The €750bn Coronavirus Recovery Fund agreed by EU members to support the bloc’s pandemic-wrecked economies could help accelerate a number of environmental trends, according to Pictet Asset Management’s Xavier Chollet.

Chollet (pictured), who manages the $1.2bn Pictet Clean Energy fund with Christian Roessing, said at least 30 per cent of the EU’s recovery fund – dubbed ‘Next Generation EU’ – will be spent on ‘pure climate action’.

Funds will be channelled through the EU’s already-established European Green Deal – which aims to make the EU carbon-neutral by 2050 – meaning that the largest economic stimulus in EU history has been built around a desire to combat climate change, Chollet said.

As European Commission president, Ursula von der Leyen, noted on the launch of Next Generation EU: “The recovery plan turns the immense challenge we face into an opportunity, not only by supporting the recovery but also by investing in our future.

Described as a “roadmap for making the EU’s economy sustainable”, the European Green Deal aims to de-couple economic growth from resource use and make environmental and climate challenges opportunities, becoming more economically and environmentally sustainable in the long run.

With the Next Generation EU fund re-confirming the EU’s staunch commitment to a climate overhaul Chollet said that this will accelerate certain investment trends, creating some major beneficiaries in the coronavirus recovery, which his Pictet Clean Energy fund is focusing on.

One such area is e-mobility – the electrical vehicle movement – and another is renewable energy, especially the theme of transitioning from fossil fuels to renewable energy sources.

On the former Chollet said that after a century of slow evolution, the automotive industry is now going electric, opening significant investment opportunities.

“We invest in companies that greatly benefit from the move to electric mobility [e-mobility],” he said.

An example of this is semiconductor companies which have a key role to play in the electric vehicle movement, with electric powered cars requiring 15x more semiconductors than a generic gasoline car.

“As such, it is really the adoption of e-mobility that will drive the growth of this company, rather than things such as global GDP [gross domestic product] growth or even new car sales,” Chollet said.

This lack of dependence on GDP growth is an important factor for the Pictet Clean Energy fund, said its manager.

“Typically, what we look for is to invest in mega-trends in secular growth that is not too dependent on global GDP growth, or industrial activity, or new car sales, but really more dependent on the fact that some industry transformation [is occurring],” he explained.

“The move towards e-mobility is very powerful and backed by many different forces, such as health - reduction of mortality due to air pollution - energy independence, regulation, [the] EU Green Deal and the move towards net zero carbon by 2050, and economics, particularly with recently announced subsidies in Europe.”

He continued: “The idea is that even if GDP is weak for the foreseeable future, the move to e-mobility will happen anyway.”

The second benefactor of the Next Generation EU fund is renewable energy, and the accelerated development of solar and wind energy.

“Wind and solar are now the cheapest source of electricity production in many countries, and they make sense from a health, EU Green Deal, energy independence, economics point of views,” he explained.

“Even though GDP growth is weak, we will transition from fossil fuel electricity to renewables. This is why we believe our investments make a lot of sense for the coming decades: they will be much less driven by economic cyclicality and more by powerful secular trends.”

Chollet’s Pictet Clean Energy fund invests in companies that are contributing to lowering carbon emissions or using cleaner, renewable energies in its production process.

“We have a role to play as investors and we should help and we should encourage this change through our investments and obviously benefit from it for our clients,” he said.

“Frankly it wasn’t the case five or 10 years ago when renewables were so much more expensive than fossil fuels, but I think today we can really do both.”

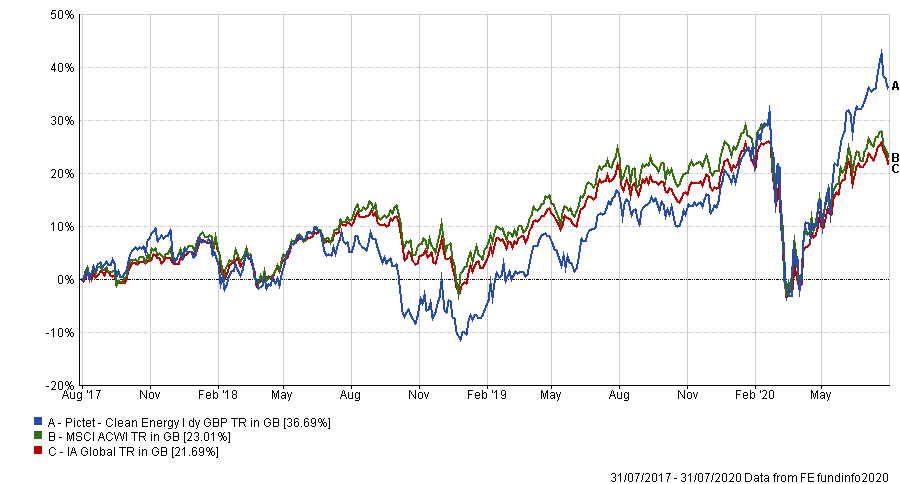

Over the past three years, the Pictet Clean Energy fund has made a total return of 36.69 per cent, outperforming both the MSCI ACWI index (23.01 per cent) and the IA Global sector (21.69 per cent).

Performance of fund vs sector & benchmark over 3yrs

Source: FE Analytics

The fund has an ongoing charges figure (OCF) of 1.11 per cent.