The battle between hedge funds and legions of retail investors over a small US computer game firm is likely to be short-lived but investment professionals are watching with close attention to see if it heralds further problems for the stock market.

The surge in the stock of US computer game retail chain GameStop has captured headlines over the past week, after retail investors bought the stock en masse.

At the centre of the story is the social media network Reddit, where members of the WallStreetBets community spotted that hedge funds had taken short positions against the loss-making chain of bricks-and-mortar chain and encouraged each other to buy GameStop shares and call options.

Behind the move was the understanding that this would push GameStop’s stock higher and put pressure on the short-sellers (a ‘short squeeze’). At some point, the hedge funds would have to buy the stock back to close their position – thereby forcing it up even higher.

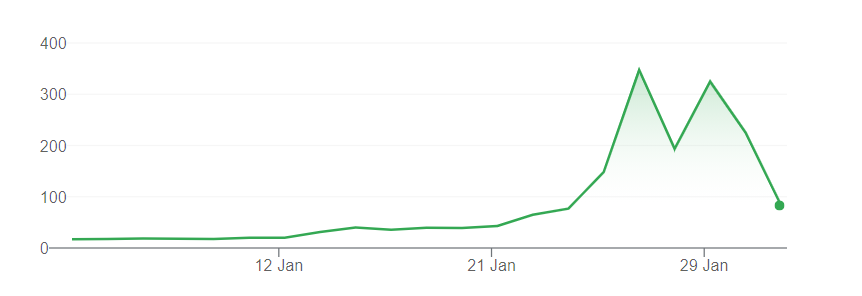

The squeeze apparently worked. GameStop started 2021 at $19 a share and it had rocketed to $470 before the end of January, a gain of almost 2,400 per cent. Other stocks were also bid up by masses over retail investors in recent weeks in similar short squeezes.

Although GameStop has fallen significantly in recent days and the WallStreetBets crowd seems to be moving onto other targets, many are asking what could come next.

Performance of GameStop over 2021

Source: Google Finance

The GameStop ‘short squeeze’ might seem like a relatively obscure event but it could potentially affect several different groups.

The retail investors buying the stock themselves are the most obvious. Some will walk away with handsome profits, others will have joined too late and end up nursing losses while some might lose money but see it as a worthwhile ‘investment’ to stick it to Wall Street.

Hedge funds and other short-sellers are clearly impacted: US hedge fund Melvin Capital posted a loss of more than 50 per cent in January and others suffered along with it. Many will be asking themselves if their other shorts will become the target of future squeezes.

Financial watchdogs will have to decide if there is a need for further regulation, although it’s difficult to make a case for any market abuse. Trading platforms such as Robinhood (which offer easy and cheap access to markets) have found themselves scrambling to meet regulatory capital obligations as well as facing criticism for suspending purchases of some shares.

But how could this affect the average long-term investor, such as Trustnet readers? Is there a danger that their portfolios are hit as internet forums become more important than fundamentals?

Joseph Amato, chief investment officer – equities at Neuberger Berman, isn’t too worried about this “extraordinary story” necessarily posing a threat to other investors or creating systemic risks, although some short-term volatility could be on the horizon.

“While at times investors and markets lose sight of fundamentals, in the long run, we believe they are the only thing that matters,” he said.

“In the near term, we are watching closely as this speculative frenzy forces some hedge funds to unwind their positions. In past cycles, the unwinding of leveraged positions has led to significant short-term volatility. There certainly exists a frothiness to this market that we are concerned about, and, based on our view of the fundamentals, we prefer some of the less expensive, cyclical and value-oriented parts of the market.

“Ultimately, however, we do think that this year has the potential to be a solid one for equities. Unlike these option-fuelled stocks, valuations in general are underpinned by improving fundamentals. When the GameStop game stops, we believe it will be a sign that we have returned to our normal lives of producing, consuming, and investing, and put the gambling aside.”

But there’s still a chance that similar short squeezes will be seen again in the near future and could become something that affects more than just parties with an immediate interest.

Waverton Investment Management’s Charles Jones and Tommy Faber described it in terms of a David vs Goliath-type battle and warned that there could be winners and losers.

They said: “It is difficult to estimate how long these dynamics will last but it is possible that long-only investors are the eventual winners, since they can use this market turmoil to buy shares in excellent businesses at discounted valuations with no change to the fundamentals.

“However, we should not be too complacent. Usually a bubble like GameStop is caused by greed, this one is driven by rage against unfairness in the financial system in which long investors have benefited. David is being motivated by good old-fashioned vengeance, let us hope he doesn’t look for new targets.”

WallStreetBets is currently the fastest growing community on Reddit, with more than eight million members; in early January, it has fewer than one million subscribers. The recent spike in trading has been driven in part by people looking for something to do in lockdown and a place to spend their US stimulus checks while the rapid rise of GameStop’s shares and the media attention that it gained will draw in others looking for the next big trade.

And the suggestion that moves like this are driven by frustrations at the social divide and represent a desire to hit out that the financial elite shouldn’t be ignored.

Christopher Smart, chief global strategist and head of the Barings Investment Institute, is watching the GameSpot story to see if it is a ‘groundhog’ – a distraction as unimportant as Punxsutawney Phil seeing his shadow – or a ‘coal mine canary’ that shows something is seriously wrong in global markets awash with leverage and central bank liquidity.

“History teaches that massive liquidity injections like those triggered by the pandemic often lead to strange things. Few would have predicted the line from subprime US mortgage securities to Greek default,” Smart said.

“When the stock price of battered business models like an electronic gaming retailer surges so wildly that some clearing firms can’t handle the volume, it may be nothing at all. But this story has gained momentum so fast, it looks likely to leave at least some damage.

“To be sure, a few minutes in one of the chatrooms that apparently drove much of the activity is a fresh reminder of just how much anger lurks in today’s world. And the announcements of Congressional investigations into the current saga suggest there is more to uncover.

“Financial bubbles and crisis triggers are usually only visible from the wreckage of the next crisis. From all appearances, the current recovery remains on track and the world’s banking system is rock solid. There will surely be more corporate bankruptcies ahead, but corporate balance sheets generally look liquid enough to avoid a cascading series of defaults.

“Still, last week’s sagging markets suggest this is a sideshow well worth watching. We just want to confirm that what looks like a groundhog isn’t really a canary.”