More than half of fund managers believe we are at the start of a new bull market, despite the ongoing coronavirus pandemic and the economic turmoil it has caused.

These are the latest findings of Bank of America’s Global Fund Manager Survey, which is a closely followed poll of asset allocator’s current positioning and thinking. The bank surveyed 190 fund managers running a total of $601bn between 2 and 10 September.

Coronavirus cases continue to climb around the globe as many economies attempt to rebuild themselves after coming out of lockdown with many social restrictions still in place.

But after an initial plunge into bear market territory, equities have climbed over recent months as massive amounts of monetary and fiscal stimulus was unveiled to combat the crisis. Since markets bottomed on 23 March, the MSCI AC World index has made a 34.26 per cent total return (in sterling).

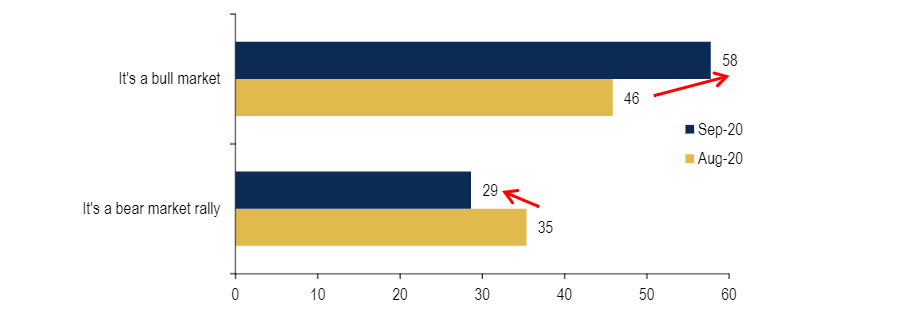

Investors believe we are in a bull market

Source: BofA Global Fund Manager Survey

When fund managers were asked in May this year, just 25 per cent thought it was the start of a new bull market. This has been climbing and, this month, some 58 per cent of the investors polled by Bank of America said they believe another bull market has begun.

In contrast, only 29 per cent of fund manager consider stocks to be undergoing a bear market rally.

There has also been some improvement in fund managers’ economic outlooks.

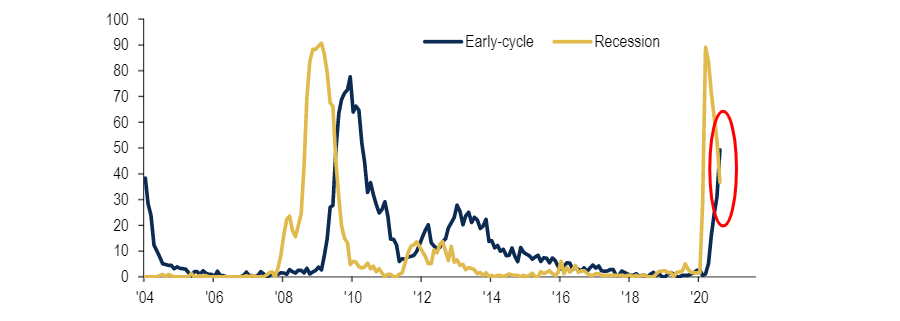

For the first time since February, more investors think the global economy is in early-cycle phase rather than a recession. September’s survey found that 49 per cent of managers said we are in the early part of the cycle, compared with 37 per cent thinking the economy remains in recession.

Bank of America added that this switch in thinking was a “key recovery milestone” in the downturns of 2009 and 2012.

Investors think early-cycle rather than recession

Source: BofA Global Fund Manager Survey

A net 84 per cent of respondents are expecting the economy to strength over the coming 12 months – the highest level since September 2003.

Bank of America added: “40 per cent of respondents expect the global economy to get ‘a lot stronger’, the highest number ever.”

When it comes to the health of companies, a net 47 per cent of asset allocators told Bank of America that the global corporate earnings will rise 10 per cent or more over the next 12 months. This is the highest reading here since February 2011 and is a stark turnaround from the situation just a few months ago.

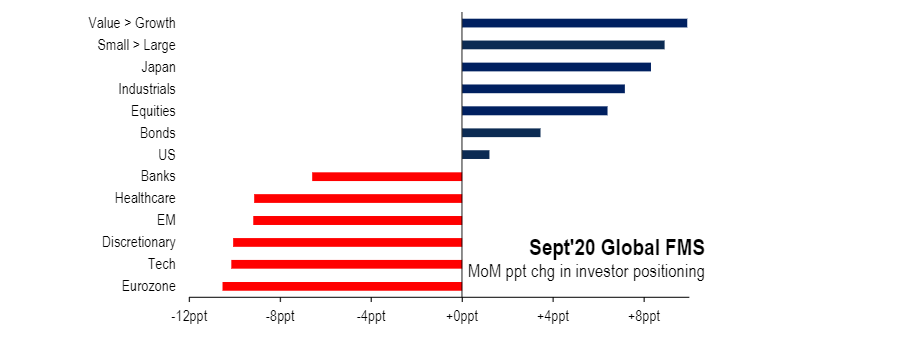

Signs of this confidence can be seen in the month-on-month changes in investor positioning. During September, funds rotated into areas associated with a more bullish mindset, such as value investing, small-caps and industrials, while moving away from defensives plays like healthcare, tech and large-caps.

However, asset allocators did not carry out any regional rotation and maintained a preference for the US over Europe, emerging markets and the UK.

Start of rotation to cyclicals

Source: BofA Global Fund Manager Survey

Relative to long-term history managers remain “stubbornly skewed” toward healthcare, tech, the US and cash, while being short areas like energy, banks and the UK.

Despite growing confidence, Bank of America said fund managers appear to be “far from dangerously bullish”. A net 18 per cent of the survey’s respondents are currently overweight equities, which is a relatively low reading when compared to the levels seen over the past decade or so.

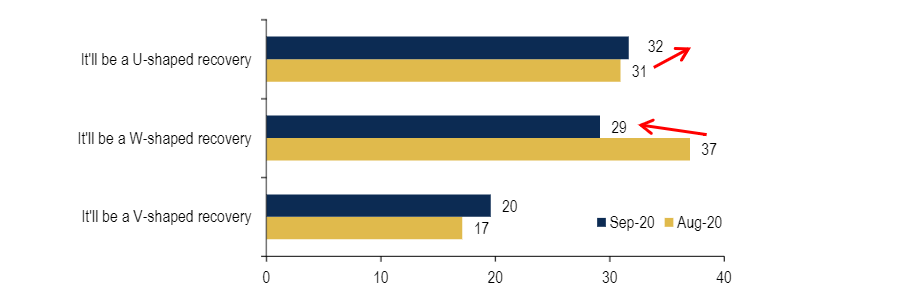

Indeed, the survey also hinted at signs of caution among fund managers. Only 20 per cent of investors believe the recovery from the coronavirus crisis will be V-shaped; 61 per cent expect it to be a U-shaped recovery or a W-shape recovery, or a ‘double-dip’.

Investors believe in U- or W-shaped recovery

Source: BofA Global Fund Manager Survey

This doubt over the sustainability of any recovery is one of the reasons why 51 per cent of investors would prefer to see companies use cash flow to improve their balance sheets. That said, a growing number (37 per cent, up from 13 per cent in April) want them to increase capex (capital expenditure).

And these doubts are reflected in portfolios, with average cash balances edged up from 4.6 per cent to 4.8 per cent in September.

Of course, the biggest threat to the economy and markets remains a second wave of coronavirus. This was the biggest ‘tail risk’ for 30 per cent of the fund managers polled by Bank of America, followed by a tech bubble, the US presidential election and the US-China trade war.

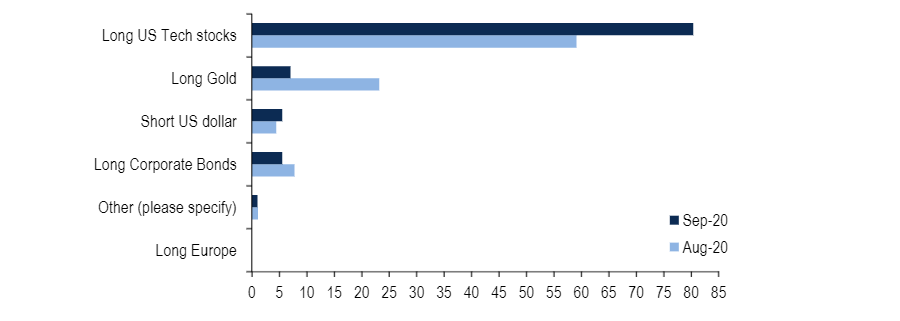

And when it comes to the most crowded trade, fund managers picked out long US tech once more.

What investors think is currently the most crowded trade

Source: BofA Global Fund Manager Survey

Some 80 per cent of fund managers view being long US tech stocks – which led the post-financial crisis bull market and have continued to rise during coronavirus – to be the most crowded trade.

This is the strongest consensus view ever for this question in the survey and is far above other crowded trades, such as long gold and short US dollar.