Looking back over one of the most testing years for markets, Trustnet asked five fund selectors to highlight their ‘favourite’ fund or trust which had surprised them the most in 2020.

Baillie Gifford Positive Change

First up is the £1.8bn Baillie Gifford Positive Change fund, co-managed by Kate Fox and Lee Qian.

The sustainable investment theme has picked up significant momentum this year, catalysed by the Covid-19 pandemic and investors who want their money to make a difference.

Even so, the Baillie Gifford Positive Change fund has “stunned”, Charles Stanley Direct’s Rob Morgan (pictured) in terms of both performance and inflows.

He said: “I have been pleasantly surprised by the extent of outperformance some of the funds operating in the socially responsible and sustainable space, not least Baillie Gifford Positive Change.”

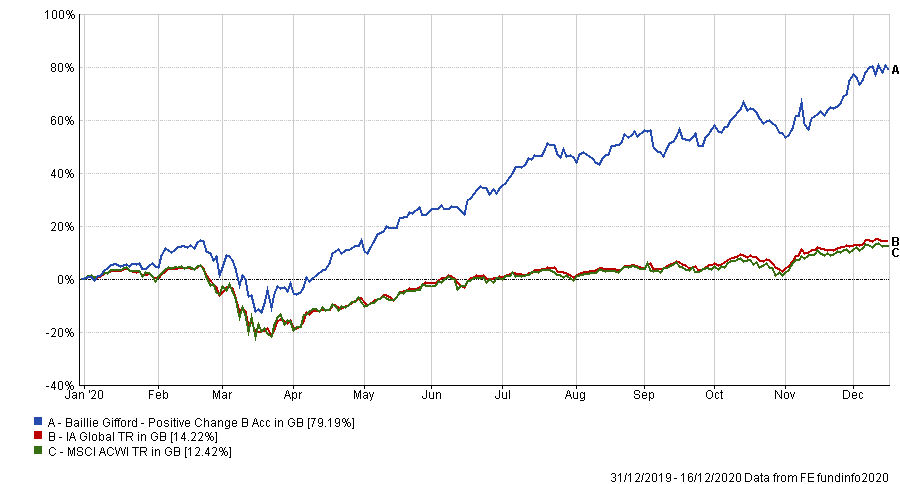

The fund has made a total return of 79.19 per cent this year (to 16 December), compared with a 12.42 per cent gain for the MSCI ACWI benchmark and a 14.25 per cent return for the average IA Global peer.

Performance of fund versus sector & benchmark YTD

Source: FE Analytics

“We have backed the fund since 2018 in the belief that it was a differentiated and adventurous option, and a refreshing change to some of the more turgid exclusion-based ethically-driven funds,” Morgan said.

In keeping with Baillie Gifford’s style, the fund has a growth bias and a high allocation to technology and healthcare stocks.

And holding companies such as Tesla and Covid-19 vaccine-maker Moderna this year has driven the fund’s high returns, according to Morgan.

“These stellar performances are unlikely to be repeated to the same extent, but its testament to the Baillie Gifford process that they are able to find companies that are helping address environmental and social problems while generating strong returns for investors,” he said.

Premier Miton UK Smaller Companies

Next up is Gervais Williams and Martin Turner’s £88.3m Premier Miton UK Smaller Companies, which was highlighted by Jason Hollands, managing director at Tilney Investment Management Services.

Hollands said: “In a year when the UK market overall is sharply down and the domestic economy experienced the sharpest contraction in over 300 years, you might expect smaller companies funds to have had a really rough time of it but actually a number of UK small-cap funds and funds with high exposure to small-caps have had a pretty stellar year.”

Indeed, while the blue-chip FTSE 100 has struggled this year with a loss of 10.16 per cent year-to-date – having failed to recover from the broad market sell-off in March – the FTSE Small Cap index has returned 4.14 per cent.

And the Premier Miton UK Smaller Companies fund has been one of the funds having a more positive 2020.

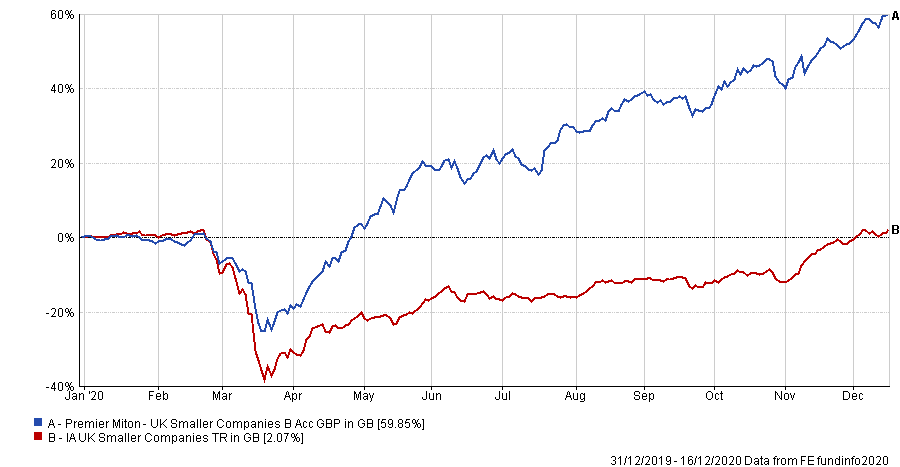

Year-to-date it has been the best performer in the entire IA UK Smaller Companies sector, with a total return of 59.85 per cent compared with 2.07 per cent for the peer group.

Performance of fund vs sector YTD

Source: FE Analytics

The things which impressed Hollands was that this performance was not driven by the outperformance of just one stock or a high allocation to growthier technology names, which make up just 20 per cent of the portfolio.

Rather, the fund has a “blended approach across value and growth”, Hollands said, with more than 100 stocks in the portfolio and around three-quarters of those holdings from the junior Alternative Investment Market.

Allianz China A Shares

The third fund is from AJ Bell’s head of active portfolios, Ryan Hughes, who said the Allianz China A Shares was his “surprise pick, in that it really delivered much more than we had hoped in a very short time frame.

“We added the fund in February as a long-term play on the growth of domestic China, conscious that we were investing in a higher risk area in the middle of a pandemic,” he said.

But Hughes (pictured) said the five Fe fundinfo Crown-rated fund’s returns have worked out “fantastically well,” this year.

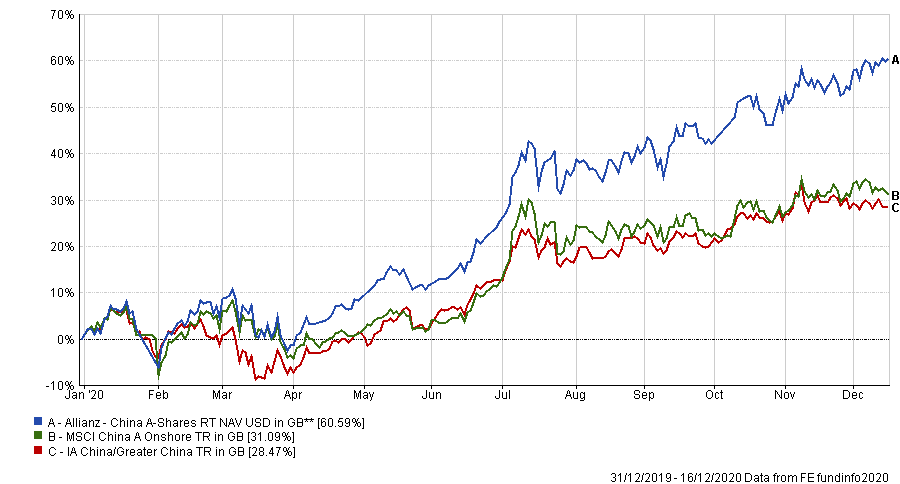

The $2bn fund co-managed by Chao-Yang Chung and Sui Ki Anthony Wong has returned 60.59 per cent so far this year, compared with a 31.09 per cent for the MSCI China A Onshore benchmark and a 28.47 per cent gain for the average IA China/Greater China peer.

Performance of fund vs sector & benchmark YTD

Source: FE Analytics

Nevertheless, Hughes still considers the fund “as a multi-year opportunity”, as more high-risk investors will look to move into China over the coming years.

Matthews China Small Companies

Staying in the same sector, the next fund – chosen by Fairview Investing co-founder Ben Yearsley – is the $317m Matthews China Small Companies fund, which is the IA China/Greater China sector’s best performer year-to-date.

“It is clearly a risky fund and is just under 70 per cent up year-to-date,” said Yearsley. “Why this is so surprising now is that at the end of January with Covid-19 just hitting in China, I don’t think anyone would have predicted a China fund in the top-10 fund by the year-end.

“Add in the fact that it’s a small cap riskier one and it’s even more surprising.”

Year-to-date the fund is up by 64.93 per cent outperforming its MSCI China Small Cap benchmark’s return of 19.94 per cent.

Performance of fund vs benchmark YTD

Source: FE Analytics

The fund’s biggest sector allocation is technology with healthcare in third, both sectors which have been major beneficiaries to the Covid-19 pandemic. Yearsley added that the ‘extreme’ valuation in some of these companies “might leave some cause for concern.”

Yearsley said that the managers, Andrew Mattock and Winnie Chwang – who took over the fund in August following the departure of former manager Tiffany Hsiao – have reduced the fund’s risk levels while maintaining exposure to ‘exciting’ opportunities.

Scottish Mortgage

The last pick, by interactive investor’s head of funds research Dzmitry Lipski, is the UK’s largest investment trust, Scottish Mortgage.

Already well-known for its track record of outperformance, its returns this year have further impressed Lipski.

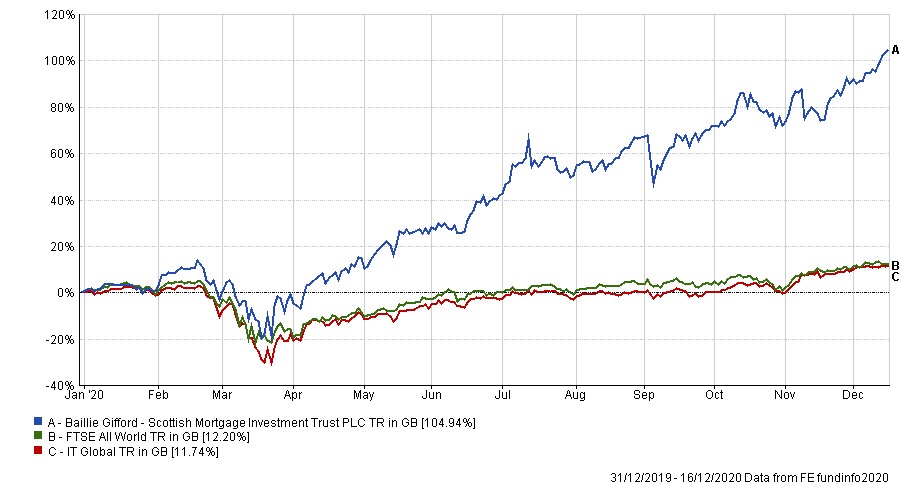

This year the £18bn trust has made a total return of 104.94 per cent compared with a 12.2 per cent gain for the FTSE All World benchmark and an 11.74 per cent return for the average IT Global peer.

Performance of fund vs benchmark & sector YTD

Source: FE Analytics

Lipski said the trust’s stellar performance in 2020 is down to the outperformance of tech stocks, which account for almost one-fifth of the portfolio.

The large-cap focused trust is managed by James Anderson and Tom Slater, who look for strong, well-run businesses which offer the best potential and durable growth opportunities for the future.