The Holy Grail for most growth managers is to find a stock they can depend on to produce above-average returns for a period of at least five years. So when a consensus is reached with a long-term portfolio holding that “it will be easy for the next 10 to 15 years”, you could be forgiven for thinking that maximising exposure to this company would be the best way for an existing investor to take advantage of this opportunity.

Yet when this was the conclusion reached by ASML’s chief scientist after a breakthrough with extreme ultraviolet (EUV) lithography, James Anderson (pictured) of the Scottish Mortgage Investment Trust was more interested in the implications for the other companies in his portfolio – and for some that haven’t even been founded yet.

Lithography systems use ultraviolet light to create billions of structures on thin slices of silicon. Together, these structures make up a chip. EUV lithography involves harnessing light of a much shorter wavelength (13.5 nanometers, rather than 193 nanometers from traditional lithography). While this may sound like scientific jargon, Anderson said it is of “unparalleled importance” for the global economy.

“Moore’s Law [that the number of transistors per silicon chip doubles every year] has carried the world in productivity and growth terms in the last 30 years,” he explained.

“But it’s becoming more powerful. One of the most significant meetings that we’ve had was one of our sessions with ASML, which is critical to the survival of Moore’s Law.

“I was amazed when its chief scientist, a veritable genius, said, ‘well now we’ve solved EUV, it is easy for the next 10 or 15 years’. This really matters. If we say we’ve got another 12 years of that, that translates into approximately a 60-fold increase in computing capacity.”

Anderson said that while it is difficult to get your mind around the implications of this development and it is impossible to gauge the exact impact, it can be taken as a given that it will turn entire industries upside down.

“It is beginning to eat indices well outside of what we define as information technology,” he continued.

“In particular, ‘Big Data’ is finally, in combination with sequencing its own exponential growth, beginning to be transformed.

“I think the implications of Moore’s Law will if anything be even more profound in what they transform from here than they have been over the last 30 years.”

Anderson's co-manager Tom Slater said that one of the best examples of the impact this can have on scientific progress can be found in solar panels, where the cost of generating energy has “pretty predictably” fallen at 20 per cent per annum over the past decade. Meanwhile, the cost of storing electricity in a battery has fallen by about 16 per cent for every doubling in capacity.

But while these figures are impressive on their own, Anderson pointed out the reality is even more dramatic when compared with even the most optimistic expectations in the recent past.

“In a way, it is very predictable,” he said. “But to put it in context, the cost of solar energy is currently running somewhere between 50 and 100 years ahead of the International Energy Agency’s predictions from 2010.”

A reliance on these principles was one of the reasons why the managers bought Tesla in 2013. They had long been criticised for their position in the stock – it has fallen by more than 30 per cent on 10 separate occasions since they invested, while in a Trustnet article from January 2019, Anderson said he regularly received “20 calls a day” from journalists denouncing it.

However, it is up 638.37 per cent over the past year, which in turn has led to questions about whether it is in a bubble. Anderson just laughed these off.

“The application of capital really mattered in the technological progress [of renewable energy],” he said.

“But I would also throw in that I think that underplays what’s going on in China, which I think is both terribly important for Tesla itself and the scale of opportunities.

“I could throw that back and say we are now lucky enough to get lots of requests about the value and rating of Tesla. But of course, Tesla way underperformed Nio [a Chinese electric vehicle manufacturer] last year, so perhaps we should be asking Mr Musk why it is doing so badly.”

Performance of stocks over 1yr

Source: Google Finance

Looking forward, the managers said that the most exciting application of Moore’s Law may be in healthcare. For example, Slater said that a PhD student carrying out genetic research 10 years ago would either amplify a gene or knock it out in an animal model. Then, after studying the consequences of this action, they would enter into a “laborious scientific programme” to see how this discovery could be taken forward.

Yet the cost of gene sequencing is falling faster than the cost of computer chips, which Slater said was responsible for the “absolutely remarkable” speed with which a coronavirus vaccine was developed by two of the trust’s holdings: Illumina and Moderna.

“In effect, it took four days to find the solution to the Covid crisis,” he explained. “Two of those days were Illumina sequencing the virus and two of those days were taken up by Moderna taking that sequencing data and translating it into an RNA molecule that would trigger an immune response.

“Now obviously it has taken longer than that, from the launch of lockdown to the finished vaccinations and the appropriate process in terms of regulatory approval and testing. But to actually find the solution took four days.”

And Anderson said that far from the end point, this could be just a mere hint of what the sector is capable of achieving in the long term. The manager pointed to a recent conversation with Alex Aravanis, the co-founder of healthcare company GRAIL, who has now returned to Illumina to supervise the combination of the two companies after the latter acquired the former.

“He said, ‘what you’ve got to understand is that if you combine sequencing with machine learning, moving towards AI [artificial intelligence], then we’re getting insights, we’re finding indications for healthcare that are running well ahead of our understanding of human biology, which completely reverses the whole process.

“And that would morph into the second example, which is one of our unquoted companies called Tempus, which is beginning to see that enormous quantities of data are translating into actionable healthcare recommendations.

“Over the last few days, Tempus has just revealed a small, dice-like device which will go in hospital oncologists’ pockets to provide them with AI answers to all the queries they have.

“To go back to a conversation with [recently retired Scottish Mortgage board member] John Kay, he said, ‘heaven help the standard general practitioners of the future’.”

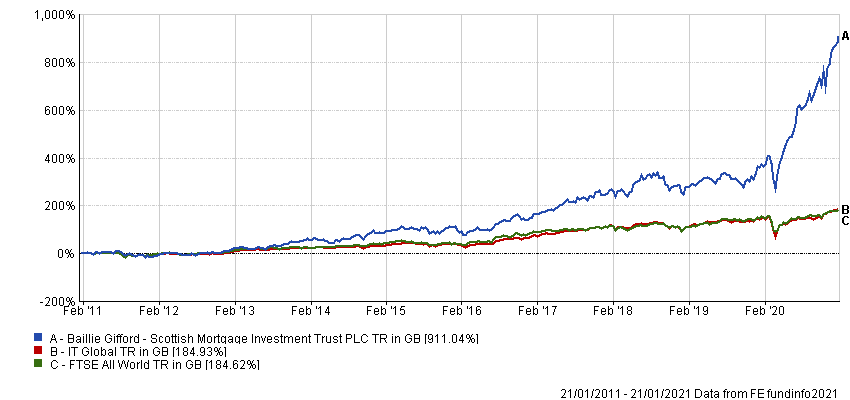

Data from FE Analytics shows Scottish Mortgage Investment Trust has made 911.04 per cent over the past 10 years, compared with 184.93 per cent from the IT Global sector and 184.62 per cent from the FTSE All World index.

Performance of trust vs sector and index over 10yrs

Source: FE Analytics

It is trading at a discount to net asset value (NAV) of 0.43 per cent and was 4 per cent geared as at the end of December.