Investors who are looking to prepare their portfolios for an eventual recovery in the UK economy should consider small- and mid-cap funds run by the likes of Amati Global Investors, Franklin Templeton and Merian Global Investors, according to Willis Owen’s Adrian Lowcock.

The UK stock market was one of the worst affected by the coronavirus crash and are still severely depressed when compared with their peak in February, despite the strong rally that took place in April.

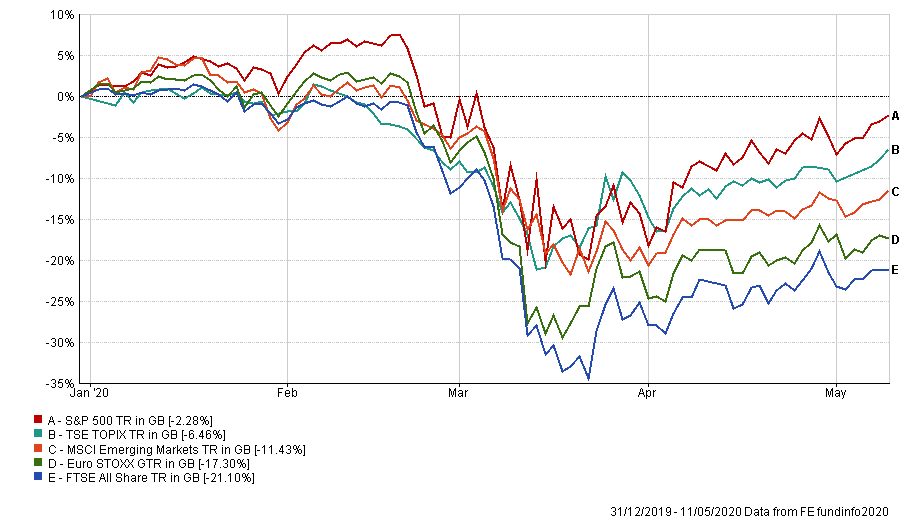

As the chart below shows, UK’s equities are still significantly behind markets such as the US, Europe, Japan and emerging markets but Lowcock – head of personal investing at Willis Owen – argued that this is creating opportunities for investors.

Performance of indices over 2020

Source: FE Analytics

“We have seen investors flee markets globally in March as the pandemic hit home and then return in April as the unprecedented levels of stimulus were put forward, but the UK has continued to amble along behind other regions thus far,” he said.

“Going forward there will no doubt be further challenges for investors in UK companies, and further afield, but there will also be lots of opportunities for skilled and experienced managers to find companies adapting to the situation.

“There are still tough times ahead, and valuations could dip from here of course, but for investors valuations across smaller companies in particular already reflect this. What they are not pricing in is any future growth domestically, but clearly there will be firms able to grow and thrive as we move through this crisis.”

Lowcock conceded that the UK’s economic outlook looks uncertain and the economy will undergo a severe contraction as a result of the coronavirus lockdown. However, he added that there will be “plenty” of smaller, domestically focused companies that are in a strong position when the economy recovers – and the key is to find the fund managers who are buying stocks like this.

“It could be easier for investors to dismiss the UK as a region to focus on now because of coronavirus and the ongoing spectre of Brexit, but as ever there are many innovative businesses in this country that will thrive,” he added.

“The top UK equity managers have proven time and time again they can find these gems in the marketplace, and we expect coronavirus, while no doubt an extreme event, will not prevent them from doing so again.”

Below Lowcock lists his three top fund picks for a domestic recovery in the UK.

TB Amati UK Smaller Companies

Lowcock’s first pick is the £299m TB Amati UK Smaller Companies fund, which is managed by Paul Jourdan, David Stevenson and Anna Macdonald. Jourdan founded Amati in 2010, giving the group focuses on smaller companies and VCTs.

“As a result, the managers have knowledge of the newest and smallest companies listing on AIM as part of their VCT work,” Lowcock added.

“The smaller companies fund is complemented by exposure to FTSE 250 companies to reduce risk. Fund performance is driven by stock selection, a result of the detailed and extensive research conducted by the team.”

Performance of fund over 5yrs

Source: FE Analytics

The fund is in the IA UK Smaller Companies sector’s top quartile over one, three, five and 10 years. On a five-year view, it sits in the third quartile for volatility, but FE fundinfo data suggest this risk has been well-used, with the strategy achieved top-decile numbers for its Sharpe, Sortino and information ratios – commonly used gauges of risk-adjusted returns.

TB Amati UK Smaller Companies has an ongoing charges figure (OCF) of 0.92 per cent.

Franklin UK Mid Cap

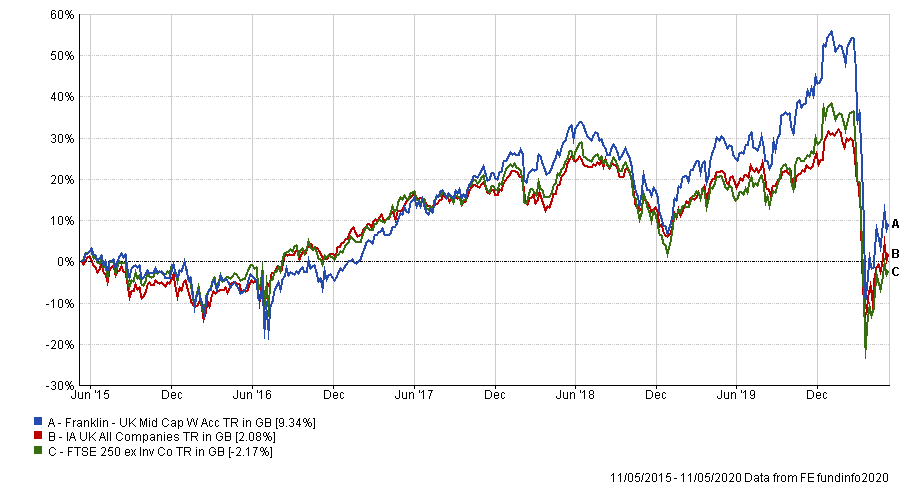

Next up is the £985m Franklin UK Mid Cap fund, which has generated some of the IA UK All Companies sector’s highest returns over the past decade thanks to a surging mid-cap market.

In 2019, Franklin UK Mid Cap achieved a 42.30 per cent per cent total return – the best of its peer group’s 254 members and the seventh highest of the entire Investment Association universe – but this was followed by the news that longstanding manager Paul Spencer will retire in September 2020.

Performance of fund over 5yrs

Source: FE Analytics

Richard Bullas, who has worked closely on the fund alongside Spencer for a number of years, will take over its management and Lowcock is satisfied with this succession plan.

“Bullas will continue with the same investment philosophy. The focus is entirely on the FTSE 250 and he assesses companies on three primary pillars: business risk, management risk and balance sheet risk,” he said.

“The process has delivered consistently and been successful over the long term, while the fund also invests with a quality style, which limits investors’ exposure to risk.”

Franklin UK Mid Cap has a 0.83 per cent OCF.

Merian UK Smaller Companies

The final portfolio that Lowcock thinks could help to capitalise on the UK economy’s eventual recovery is the £1.1bn Merian UK Smaller Companies fund. It is in the top quartile of the IA UK Smaller Companies sector over five years.

Performance of fund over 5yrs

Source: FE Analytics

“Merian has one of the most highly regarded small- and mid-cap teams, headed by Dan Nickols who is the manager of this fund,” he said.

“Companies must demonstrate at least one of these characteristics: the ability to grow earnings faster than the market average for an extended period of time; the scope to generate a positive surprise or the potential to be re-rated relative to the market.”

Nickols takes a “pragmatic approach” when it comes to valuations, which means that the fund will invest in growth, value and recovery companies – although the portfolio has tended to have a tilt to growth.

Merian UK Smaller Companies has an OCF of 1.03 per cent.