Aviva’s Giles Parkinson has described himself as “surprised and bemused” by the fuss the investment industry is making about ESG issues, saying a focus on these considerations is something every fund manager needs to incorporate into their process if they want to outperform.

Parkinson runs the Aviva Global Equity Endurance fund, which aims to not only beat the MSCI AC World index, but do so with a more resilient return profile, meaning it attempts to limit downside in corrections while keeping up with the market during rallies.

To do this, he looks for “durable” companies that are predictable, sustainable and available for a discount compared with a projection of future cash flows. And the manager said it almost goes without saying that a focus on ESG [environmental, social and governance] issues plays an important role in unearthing these businesses.

“I’m slightly surprised and bemused by how much is made of ESG because it has always struck me as a fund manager this is just what you need to do,” he commented.

“A lot of funds people struggle to articulate why ESG is important other than just, ‘well some clients want us to do it’, or ‘it sounds like a nice thing to do’. No, it really matters because it is important to what a stock is worth and ultimately we need to deliver outperformance by supporting market efficiency.”

Parkinson said he treats a poor score on environmental and social parts of the ESG equation as an intangible liability. For example, creating a lot of pollution is not something that will show up on the balance sheet of a chemical company, but it may end up costing a significant amount of money to clear up at a later date. Similarly, a price-gouging drug company may look like it is delivering “wonderful revenue growth and expanding margins on a Bloomberg screen”, but the manager said society and politicians will eventually take action against it.

However, he said there is more to environmental and social issues than their potential negative impact, which helps to explain why he is positive on the HVAC (heating, ventilation and air conditioning) industry.

“As much as half the energy consumed in a modern building is heating the thing and cooling it down, so the energy efficiency of those units is material in terms of how much power it consumes,” he explained.

“You saw this recently where if Joe Biden gets into power there is some sort of proposal about stimulus measures focused on renewables and energy efficiency. That will be very, very beneficial for the HVAC industry as a whole.

“That was not part of the thesis of owning Trane Technologies. We weren’t predicting that the US and Europe would come out with these sorts of measures and government policy support. But it’s recognising that it is on the right side of history.”

Governance is the element of the ESG abbreviation that has the most obvious impact on performance – as Parkinson put it, every investor in a company wants it to be run by a management team capable of seizing growth opportunities while maintaining the competitive advantages they have built or inherited.

“At worst, you want to avoid management that has its fingers in the till,” he added.

However, this is the metric that the Aviva Global Equity Endurance fund often falls down on – it has an A-rating from MSCI, when the maximum is AAA.

“When we drilled into that, we found it’s often because we are drawn towards family-controlled or family-run companies and these tend to have board structures that don’t fit with governance best practice,” Parkinson continued.

“However, for us we’re keen to align ourselves with managers that care passionately about growing sustainable business value over the long term. When it comes to something like Campari or Heineken, the family involvement and support is actually part of the positive case, even though it might officially throw up a slightly negative score from MSCI.”

For Parkinson, this highlights the importance of carrying out his own research into ESG factors rather than taking a tick-box approach. While he does use MSCI’s ESG scores, Aviva also has its own internal team devoted to this area and the manager uses both sources to throw up red flags.

However, he just takes this to mean an issue warrants further investigation, and the ultimate decision rests on the manager’s view on the sustainability of a company in light of future ESG concerns.

Parkinson said the downside to relying only on external data can be summed up in how the ratings agencies view China’s tech giants.

“Tencent owns the WeChat app which is a very durable piece of infrastructure, it’s almost impossible to function as a Chinese citizen without it,” he added. “Yet although it scores reasonably on ESG from MSCI’s point of view, we’re not quite so comfortable with its participation in the Chinese surveillance state, so for ESG reasons, that’s one we passed over.

“Then you have something like Berkshire Hathaway which [scored badly] because it has a shocking board structure – apparently he [Warren Buffett] has filled it with his own mates, family and his business colleagues.

“And yet that’s a management team that cares passionately about shareholder value.”

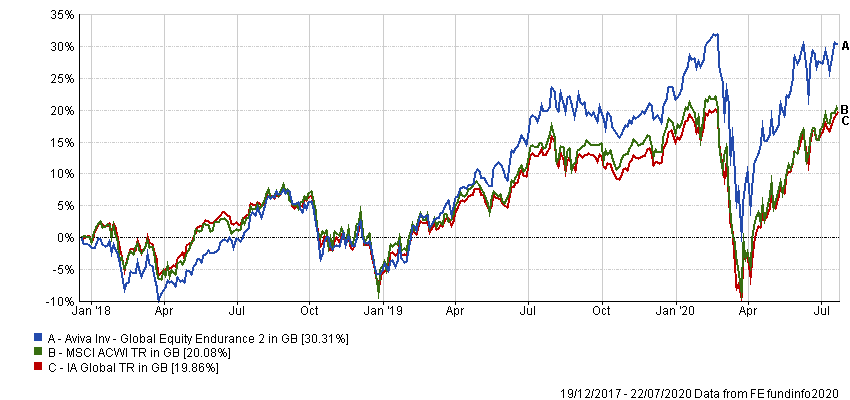

Data from FE Analytics shows Aviva Global Equity Endurance has made 30.31 per cent since Parkinson took charge at the end of 2017, compared with gains of 20.08 per cent from its MSCI AC World benchmark and 19.86 per cent from its IA Global sector.

Performance of fund vs sector and index under manager

Source: FE Analytics

The £268m fund has ongoing charges of 0.87 per cent.