It’s the middle of the summer and most investors are off trying to make the most of the quiet time and good (if temperamental) weather.

Yet, while I’ve been stuck indoors, I’ve been thinking of ways to improve my very modest Lifetime ISA (LISA) portfolio.

Having added two global strategies to the two UK-focused funds to my LISA, I wanted to add a position in what I think will be another long-term growth trend.

As I’ve noted before, I am no expert and hold no investment qualifications, nor am I allowed to give investment advice. And, as always, I look forward to being lambasted in the comments once more.

Dear reader, the latest addition to my portfolio has been an exchange-traded fund (ETF).

Some will be surprised to learn that – having been accused of being a cheerleader for the active management industry in the past – I have no particular bias to either passive or active.

It’s not just any old ETF, however: it’s a thematic strategy and one which I believe will play an important role in the development of the global economy in the coming years.

So, without further ado, the passive fund I’ve added to my portfolio.

It's… L&G ROBO Global Robotics and Automation Ucits ETF.

The $849.9m passive strategy – often referred to by its distinctive ticker, ROBOT – aims to track the performance of the ROBO Global Robotics and Automation Ucits index: a basket of stocks actively engaged in robotics and automation-related activities.

Robotics & automation is one of the themes that has played an increasingly important part in our everyday lives and a part of industry where great strides continue to be made.

The market size for artificial intelligence analytics and technology alone could exceed $110bn by 2024, according to the bank, while the global industrial robot market is expected to rise from $11bn in 2014 to $24bn by 2025.

The index which the ETF tracks includes just over 80 stocks – from a global universe of more than 1,000 – across 12 sub-sectors in 14 countries and is built to minimise risk by limiting reliance on the largest-cap players.

Broadly, L&G Investment Management said, the robotics and automation industry can be thought of as two different areas: ‘technology’, or those companies offering products and services to help robots ‘think, sense and act’; and, ‘applications’ that deploy such technology into a product, services or manufacturing process to increase efficiency or productivity.

Companies that derive most of their revenues from robotics and automation are equally weighted and given an aggregate weighting of 40 per cent in the index, while companies that derive only a proportion of their revenues from those areas are equally weighted and given an aggregate weighting of 60 per cent.

Furthermore, only companies of a sufficient size (based on the total market value of its shares) and liquidity (based on daily traded volumes) are eligible for inclusion.

However, if you’re expecting well-loved FAANGs names – Facebook, Amazon, Apple ($2trn!), Netflix and Google-parent Alphabet – to make an appearance in the portfolio, you might be disappointed. It’s not a specific play on the mega-cap tech names that have driven the markets during the past decade.

Indeed, the index includes such names as Vocera, Nvidia, Brooks Automation, Cognex and Intuitive Surgical – companies which may mean very little to the average UK investors but are pioneers in their respective fields.

And given the highly specialised nature of the industries they serve, these companies often have some of the quality characteristics that some of the very best active managers look for.

Indeed, some of the companies exhibit the types of ‘economic moats’ that restrict the impact of competition on their revenues.

But, I hear you all asking: ‘How has it performed?’.

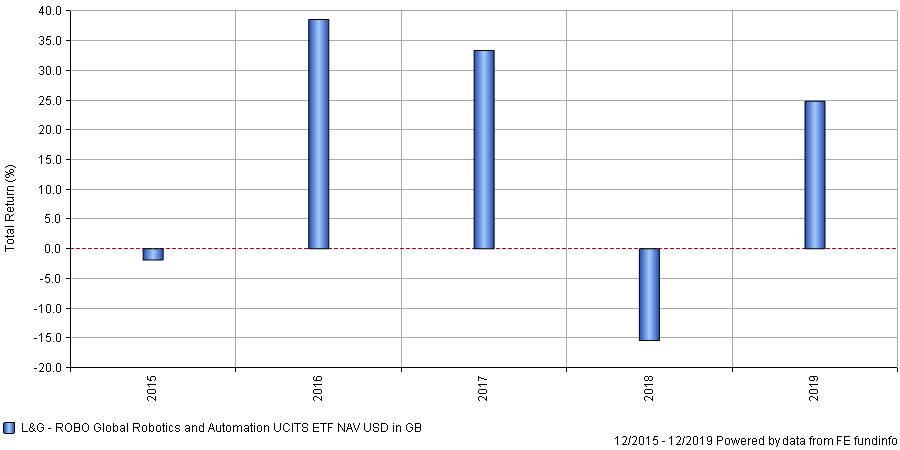

Well, dear reader, in 2019 L&G ROBO Global Robotics and Automation Ucits ETF returned 24.80 per cent but during the prior year (2018) it had made a loss of 15.42 per cent, which had followed a 33.36 per cent gain in 2017, as the below chart shows.

So far this year, the ETF is up by 14.11 per cent (as of 20 August).

Annual performance of ETF since launch

Source: FE Analytics

Over five years to end-July it has an annualised volatility of 18.03 per cent. Indeed, it sits at the riskier end of the risk/reward profile and is rated a six on the one-to-seven scale of lowest-to-highest risk.

In its key investor information document (KIID), LGIM noted that the ETF is “subject to the risks associated with technology-focused companies and are particularly vulnerable to rapid developments in technology (which may leave their products out-of-date), government regulation and competition from domestic and foreign competitors who may have lower production costs”.

The asset manager continued: “Such companies may also have difficulties establishing and maintaining patents, copyrights, trademarks and trade secrets relating to their products which could negatively affect their value.”

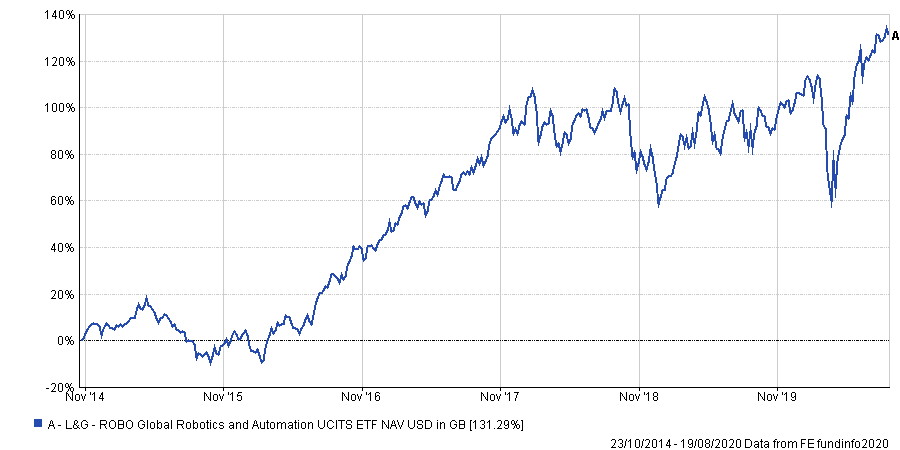

On a cumulative basis, however, it has made a total return of 131.29 per cent (in sterling terms) since launch in October 2014.

In comparison, an investment in the FTSE 100 – the UK’s blue-chip investment index – would have returned just 20.04 per cent.

Performance of ETF since launch

Source: FE Analytics

Nevertheless, past performance is no guide to future returns and – as LGIM notes – the strategy may not be appropriate for those wishing to withdraw their money within the next five years.

However, as it sits within my Lifetime ISA – which will not be accessible by me for the next 20-plus years – it should hopefully provide some exposure to what I think will be one of the key trends of the next decade.

L&G ROBO Global Robotics and Automation Ucits ETF has an ongoing charges figure (OCF) of 0.81 per cent.