Having released a “crisis playbook” with the aim of predicting how Covid-19 would affect equity markets earlier this year, the team behind the T. Rowe Price Global Focused Growth Equity fund explain how the fund has fared in 2020.

Identifying the companies that would accelerate and benefit from the virus was something that needed to be done in the early sell off, when the disparity between value and growth was at its widest.

And having done this earlier on in the year, the fund – which is overseen by FE fundinfo Alpha Manager David Eiswert – has made a top-quartile return year-to-date.

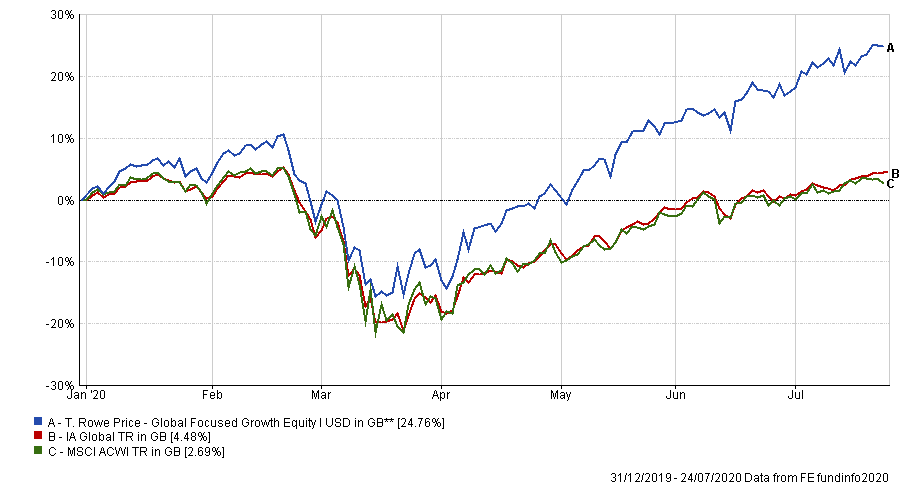

So far in 2020 year, the fund has returned 24.76 per cent, while the IA Global has returned 4.48 per cent and its benchmark, the MSCI ACWI has returned 2.69 per cent.

Performance of fund vs sector & benchmark YTD

Source: FE Analytics

Laurence Taylor, global equities and portfolio specialist at T. Rowe Price, said the last six months can be characterised by an unequivocal need to manage risk: as the pandemic took hold and more recently as microbubbles have emerged.

“He [Eiswert] owns and has a philosophy based around companies with insights about improving economic returns,” he said. “So not the fastest growers, but where we see an acceleration in sales, margins, earnings and cash flow.”

During one of the fastest drawdowns in market history, finding companies that display both balance sheet quality and management quality will allow these companies to survive.

“Markets became cheap, and they became cheap very quickly,” explained Taylor. “Then there was this pent-up opportunity masked by tremendous uncertainty.”

The portfolio strategist said that because the value/growth spectrum had been extended so far and so fast, investors were seeking to find “comfort in the narrow segments of perceived safety”.

The specialist explained that changes had been made in order to balance out the portfolio.

“We’ve now found ourselves trimming segments of the portfolio and trying to find solutions from the companies we like in the segment of cyclical growth,” he said.

Looking at the recent returns of the T. Rowe Price Global Focused Growth Equity fund, its weighting towards US equities have undoubtedly enhanced its performance during the pandemic.

“The US was strong, acquiring market cap dominance within the [MSCI AC World] index over the last decade,” said Taylor. “And that has only accelerated during this crisis.”

Indeed, the US can boast quite a substantial advantage in its large technology companies, in comparison to Europe and Japan.

“As those big platform companies have grown into global national monopolies, the weight of the index has grown as well,” the portfolio specialist explained.

However, given its benchmark-agnostic investment approach to sourcing opportunities the fund is now underweight US equities, reducing exposure to the FAANGs group of stocks – Facebook, Amazon, Apple, Netflix, and Google-parent Alphabet.

Leaning away from US equities and more towards Europe and Japan is in anticipation of a Democratic clean sweep in November, taking the House of Representatives, Senate and Executive.

“Towards the back-end of the year, there is pretty decent bull case for non-US dollar, non-S&P 500 equities,” said Taylor. “This clean sweep will be met with higher taxes, more social spending and increased infrastructure spending.”

Fading back on the FAANGs and lessening exposure to US equity cyclicals is also due to the unconstrained fiscal stimulus.

“The outlook for those big platform companies is that someone will have to pay for that big fiscal spending, if you see high earnings estimates missed off very large market caps [stocks], that in itself will weaken that US return stream which has been bulletproof for 12 years now,” he explained.

Interestingly, five of the top-10 holdings are cyclical growth names, including Morgan Stanley, London Stock Exchange, Samsung and Infineon, which deal in electric and semi-autonomous vehicles.

“It’s the least concentration in the FAANGS that we’ve had in David’s tenure, and certainly one of the punchiest cyclical growth profiles in that same time frame,” Taylor added.

Eiswert, in his crisis playbook, saw the acceptance of digital signatures as being one of the beneficiaries from this crisis. Considering that before the pandemic, the healthcare industry and governments were reluctant to accept digital signatures, there has been substantial change.

Taylor said Eiswert bought electronic signature platform DocuSign, which is one of the key Covid beneficiaries among other automation and digital solutions stocks.

“These stocks have all been strong so now it’s a case of not just hiding in them but taking some active decisions in them,” he said.

“In our case, as we don’t just focus on the fastest growers, I think I can differentiate our activity and current top-10 with a lot more cyclical lean in and a lot more cyclical power.”

Taylor also cites the survivability and growth characteristics of the companies in the holdings.

“In a world where there’s not a lot of yield or growth, we feel good about our ability to help investors achieve returns,” he concluded. “The next few months could be bumpy, but that may give people the chance to top up their position size.”

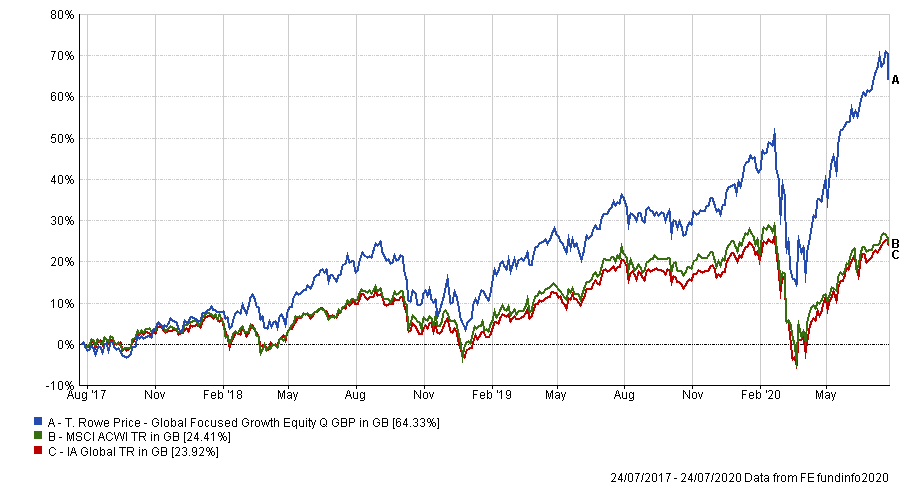

Performance of fund vs sector & benchmark over 3yrs

Source: FE Analytics

Over three years, the T. Rowe Price Global Focused Growth Equity fund has made a total return of 64.33 per cent compared with a gain of 24.41 per cent for the MSCI AC World index and a 23.92 per cent return for the average IA Global peer. It has an ongoing charges figure (OCF) of 0.88 per cent.