Growth investors have taken their strong performance through this year’s tumultuous market as evidence of the style’s superiority over its value counterpart. The theory goes that any sustained outperformance of the growth style will come to an end during a crash when investors realise their expectations for exponential expansion were hopelessly optimistic and return to what they know they can trust – value.

This has been turned on its head in this year’s slump – the economic lockdown has favoured the fast-growing tech giants that allow people to operate online, while punishing “old world” value stocks that rely on physical human interaction on either the supply or demand side.

Yet while many analysts have hailed this development as proof that value investing is dead, Edward Troughton, partner at Oldfield Partners, described this view as somewhat blinkered.

“We all know that hindsight is a wonderful thing and it is easy to be convinced you are permanently right after 11 years in which growth investing has quite clearly outperformed value,” he said.

“But there is very rarely only one side to an argument and, as we are so often reminded, ‘this time it’s different’ are four of the most dangerous words in investment.

“As Nassim Taleb says in The Black Swan: The Impact of the Highly Improbable: ‘Once your mind is inhabited with a certain view of the world, you will tend to only consider instances proving you to be right.’”

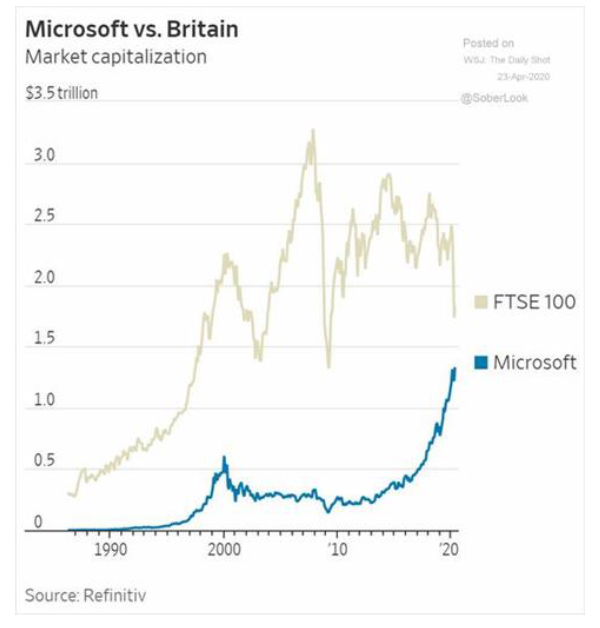

Troughton noted that, while the economic lockdown has provided an enormous boost to the tech giants such as Microsoft, Amazon, Google and Netflix, these are now being priced for endless growth. To put this in context, he pointed out the market cap of Microsoft is now not far off the value of the entire FTSE 100.

This view on the excessive valuations of the tech giants is echoed by James Klempster, director of investment management at MGIM.

“While they have done well so far, the one thing I would say is watch this space,” he commented.

“Some of the valuations are in P/E [price-to-earnings] multiples of hundreds and to justify that you’ve got to see either a massive increase in revenue or some kind of massive increase in the ability to translate that revenue into profit.

“I understand they’ve done well in this period, and rightly so. People who didn’t have a Netflix subscription went and got one. I’m consuming more stuff through Amazon.

“But where do you get the next layer of growth? If the growth doesn’t come, then they’ve got to make a profit, and how are you going to make that much more profit?”

To see for yourself how dangerous the assumption of exponential growth is, Troughton said you just need to ask yourself one question: how differently would this have worked out if the virus had been technological rather than human?

“Would the above chart look the same and growth investors been quite so boastful?,” he asked.

“We are currently in an extraordinary zombie economy where the aforementioned tech companies can shine.

“But we will come out of this. People will return to pubs, cafes, theatres and they will hold weddings again. People will desperately wish to travel and catch some much-needed sun, relax and forget about the current nightmare.

“And, much more mundanely, they will buy homes, catch a train and drive cars, driving up the consumption of oil and use of financial services in the process. In short, there is a time coming when the pent-up demand will be released and stocks that have often been priced as if they were being driven to extinction will perform.”

This isn’t to say that Troughton believes tech giants, or even steady quality growth companies, will suffer. Far from it: he said they will remain “giants of the world economy”, but warned their prices will need to take a breather while their earnings catch up.

“After all, valuations and cash flow do matter,” he added. “There will be a time when it will be recognised that good, solid companies with sound balance sheets and the best chance of surviving these tough times were priced down to the most extraordinary levels.

“These companies are long-term winners that will not only survive but also, with patience, perform exceptionally. There has, arguably, never been a better time to invest in these types of companies, at quite exceptional valuations, and into a value strategy.”

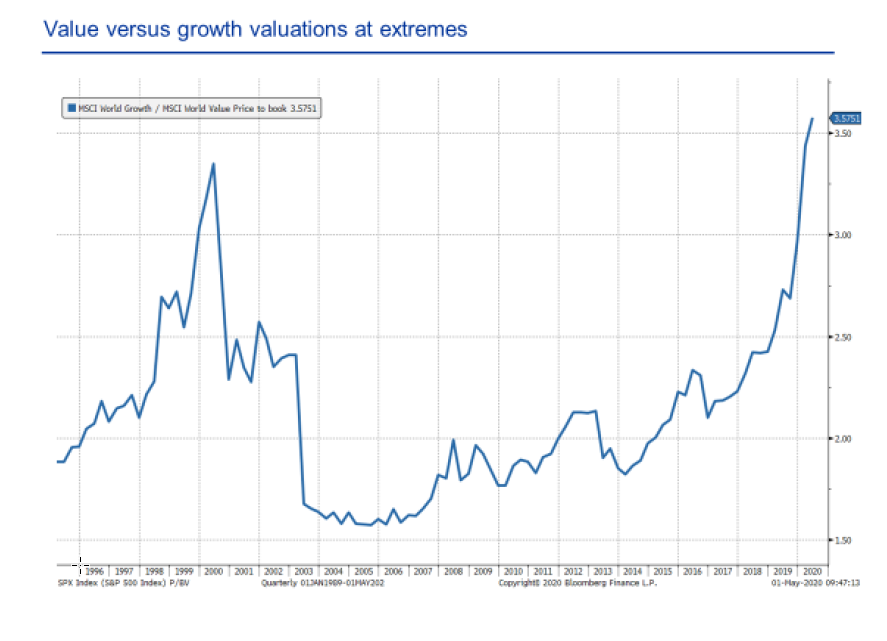

There is evidence to show that value investing outperforms growth over the long term – however, this needs some explaining: the starting valuation of a stock is the key determinant of long-term returns. The huge underperformance of value in recent years is explained by the fact that investors have been willing to pay more and more for growth.

Troughton acknowledged that there are many different ways to invest successfully, but said there is a time and a place for value – and that is generally when no one else is talking about it.

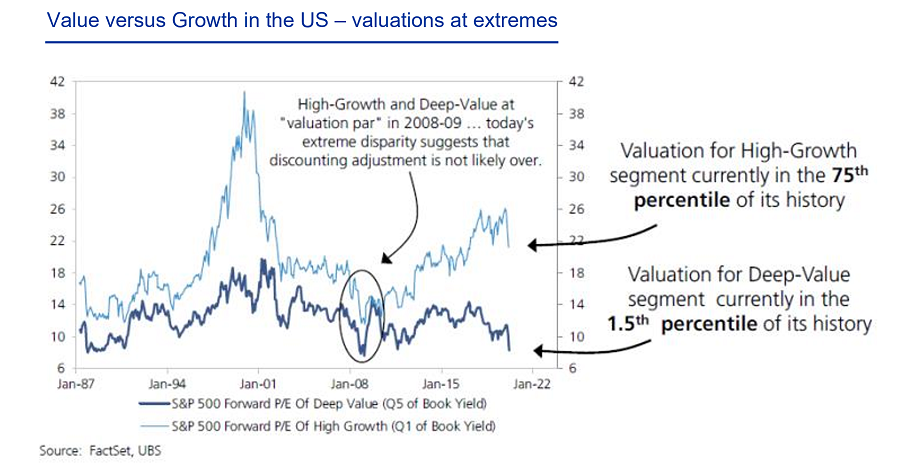

“We strongly believe that every portfolio should have a balance,” he continued. “The evidence we see at Oldfield Partners is that the vast majority of portfolios are very overweight in growth, while having little or no exposure to value. It is likely, as has been the case in the past, that when value turns it will do so sharply – we are now at extremes previously only seen in the tech bubble of 2000 and the Great Depression.

“Detractors may use those fateful words ‘this time it’s different’. Of course, no one knows what will happen next, but we don’t think this time is different, because investor behaviour has not changed. When looking at some of these charts (and in particular the one below), logic would suggest that the snap back to value is not far away.”

He added: “Value investing’s performance has been deferred over recent years, which has been painful for dedicated practitioners like ourselves.

“Being a value investor requires patience – this is a long-term strategy. In a world increasingly driven by short-term results, it is difficult for investors to be contrarian and invest away from the herd, but this is amongst the two or three most extreme, and therefore best times, in the past 100 years to allocate to value. Now is the time to take action, now is the time to be brave,” he finished.