UK equity income managers have taken the opportunity to remove names from some of the sectors most affected by the Covid-19 coronavirus over the past six months in favour of those that have seen less of an impact from the pandemic, Trustnet research shows.

The latest Link Group UK Dividend Monitor calculated that in a best-case scenario, payouts on a headline basis (including special dividends) would fall by 45 per cent from £110.5bn to £60.5bn in 2020. In its worst-case scenario they would fall by 49 per cent to £56.7bn.

The administrator said it was likely that many companies had taken action to put their dividend policy on a more secure footing over the long term from previously “unsustainable” levels.

Many UK income managers have taken action to ditch stocks with more challenged outlooks for dividends and add names that have been less affected by the pandemic.

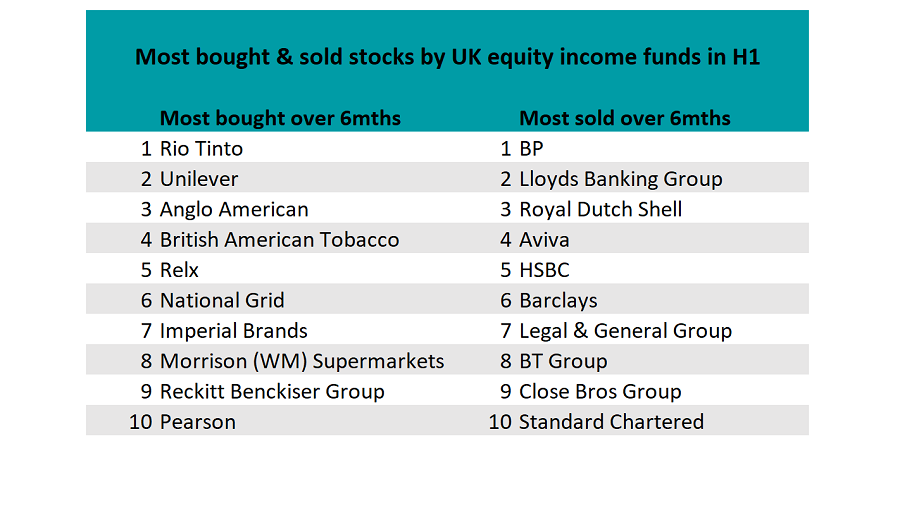

Below, Trustnet reveals which stocks fell in and out of popularity over the past six months (as at 30 June) using the FE Analytics Market Movements tool.

Source: FE Analytics

The most sold stock over this time was oil giant BP, by position size.

While the company did not cut its dividend, uncertainty during the first half – when oil prices plummeted following a Russia/Saudi spat – and the ongoing decarbonisation trend has painted a less-than-rosy picture for the oil & gas sector.

As such, managers have cut or reduced positions in BP and it is no longer one of the most held UK income names, with just 26.73 per cent of the UK Equity Income sector’s funds holding the company, down from 42.57 per cent at the end of 2019.

Royal Dutch Shell cut its dividend by two-thirds during the second quarter of the year – the first reduction since the second world war – and was the third most sold stock.

However, it saw the second-biggest change in ownership among UK income funds, after BP, falling from 38.61 per cent to 22.77 per cent.

Its payout had previously been flagged by Link Group as vulnerable because it is supported by borrowing.

“Shell is unprofitable if oil falls below $50 per barrel, yet crude was trading at less than half that level for a time,” said Link Group analysts.

“Oil has bounced back but is still some way below the level that can generate significant dividend-sustaining profits for Shell and many other oil producers around the world.”

Making up the top-10 were a range of financial names, including banks and insurers, which found themselves in the crosshairs of regulators fearful of another credit crisis.

The Bank of England told banks to cancel payouts and leaned on the insurance sector to suspend dividends as well.

As such, Lloyds Banking Group was the second most-sold UK income stock during the first half and its ownership among UK income funds dropped the most from 19.8 per cent to 2.97 per cent.

Other big financial names featuring among the top-10 included banks HSBC and Barclays, insurers Aviva and Legal & General, and financial services company Close Brothers Group.

The only non-financial name in the top-10 was BT Group, which cut its dividend for the first time in 36 years and warned of lower payouts in the years ahead.

Top of the list of names that UK equity income managers have added to over the past six months is mining company Rio Tinto.

Ownership of the miner rose from 22.77 per cent to 28.71 per cent over the first half, as it announced a 24 per cent increase in its annual dividend during the first quarter as profits were boosted by iron ore prices.

Fellow miner Anglo American was also among the top-10 stocks UK income managers added to during the first half, as it made only a “very small cut” to its dividend during the second quarter.

In second place was multi-national consumer goods company Unilever, which has benefited from higher sales during the lockdown period thanks to its hygiene and in-home food products. It was seen as more defensive during the pandemic.

Another consumer goods company among the top 10 was Reckitt Benckiser, which specialises in health, hygiene and nutrition products.

Other defensive names that UK income managers added to during the first half included tobacco companies British American Tobacco and Imperial Brands, data and professional services company Relx, energy company National Grid, supermarket Morrison, and educational publisher Pearson.

Currently the most-held stock by UK equity income managers is drugmaker GlaxoSmithKline, which is present in 53.47 per cent of portfolios, followed by British American Tobacco (33.66 per cent) and Rio Tinto (28.71 per cent).