The trend toward ESG (environmental, social & governance) strategies has continued well into 2020, despite the economic fallout of the coronavirus pandemic.

Interest in the strategies has built as the strategies have outperformed their equivalent mainstream counterparts, according to The Share Centre investment analyst Tom Rosser.

Despite the impact of nationwide lockdowns, the efforts of decarbonisation and declining energy prices have been accelerated by Covid-19, and investors are looking to strengthen their portfolios, he explained.

Below Rosser has highlighted three fund picks for investors looking to explore climate investment opportunity.

VT Gravis Clean Energy Income

First on the list, is the £127.9m VT Gravis Clean Energy Income fund managed by William Argent.

“It is one of the earliest institutional scale investors in renewable energy in the UK and offers investors great potential for competitive total returns as well as exposure to environmentally friendly assets,” said Rosser.

Argent uses a quantitative and qualitative approach to selecting investments. The quantitative side involves considering a company’s net asset value, which allows the manager to appraise its value and compare it against other companies.

“The VT Gravis Clean Energy Income fund provides investors with access to a wide range of clean energy investments and has high exposure to wind and solar assets across a diverse range of geographic regions,” said Rosser.

“It benefits from both growth, stemming from exposure to a sector which is growing in demand, and income which is generated by renewable energy assets in the form of subsidy payments and revenue from power sales.”

Performance of fund vs sector since inception

Source: FE Analytics

Since inception, VT Gravis Clean Energy Income has made a total return of 51.75 per cent, compared to 20.71 per cent from the IA Global sector. It has an ongoing charges figure (OCF) of 0.8 per cent.

L&G Future World Climate Change Equity Factors Index

The analyst’s second fund pick is the £81.4m L&G Future World Climate Change Equity Factors Index fund, a passive strategy.

The fund aims to provide both income and capital growth by tracking the performance of the FTSE All-World ex CW Climate Balanced Factor index.

It invests almost exclusively in the shares of index constituents although it may omit those that don’t meet its climate impact pledge.

“The fund aims to track the performance of an index which starts with over 3,000 securities and reduces or eliminates exposure to those involved in fossil fuels or emitting high levels of carbon dioxide relative to other companies in the same sector,” explained Rosser.

“The index also increases exposure to those companies producing goods, products and services allowing the world to adapt to, mitigate or remediate the impacts of climate change.,” explained Rosser.

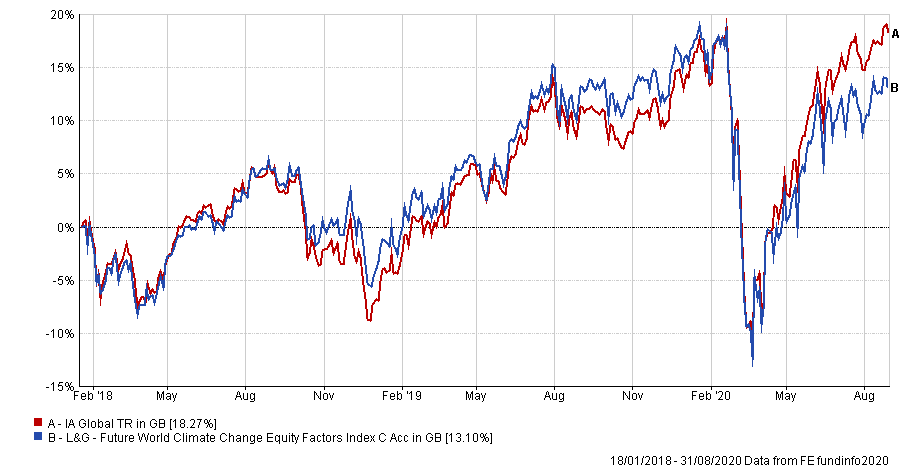

Performance of fund vs sector over 5yrs

Source: FE Analytics

During the past five years, L&G Future World Climate Change Equity Factors Index fund has returned 13.10 per cent, in comparison with 18.27 cent for its average peer in the IA Global sector.

The analyst outlined that its low OCF of 0.30 per cent makes it a low cost way for investors to access climate conscious companies, which include the likes of Apple, Microsoft and Intel.

“Performance is unlikely to be off the charts,” added Rosser. “But over time the total returns produced should compound up well.”

JLEN Environmental Assets

The final pick is the £645.1m JLEN Environmental Assets fund, a closed-ended strategy managed by Chris Tanner and Chris Holmes.

“The fund invests in projects utilising natural or waste resources to support more environmentally-friendly approaches to economic activity,” he said.

Rosser said wind, solar, waste and wastewater, anaerobic digestion and hydroelectricity make up the major themes within the portfolio. These themes, he continued have delivered strong risk-adjusted returns and income over time, even outpacing the FTSE All Share index.

“In 2019/20 the fund helped avoid 445,000 tonnes of waste going to landfill and contributed towards 115,000 tonnes of reusable materials being recycled,” added Rosser.

“The investment and environmental benefits are clear to see and with the fund trading on the London Stock Exchange it also provides investors with ease of access and additional liquidity compared to open-ended funds,” he said.

Performance of fund vs sector over 5yrs

Source: FE Analytics

Over five years, JLEN Environmental Assets has returned 52.52 per cent in comparison with 55.59 per cent from its average peer in the 13-strong IT Renewable Energy Infrastructure sector.

The fund is not geared, has ongoing charges of 1.26 per cent, is trading at a premium to NAV (net asset value) of 28.2 per cent and has a yield of 5.5 per cent, according to data from the Association of Investment Companies.