Equity funds suffered their second straight month of outflows in July with the UK being the hardest-hit region thanks to continued weakness in the domestic stock market, according to global funds network Calastone.

The latest edition of the Calastone Fund Flows Index (FFI) shows UK-based investors pulled £240m from equity funds in July. This represents some improvement on the net outflow of £1.2bn in June, however.

Active equity funds had outflows of £638m last month while passive funds benefitted from inflows of £398m, continuing a trend that has been seen for some time.

Edward Glyn, head of global markets at Calastone, said: “Caution on equity markets has prompted outflows from equity funds for two months in a row. Weakness in stock markets in July seems to have justified that scepticism and ensured that June’s outflows from equities continued though at a lower level.

“But even though capital is leaving equity funds overall, a wide gulf is opening up between those funds in favour and those leaving investors cold. The dichotomy between growth and value helps explains why this is happening.”

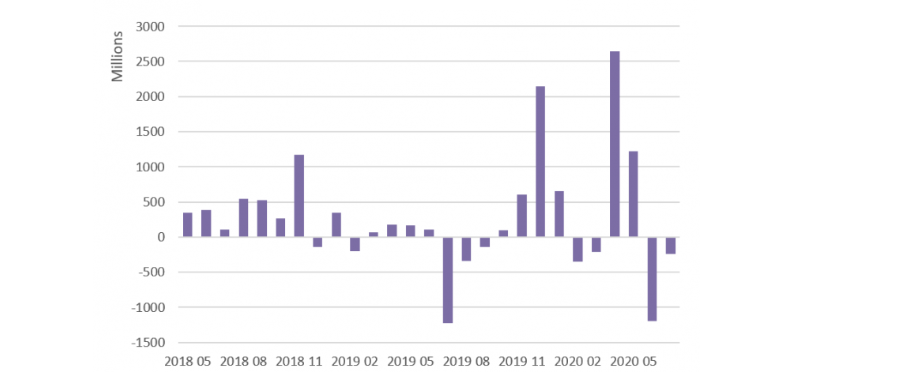

Net monthly flows for equity funds

Source: Calastone

Glyn noted that the value of future profits is essentially being inflated by record-low interest rates around the world. As growth stocks tend to have more of their value tied up in ‘the future’, their share prices benefit significantly more when money is cheap.

Conversely, stocks where a larger share of their return is delivered today – such as those that are held for their dividends – are less attractive as their valuation depends more on things going well right now.

“With so many ‘value stocks’, many of which have cut dividends hard, it’s no wonder the UK stock market has underperformed in the global market rally since March,” Glyn said. “This explains the outflows from UK-focused funds and helps explain the increased surge in outflows from income funds.”

This can be seen in the July’s Calastone FFI as UK equity funds suffered the heaviest outflows of the money, with £377m flowing out over the month. This followed £679m in July, which was the highest ever on record and an all-time high for outflows.

In addition, last month saw outflows from equity income funds accelerate to £705m, breaking their record for a second month running.

European equity funds, meanwhile, had their 26th consecutive month of net outflows but they only lost £62m. Calastone attributed this reduction in negative sentiment towards European funds reflects a relatively effective response to the pandemic.

Not all equity categories were hit with outflows in July, however, with global funds taking in £605m during July. April to July 2020 were four of the best eight months on record for global fund inflows, with investors committing almost £3.1bn to them.

Glyn said global equity funds’ skew towards growth stocks is one reason why they are remaining relatively popular with investors. However, he also highlighted that the growing popularity of environmental, social, and governance (ESG) funds is creating a significant boost for global strategies.

In July, £320m of inflows went into global ESG funds – more than half of the total into all global equity funds. This is all the more impressive when the far smaller size of the ESG category relative to general global equity is considered.

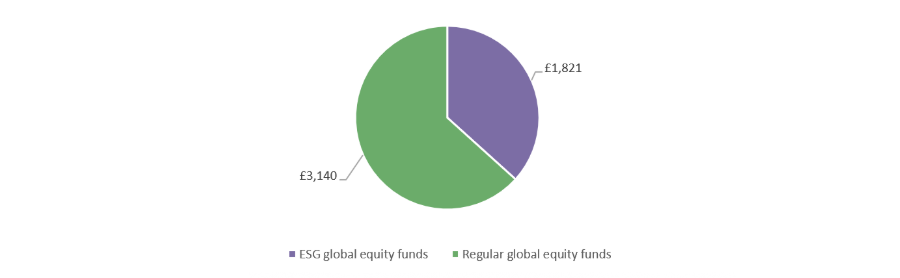

Over the last year, one-third of the money going into global funds has ended up in those focused on ESG investing, as the chart below shows.

Net inflows to global funds over 12 months

Source: Calastone

“Crucially, [global funds] are benefitting from a huge marketing push by the fund management industry in favour of ESG funds, partly in response to very strong investor demand for ESG products and partly because they offer better margins for managers,” Glyn explained.

“Indeed because ESG funds tend to be actively managed, they are also the one area of real strength for active equity funds, which are otherwise suffering at the expense of their passive counterparts.”