Gilt funds have edged out their peers in the IA Sterling Strategic Bond and IA Sterling Corporate Bond sectors as the best performers over three years during the past six months, Trustnet research shows.

With the average holding period for an open-ended fund found by the Investment Association to be three years, it has become an increasingly important period for investors to judge performance.

However, three-year rankings are never set in stone and leadership can change as market conditions shift and strategies just celebrating their third anniversary enter the rankings.

Having previously looked at equity funds, Trustnet has ranked all the bond funds in the IA universe by their three-year returns and compared the current standing with how the rankings looked six months ago.

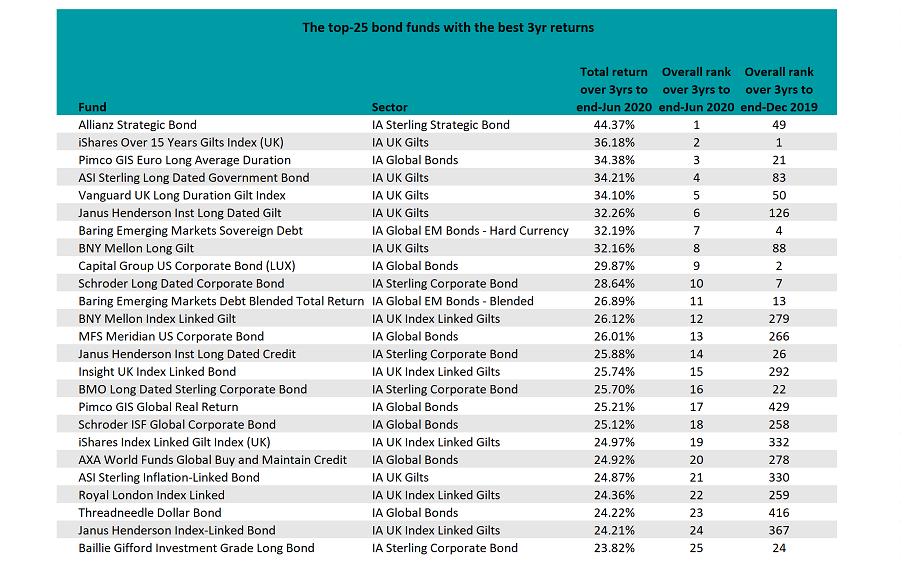

As the below table shows, there has been a lot of the change in the names at the top of the table during the past six months.

Source: FE Analytics

The best performing bond strategy was the £2bn Allianz Strategic Bond fund managed by fixed income veteran Mike Ridell and Kacper Brzezniak, which rose from 49th place into the top spot.

The four FE fundinfo Crown-rated fund has made a total return of 44.37 per cent over the past three years to end-June, having been second-ranked over the three years to the end of 2019.

The Allianz Strategic Bond fund invests in different parts of the corporate and government bond market around the world and has four core global drivers of alpha: duration (interest rate risk), credit, FX, and inflation.

The Allianz fund was the only strategy from the IA Sterling Strategic Bond among the top-25 best performing bond strategies, with many of the other strategies hailing from the two UK gilts sectors (IA UK Gilts and IA UK Index Linked Gilts, six and five respectively) and the IA Global Bonds sector (seven).

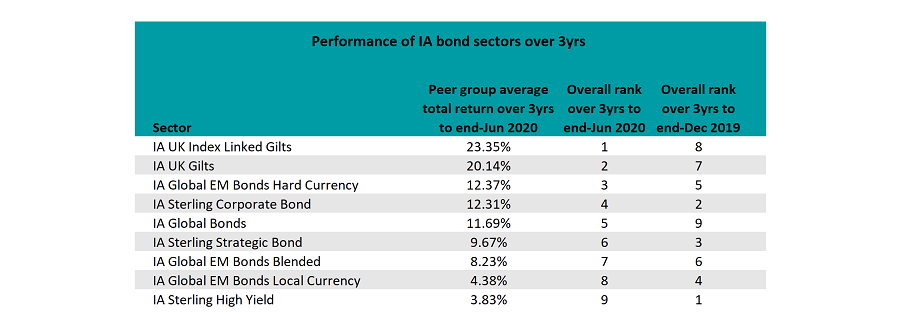

This is also reflected in the sector positioning with both gilts peer groups jumping up the three-year average performance table over the past six months.

Source: FE Analytics

Indeed, gilt funds were well-represented at the top of the table, making up half of the top-10, including the second-placed £1.8bn iShares Over 15 Years Gilts Index fund, a low-cost strategy tracking the FTSE Actuaries UK Gilts Conventional Over 15 Years index, which has made a total return of 36.18 per cent over the period.

Another passive gilt strategy made the top-five with the £571.2m Vanguard UK Long Duration Gilt Index fund – which tracks the Bloomberg Barclays UK Government 15+ Years Float Adjusted Bond Index – in fifth place, with a total return of 34.10 per cent.

While gilt yields have fallen in recent months, UK government bonds remain a safe haven asset for many investors and the Bank of England’s bond purchasing programme (given a new lease of life since the onset of the pandemic) has ensured steady demand.

One other gilt fund at the top of the table was the £21m, five Crown-rated ASI Sterling Long Dated Government Bond fund, with a total return of 34.21 per cent placing it fourth rising from 83rd in the previous three-year period.

Nestled among the gilt strategies at the top of the table was the third-placed, €161m Pimco GIS Euro Long Average Duration fund, overseen by Lorenzo Pagani and Michael Surowiecki. Ranked in 21st place during the prior three-year period, the fund invests in long-duration assets with at least two-thirds of the portfolio held in euro-denominated debt, the fund made a 34.38 per cent total return in the three years to 30 June.

One of the biggest movers in the top-25 funds was the Pimco GIS Global Real Return strategy, which climbed 412 places higher during the past six months, having returned 25.21 per cent. The $1.7bn strategy has been managed by Pimco’s Pagani – alongside David Brhel, Daniel He and Steve Rodosky – since former manager Mihir Worah announced his retirement at the end of last year.

The fund is an actively managed portfolio of primarily intermediate duration, global inflation-linked bonds issued by governments and their agencies, and corporations. According to the asset manager, it aims to offer a hedge against inflation, consistent real returns, low volatility, portfolio diversification and a broad opportunity set.

Inflation-linked strategies and those offering protection against inflation were among some of the biggest gainers as investors start to prepare for the potential inflationary impact of the significant sums in stimulus that have been pumped into markets since developed economies went into lockdown to prevent the further spread of Covid-19.

Other big movers among the top-25 three-year performers included Threadneedle Dollar Bond, Janus Henderson Index-Linked Bond, iShares Index Linked Gilt Index, and ASI Sterling Inflation-Linked Bond.