Just over half of the funds that generated top-quartile returns in 2020 have plunged to the bottom of their sectors this year, Trustnet research shows, after a stronger economic outlook sparked a rotation in markets.

Over 2021 so far, government bond markets have sold off on the back of concerns that the economic rebound that follows the coronavirus vaccine rollout could lead to higher inflation.

These worries then spread to the equity market, where many of the growth stocks that led the market in 2020 were hit hard and the unloved value style – which tends to do better in periods of higher inflation – rallied.

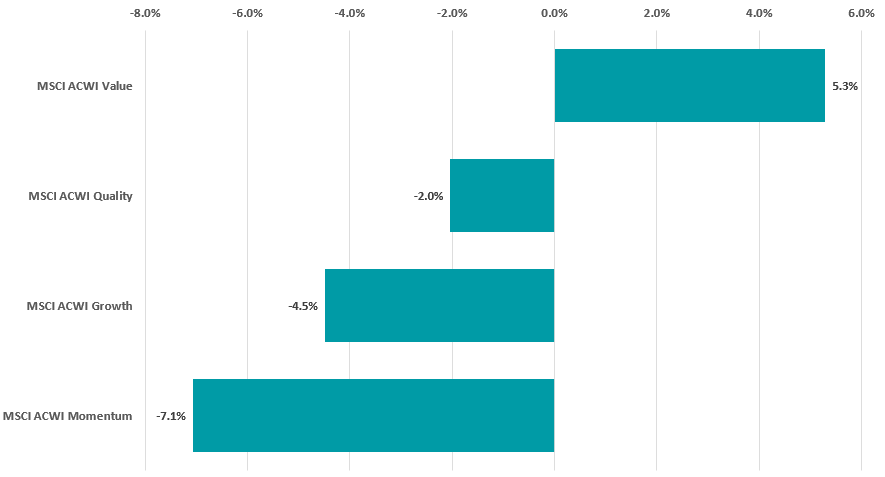

FE fundinfo data shows the MSCI ACWI Growth index was up close to 30 per cent in 2020 while its value counterpart was down 3.4 per cent. But between the start of 2021 and 9 March, the value index gained 5.3 per cent while growth stocks fell 4.5 per cent.

Performance by investment style in 2021

Source: FinXL, as at 9 Mar 2021

This has had a profound effect on the relative performance of funds in the Investment Association universe, with many of the funds that made some of the highest total returns of 2020 finding themselves at the bottom of the pile for the opening two months of 2021.

Of the 679 funds that made top-quartile returns last year, only 95 – or 14 per cent – were in their peer group’s top quartile over 2021 to 9 March. But 343 of 2020’s top funds – or 50.5 per cent – are now in the bottom quartile.

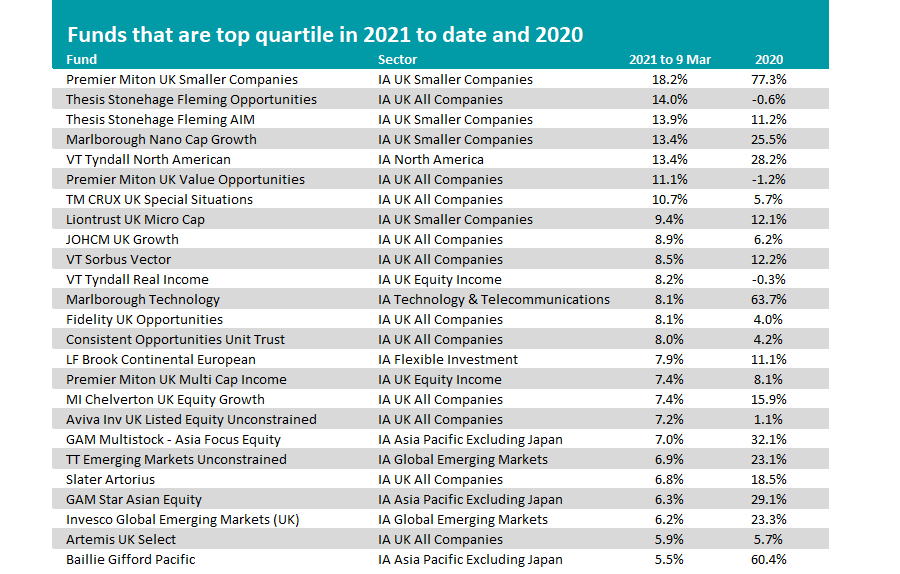

Some of those that have held onto a first-quartile ranking can be seen in the table below, which features the 25 that have made the highest total returns over 2021 to date.

Source: FinXL, as at 9 Mar 2021

Gervais Williams and Martin Turner’s £213m Premier Miton UK Smaller Companies tops the list after making 18.2 per cent in 2021. Last year’s 77.3 per cent total return was the highest made by any UK equity fund in the Investment Association universe.

The mangers also head up the £982m Premier Miton UK Multi Cap Income fund, which appears in the above table thanks to its 7.4 per cent return over 2021 so far.

In all, Premier Miton Investors has 10 funds among the 95 that were able to hold onto a top-quartile ranking over 2021’s start. Some of the others, that don’t appear on the above list, include Premier Miton UK Value Opportunities, Premier Miton US Opportunities and Premier Miton Cautious Multi Asset.

No other asset management house has close to as many funds appearing among the full 95.

Invesco comes in second place with four funds making first-quartile returns in both periods, while Slater Investments and Schroders have three. BlackRock, Carmignac Gestion, Legal & General, GAM Fund Management, Majedie Asset Management, Marlborough Fund Managers and Jupiter are some of those with two funds on the list.

But as noted earlier, more than half of the Investment Association funds that made top-quartile returns in 2020 have fallen into their respective sector’s bottom quartile in 2021 so far.

The 25 sitting on the worst returns this year can be seen in the table below.

Source: FinXL, as at 9 Mar 2021

Many of the funds with the heaviest losses focus on Japanese equities. The IA Japan and IA Japanese Smaller Companies sectors are the two worst performing peer groups over 2021 so far, with respective average losses of 2.4 per cent and 2 per cent.

Gilts funds also feature heavily, reflecting the bond market sell-off that was sparked by concerns over higher inflation. This spilled over into the equity market, causing many growth funds – which had surged in 2020 – to lag behind value.

We can see this when we look at the fund groups with the most strategies that have dropped from the first quartile in 2020 to the bottom in 2021.

Baillie Gifford is at the top of the list, accounting for 15 of the 343 funds.

The group has a very strong long-term track record thanks to its quality-growth approach and preference for companies that are disrupting and changing their industries.

This led to several of its funds topping their peer groups in 2020, while Baillie Gifford American made the year’s highest return of the whole Investment Association universe.

However, many are struggling in 2021 as growth stocks fall behind. Some of the group’s funds that are currently in the bottom quartile include Baillie Gifford American, Baillie Gifford Long Term Global Growth Investment and Baillie Gifford Managed.

Other fund houses with several strategies that have fallen from the top quartile to the bottom include Aberdeen Standard Investments, Liontrust, Janus Henderson Global Investors and Columbia Threadneedle.