There is a temptation among fund managers – and it has to be said, certain financial journalists – to oversimplify a description of their investment process into a pithy phrase that can fit neatly into a headline or a single sentence on the front of a sales brochure.

This may be your first assumption when a fund manager likens investing successfully to looking after your health and wellbeing. However, Ramesh Mantri’s point is that just as the majority of investors know what it takes to build wealth over the long term, the majority of people know what it takes to lead a healthy lifestyle. Yet the fact so many people are unhealthy shows this is easier said than done.

“Our philosophy is that outsized returns are earned by investing in great businesses at attractive valuations,” said Mantri, who runs the Ashoka India Equity Investment Trust.

“You can say this is a fairly simple philosophy, but the devil lies in the detail. What really matters is the quality of execution. Just because you know the right answer, it does not mean you can implement the right answer.

“For example, everyone knows what you need to do for good health: eat well, exercise, sleep well and live a tension-free life. But how many people do that on an everyday basis and throughout their lifetime? So what really matters is discipline.”

The discipline that Mantri follows involves looking for three key attributes in a potential holding: superior returns on incremental capital, a scalable long-term opportunity and strong execution and governance.

Again, the manager said that these sound fairly obvious: the return on incremental capital has to be above the cost of capital to make a profit, the business needs to be capable of growing if you want your wealth to as well, and good governance means that all investors benefit rather than just the majority shareholder.

Yet he said such attributes cannot be captured by traditional valuation metrics such as P/E (price-to-earnings) and EBITDA (earnings before interest, taxes, debt and amortisation) multiples, which are “flawed”.

“We want to take a forward-looking view of businesses, not just look at the past as a mirror into the future,” he explained. “Some businesses have had a great past 100 or 150 years, but have no future.

“For example, anything linked to the internal combustion engine, because electric vehicles will start rapidly replacing them in the next couple of decades.

“We will not put money into anything that has the risk of getting disrupted in the future.”

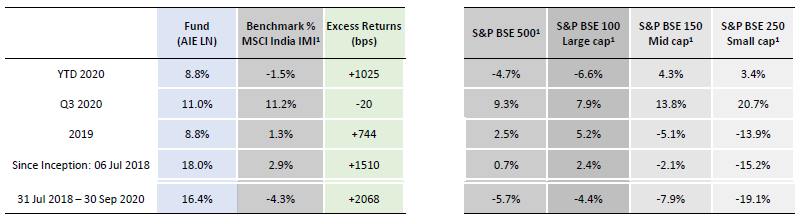

Performance of trust vs indices

Source: White Oak

Instead, Mantri prefers to analyse businesses by looking at free cash flows and using White Oak’s proprietary Opco Finco method.

He pointed to Nestlé India as an example of a stock he was convinced to invest in using this approach, even after it had been labelled as expensive by other investors.

“We would say, ‘tell us how it is expensive’,” the manager continued, “and they would say ‘the market is trading at 20x earnings, Nestlé is trading at 45x earnings, so Nestlé is trading at a 125 per cent premium to the market and that's a very high multiple’.

“But on our free cash-flow multiple, Nestlé was trading at 45x and the market was trading at 38x, so Nestlé was only trading at a 25 per cent premium to the market. This is like getting to buy a Mercedes at a 25 per cent premium to a Fiat.

“We invested in Nestlé two years ago, and even before Covid happened, the stock doubled over the two years, when the market only went up by 15 per cent and, post-Covid, Nestlé has gone up further and the market has corrected. The gap has only grown.”

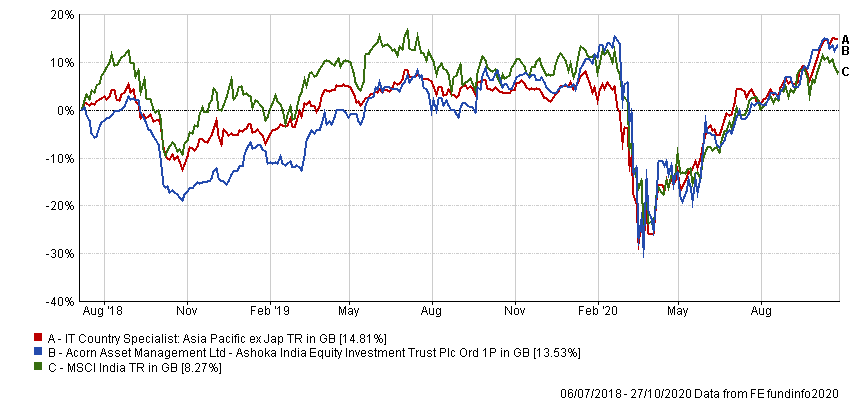

Performance of trust vs sector and index since launch

Source: FE Analytics

Data from FE Analytics shows Ashoka India Equity has made 13.53 per cent since launch in July 2018, compared with 14.81 per cent from the IT Country Specialist Asia Pacific sector and 8.27 per cent from the MSCI India index.

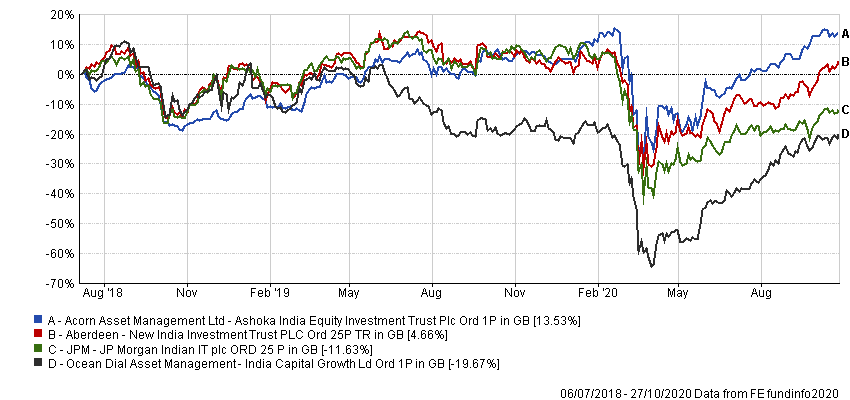

It has also beaten the other major Indian investment trusts over this time: Aberdeen New India, JP Morgan Indian and India Capital Growth, all of which trade at double-digit discounts.

Performance of trusts

Source: FE Analytics

However, even though Ashoka India Equity trades at a discount of just 0.74 per cent, Mantri still believes investors would be better served by his trust over the long term.

“Some of the [other trusts] have taken corporate actions to reduce the discount. But investors are much better off with us, rather than the other three, just because discounts can't cover for if you deliver bad performance. Often, discounts don't narrow,” he finished.

Ashoka India Equity is not currently geared and has ongoing charges of 0.9 per cent.