ESG (environmental, social and governance) and sustainable investment has been building momentum for several years, with a growing number of investors taking a more responsible approach when constructing their portfolios.

But 2020 could prove to be a turning point for the style as the coronavirus pandemic has placed a spotlight on companies’ environmental and social responsibilities.

According to the latest data from the Investment Association (IA), responsible investment funds had another strong month of net retail sales in May, attracting £911m and building on the momentum of recent months.

With many looking to invest sustainably for the first time, below are four funds to sculpt an ESG portfolio around.

Liontrust Sustainable Future Global Growth

First up is the £802.9m Liontrust Sustainable Future Global Growth fund, co-managed by Peter Michaelis, Simon Clements and Chris Foster.

Holding an FE fundinfo Crown Rating of five, the fund has been one of the top performers in the IA Global sector across all time frames to 3 August, making top-quartile returns over one month, three months, year-to-date, one year, three years, five years and 10 years.

The ethos of investing into ESG is very much in the bones of this fund’s management team, an element that AJ Bell head of active portfolios Ryan Hughes said is vital when looking where to allocate a sustainable investment.

“With the growth of ESG investing, it is vital to look carefully at the approach and criteria used by different managers to ensure that their approach resonates with your understanding/beliefs in ESG investing,” Hughes said.

“Some managers have been doing this for many years with others having only just had the epiphany and may be operating simply by getting an external company to screen out certain stocks. We much prefer managers who have clearly demonstrated that they have their ESG credentials firmly embedded in their investment philosophy and process and therefore favour those managers who have been doing this a long time rather than the newer entrants.”

He added: “As a result, I would suggest the Liontrust Sustainable Future Global Growth fund as a long-term core holding.”

The fund is run thematically to identify key structural growth trends that the managers believe will shape both the global economy and future trends.

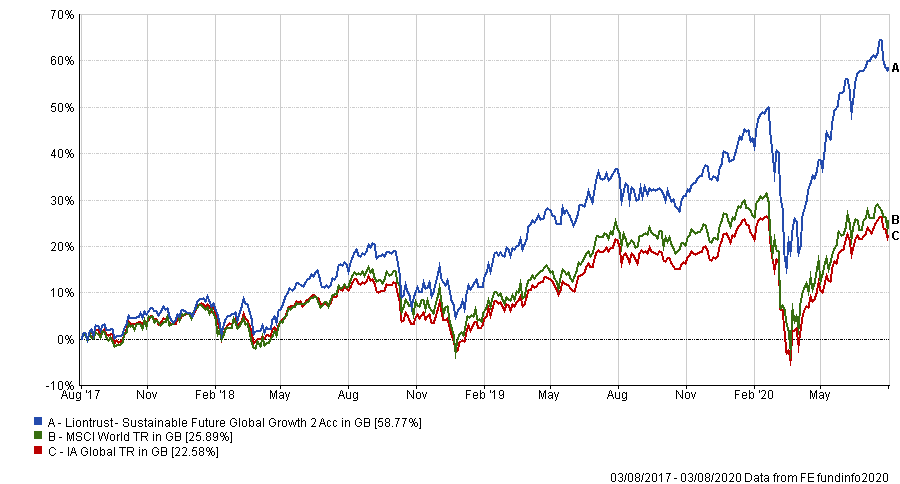

Fund performance versus sector and index over 3yrs

Source: FE Analytics

Over the past three years, Liontrust Sustainable Future Global Growth has made a total return of 58.77 per cent – outperforming the MSCI World index (25.89 per cent) and the IA Global sector (22.58 per cent).

The fund has an ongoing charges figure (OCF) of 0.79 per cent.

BMO Responsible Global Equity

Next up is Jamie Jenkins and Nick Henderson’s BMO Responsible Global Equity fund, which was picked by Tilney’s Louie French

Just like the previous fund, BMO Responsible Global Equity has been a top performer in the IA Global sector, also producing top-quartile returns over all time frames up to and including 10 years.

French, senior research analyst and sustainable portfolio manager at Tilney, said the BMO fund was one of his “top picks”.

“We would describe this fund as following ‘mid green’ ESG criteria, as its ‘invest, avoid and improve’ philosophy means it includes companies aiming to improve their ESG characteristics as well as those whose sustainability profiles are already strong,” he said.

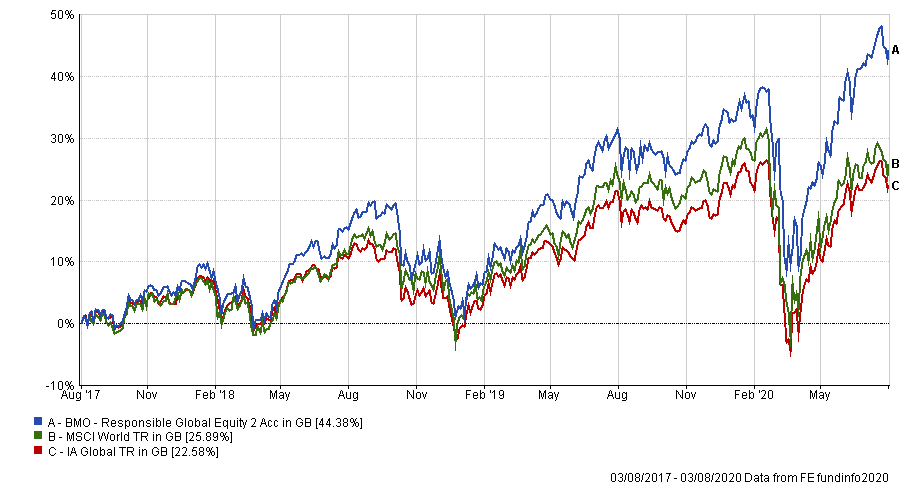

Fund performance versus sector and index over 3yrs

Source: FE Analytics

The £789.9m fund invests in companies that are screened against the classic ESG ‘sin stocks’, avoiding tobacco, alcohol, weapons, gambling, nuclear and pornography, while investing in companies making positive environmental and social impact.

BMO Responsible Global Equity has an OCF of 0.79 per cent.

Baillie Gifford Positive Change

The third pick is from GDIM investment manager Tom Sparke, who said: “One of my favoured funds in the ESG space, and one that is an excellent core holding, is the Baillie Gifford Positive Change fund.”

Calling it a “cornerstone of an ESG portfolio”, Sparke said GDIM’s Ethical Investment Model Portfolios range have held the Baillie Gifford fund for some time and have been rewarded with “excellent performance in that time, especially during this year”.

In fact, year-to-date the fund has been the second-best performer in the entire IA Global sector.

The fund is run by a five strong management team, made up of Julia Angeles, Kate Fox, Kirsty Gibson, Lee Qian and Will Sutcliffe, who have all managed the fund since launch in 2017.

It is run with a growth bias, which is in keeping with Baillie Gifford’s overall investment style. Sparke said it has an “undeniable bias toward companies that utilise technology in innovative and forward-think ways”.

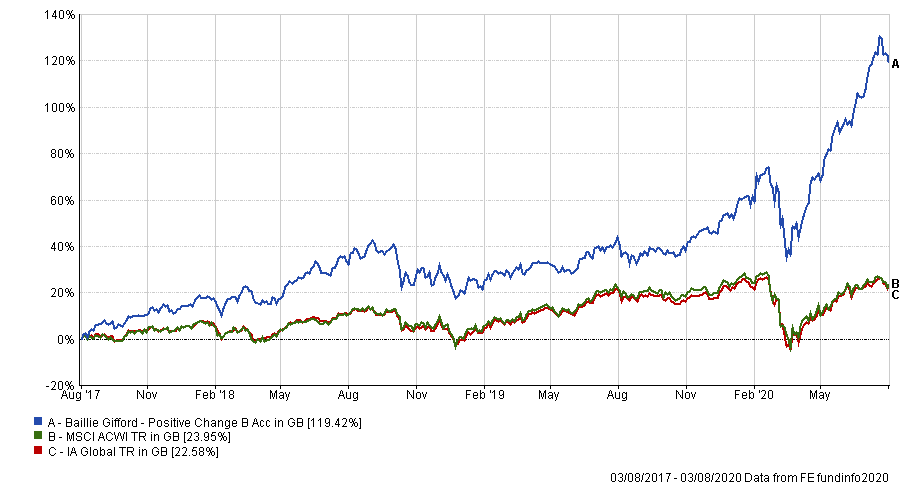

The £889.7m fund has made top quartile returns over three years, making 119.42 per cent total returns and beating its average peer and index.

Fund performance versus sector and index over 3yrs

Source: FE Analytics

Baillie Gifford Positive Change has an OCF of 0.55 per cent.

Royal London Sustainable World Trust

The final pick is the £1.5bn Royal London Sustainable World Trust, which is run by FE fundinfo Alpha Manager Mike Fox.

Adrian Lowcock, head of personal investing at Willis Owen, said: “Fox has developed and finessed the equity process over time and believes it should be responsive to change and able to evolve.”

Alongside creating a positive social impact, the companies Fox looks for are “innovative and disruptive companies so the portfolio is less exposed to the old economy and tilted more toward structural growth”, Lowcock said.

Following suit with a strong performance record, the Royal London Sustainable World Trust is the top performing fund of the 151-strong IA Mixed Investment 40-85% Shares sector over three, five and 10 years.

Fund performance versus sector and index over 3yrs

Source: FE Analytics

The five FE fundinfo Crown-rated fund has an OCF of 0.77 per cent.