The UK is likely to be one of the best performing markets over the next 20 years, according to Premier Miton Investors’ Gervais Williams (pictured), who adds that there are further opportunities to be found in a “valuation dichotomy that is at its most attractive in my entire career”.

Williams’ Premier Miton UK Smaller Companies fund was the best performer in its IA UK Smaller Companies sector last year, with gains of 77.33 per cent. This was more than double the return of the fund in second place, FP Octopus UK Micro Cap Growth.

The manager said this could be partly attributed to a bounce-back from a period of underwhelming performance the year before.

“We had a very bad 2019,” he explained. “We tend to invest in companies that are below the radar screen for a lot of investors and [performance] was made worse by the gridlock in Parliament, when nobody knew who was going to be driving Brexit or whether we would go through Brexit without any leadership at all. There was massive uncertainty.

“Then of course, overlaid with that were the Woodford anxieties, which were mainly related to private companies. But a lot of people linked small quality companies to private companies, which I thought was very unwise.”

However, it wasn’t all bad for the manager.

He said his focus on well capitalised stocks meant that although some of them fell, they didn’t need to raise money through an emergency fundraising at depressed levels – unlike much of the market last year.

“We came into 2020 at low levels and didn’t need to change the portfolio very much,” Williams added. “And a lot of our picks came right very early.

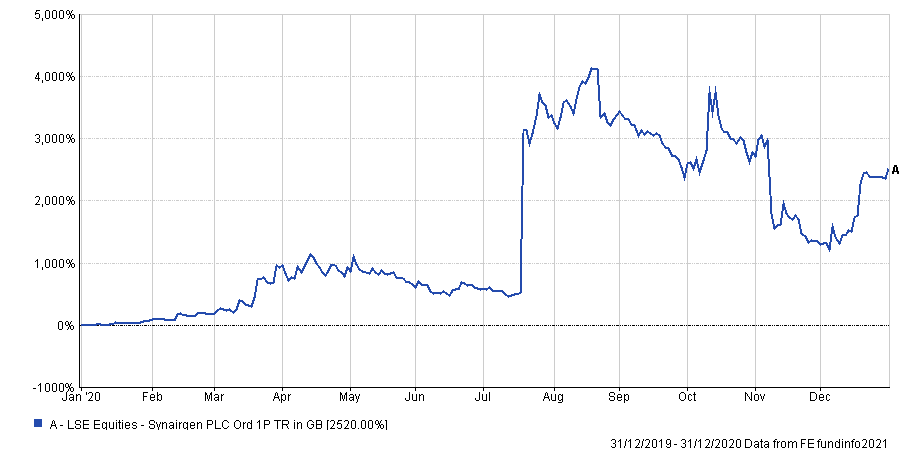

“There was also more opportunity further along in the year and we were able to put some money into things like Synairgen and some of the meditechs, which made absurd amounts of money.”

Performance of stock in 2020

Source: FE Analytics

Williams is confident he can make further gains going forward, pointing out the FTSE All Share is now at its lowest level compared with the S&P 500 since 1975.

The manager said this is because the UK tends to have more shorter duration-type investments, which deliver a faster cash payback, but don’t offer the same potential for “long-term knockout returns”.

However, he prefers shorter-duration investments, pointing out no one knows what will happen over the next 10 or 20 years.

“Ultimately, we want our companies to be sustainable even in difficult circumstances,” he continued.

“I think the UK is actually massively overlooked and its stock market is likely to be one of the best performers over the next 10 to 20 years, partly because there will be a move from long to short duration.”

Of course, numerous UK managers have for many years been highlighting the valuation discrepancy with the US as a buying opportunity, yet the gap has continued to widen.

However, Williams said that the coronavirus crisis could end up creating the catalyst needed to turn this relationship on its head.

“Basically, it is bond yields,” he explained. “If we find for whatever reason that bond yields go up – because there are a lot of defaults and companies go bust, or because inflation picks up – it makes long duration less attractive, especially when there have been ultra-high valuations in bonds up to now.

“The UK is so lowly valued at the moment, it is quite absurd. Especially the sort of the companies we’re investing in. I can hardly believe how cheap it is.”

He added: “What’s amazing, and this is probably the most attractive moment in my entire career, is the valuation dichotomy between a lot of the long-duration technology-led ‘potential’ companies and the current cash-generative grubby things like mining companies and slightly difficult-to-understand financials. I’ve never known such a disparity between those two.

“Currently you can buy companies on P/E [price-to-earnings] ratios of five or four with immediate cash paybacks of sensational returns. It is quite honestly astonishing. The risk/reward ratio is sensational.

“You think, ‘for goodness sake, someone’s got to work it out’.”

Data from FE Analytics shows Premier Miton UK Smaller Companies has made 259.87 per cent since launch in December 2012, compared with gains of 157.29 per cent from its IA UK Smaller Companies sector.

Performance of fund vs sector since launch

Source: FE Analytics

The £138m fund has ongoing charges of 0.91 per cent.