fashion at the moment and as a result there are fewer managers pursuing this approach where once it was the predominant style.”

Hughes said that Schroder Global Recovery’s correlation to Scottish Mortgage is just 0.46 since it launched just under five years ago, which highlights how the two are invested in very different areas.

“While performance has clearly been painful, it would certainly bring diversification to any portfolio with Scottish Mortgage but will give some protection should the market pivot towards value investing,” he added.

As Hughes pointed out, value investing has struggled since the 2008-9 financial crash, as the persistently low interest rate environment has favoured growth stocks.

Growth versus value over 10yrs

Source: FE Analytics

But this is where the strength of the Schroder management team comes into its own, according to GDIM investment manager Tom Sparke, who also picked the Schroder Global Recovery fund.

He said: “One of the most prominent value teams in the market today is that of Schroders, whose Recovery funds have an embedded process of picking companies that are on low valuations but with good turnaround prospects.

“The experienced Global Recovery fund team share the longer-term view of the Baillie Gifford team but run a more diverse portfolio of assets within which you would not find any common holdings with Scottish Mortgage investment trust.”

Over the past three years, Schroder Global Recovery has underperformed against its MSCI World benchmark and IA Global peer group, having lost 13.14 per cent.

Performance of fund versus sector and index over 3yrs

Source: FE Analytics

It has an ongoing charges figure (OCF) of 0.94 per cent.

Ninety-One Global Special Situations

Sticking with the theme of holding an utterly polarised style fund, FundCalibre’s Juliet Schooling Latter recommended the £137m Ninety-One Global Special Situations fund.

Run by Alessandro Dicorrado and Steve Woolley, Ninety-One Global Special Situations is “completely different” to the Scottish Mortgage trust, according to Schooling Latter.

“It is chock- full of value stocks – companies that are cheap and out of favour,” she said.

“It has a bank, builders’ merchant and airline in the top 10, so it’s quite risky and has suffered in a growth environment. But if we do get a snap back in value – or the news is ‘less bad’ – it could do very well.”

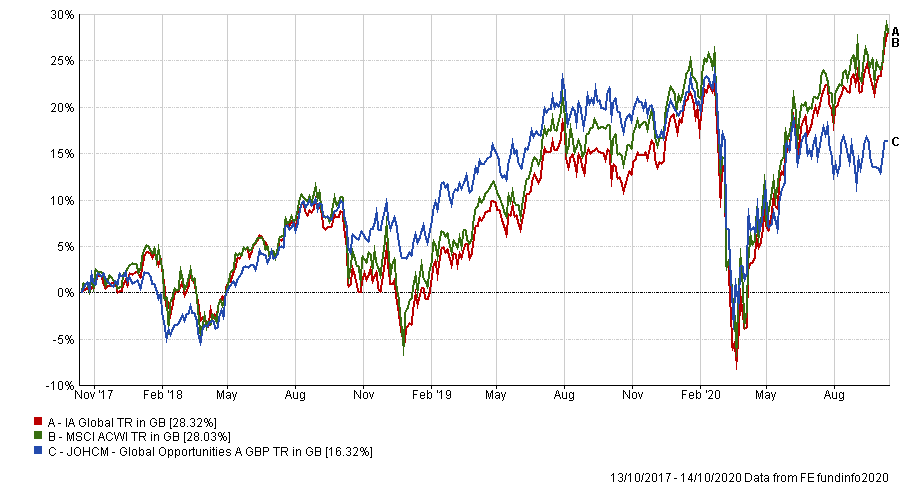

The fund has made a loss of 23.20 per cent over the past three years, an underperformance compared to its IA Global peer group (up 28.32 per cent) and MSCI ACWI index (up 28.03 per cent).

Performance of fund versus sector and index over 3yrs

Source: FE Analytics

Ninety-One Global Special Situations has an OCF of 0.88 per cent.

JOHCM Global Opportunities

“Alternatively, JOHCM Global Opportunities is perhaps a more cautious option,” Schooling-Latter continued.

“It buys quality companies but has a strong valuation discipline so will have a different portfolio make up to Scottish Mortgage.”

FE fundinfo Alpha Managers Ben Leyland and Robert Lancastle aim to identify long-term trends and themes and then buy undervalued, high quality companies which benefit from these trends and themes for the £402.6m portfolio.

Schooling-Latter said: “The managers very much believes that the price you pay for a company means something in the long term.”

The managers are also happy to hold a large portion of cash in the fund during periods of market uncertainty of “when there simply aren’t any opportunities in the market”, she added.

This ability to hold high levels of cash worked well for the fund during the March-April crisis period. “When the cash position was high and the manager was able to redeploy that money into new, better value, stock ideas,” Schooling-Latter said.

Performance of fund versus sector and index over 3yrs

Source: FE Analytics

JOHCM Global Opportunities has an OCF of 0.85 per cent.

Trojan

The final pick is the £5.2bn Trojan fund, chosen by Adrian Lowcock, head of personal investing at Willis Owen.

The fund is run by FE fundinfo Alpha Manager Sebastian Lyon and co-manager Charlotte Yonge. Like all of the funds managed by Troy Asset Management, Trojan places capital preservation at its core; it does this by building a portfolio based on quality blue-chips, index-linked bonds, gold and cash.

Lowcock said: “Lyon’s philosophy is to avoid destructive falls in value which makes it easier to then grow returns over the longer term.”

According to Lowcock, this is achieved by considering the risks of an investment from business models, high debt, valuations and corporate governance.

Lowcock said that recently the fund has moved away from its historically UK-focused tilt to now having a “greater US bias”.

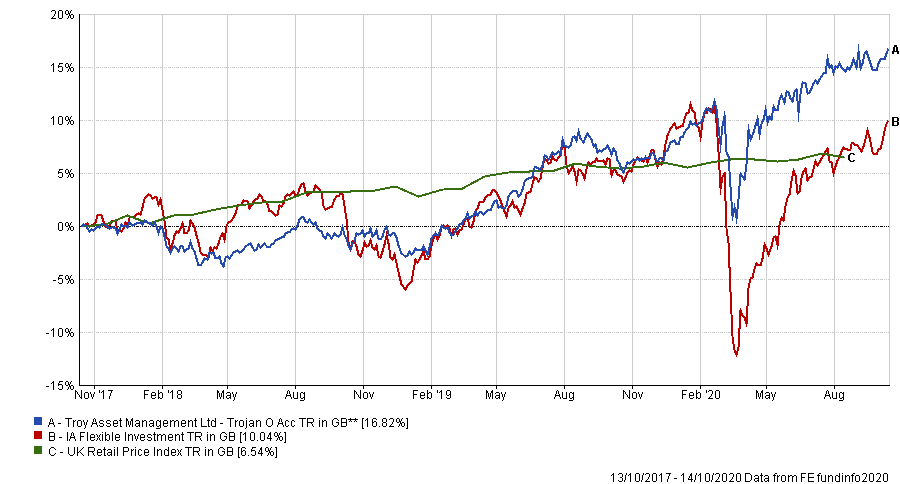

The five FE fundinfo Crown rated fund has outperformed both the IA Flexible Investment sector and UK Retail Price index over the past three years, with a total return of 16.82 per cent.

Performance of fund versus sector and index over 3yrs

Source: FE Analytics

Trojan has an OCF of 1.02 per cent.