Some of the biggest arguments against relying on the FTSE 100 for income have been amplified by the coronavirus crisis, according to LF Gresham House UK Multi Cap Income manager Brendan Gulston.

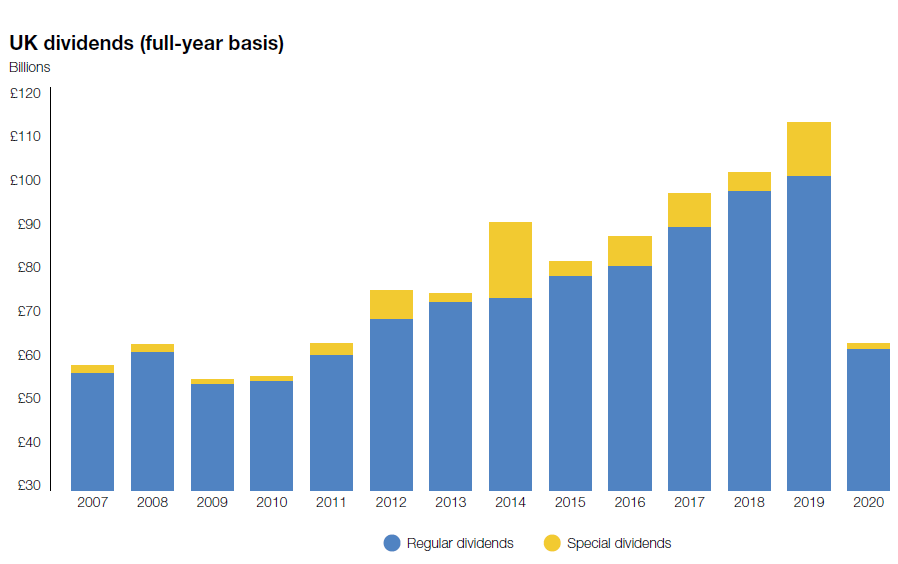

The Link Dividend Monitor showed UK dividends fell 44 per cent to £61.9bn last year on a headline basis, which was the lowest annual total since 2011.

Source: Link Dividend Monitor

While there was an improvement towards the end of the year, with Q4 payouts slightly ahead of the group’s revised expectations, Gulston said this was mainly down to currency movements and non-recurring special dividends, which masked underlying earnings figures that weren’t as secure as the payouts suggested.

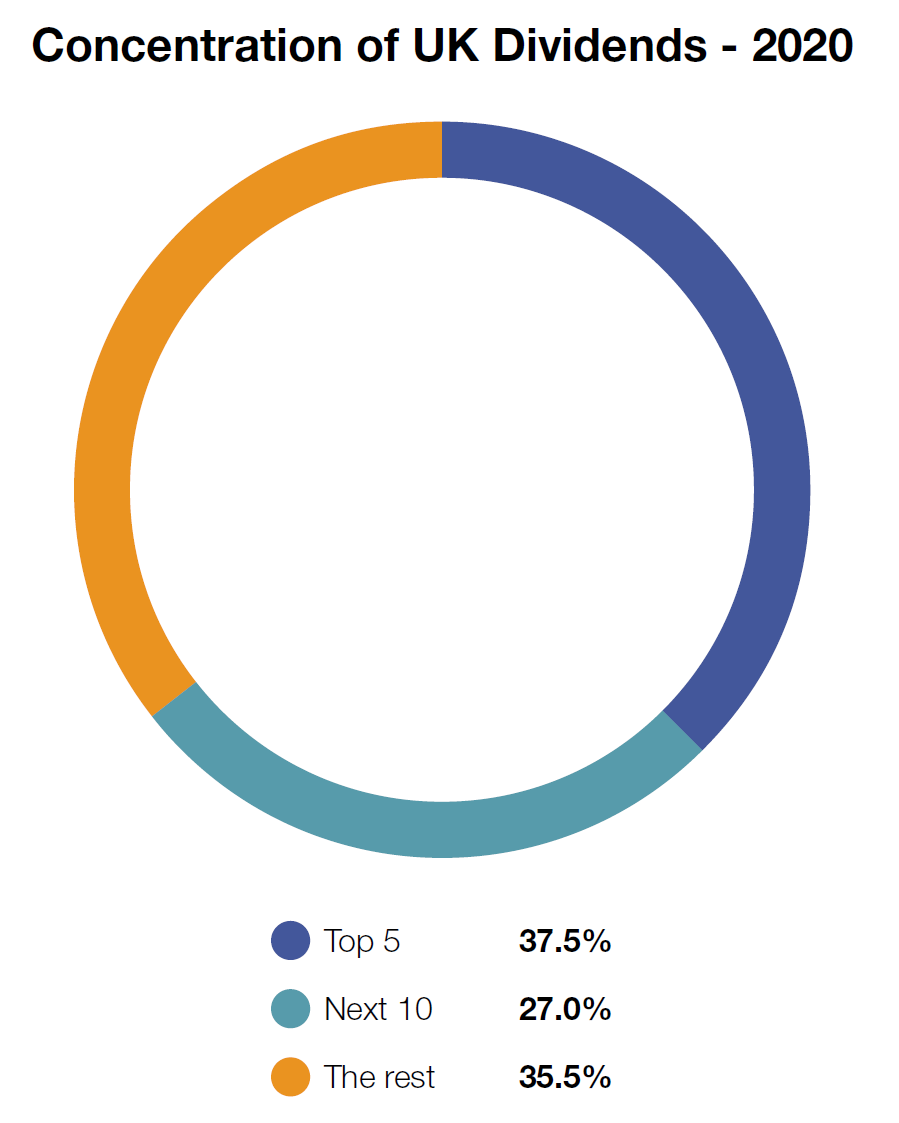

And he added that there are many reasons to be wary of the biggest dividend payers over the coming years. The first of these is down to the problem of concentration risk.

“In 2019, some five big players paid out £27.2bn, or 34 per cent, of total UK dividends, and the top 15 paid out 64 per cent,” the manager said.

“Last year we saw a huge amount of dividend cuts and that £27.2bn from the top five fell to about £23bn, but the concentration increased to 37.5 per cent.

Source: Link Dividend Monitor

“I'm not saying FTSE 100 companies are not attractive places to get an income, but our view is that if you are relying on that, you're not diversified and, if something bad happens, that could have a disproportionate impact on your fund.”

Gulston pointed out that not only are dividends concentrated in a small number of stocks, they are also concentrated in a handful of sectors. Data from the Link Dividend Monitor shows just three sectors – miners, banks & financials and oil & gas – were responsible for £61.8bn of UK dividends paid out in 2019, or 56 per cent of the total.

And the manager said the problem with companies in these sectors is their fate is to a large part determined by external factors that are outside of the control of the management team.

“Those three sectors were the hardest hit last year,” he continued. “The political pressure on the banking sector entirely wiped out dividends from £15.6bn to zero. Miners and oil & gas rely on commodity prices and [the former] is very geared into cyclical factors. Mining dividends were down 57.7 per cent and oil & gas dividends were down 42 per cent.

“We don't want to be having to take that risk.”

While the banks were subject to political pressure when the government forced them to cancel dividends, Gulston said this is just one example of how larger companies attract greater scrutiny, which is likely to become more of an issue in the recovery.

“You've got companies that received furlough money paying out huge dividends. This is probably going to get a bigger impact in terms of focus from the media if you are in the FTSE 100 rather than smaller companies.”

So what are the options for income investors? The Link Dividend Monitor noted that despite the widespread dividend cuts in the FTSE 100 in 2020, it actually fared better than the FTSE 250. For the full year, the top 100 companies saw underlying dividends fall 35 per cent, compared with 56 per cent from the mid caps.

The group said this was mainly because the larger firms have more resilient balance sheets, greater geographical diversification (with significantly less exposure to the disruption in the UK) and superior access to capital if they need it.

Yet while dividends across the market fell 44 per cent, those in the LF Gresham House UK Multi Cap Income fund were down just 17 per cent.

Gulston attributed this to his portfolio positioning, with 80 per cent in companies in “robust resilient” and “thematic structural” categories.

“Some companies in the portfolio were just completely unaffected,” the manager explained. “They operated in markets that continued as usual and in some cases benefited because of structural advantages of the market and of their proposition.

“An example would be a company like Emis. Its market share in GP [general practitioner] software continued as normal and it offered additional functionality for remote consultations.

“Another example is Randall & Quilter, a specialist insurance business that essentially takes legacy liability books off large corporates. It has been operating for about 30 years in a market that is driven by a structural tailwind of regulatory change rather than external factors.

“But Covid was a tailwind as it negatively impacted cash flow and meant corporates were looking to get rid of, say, a £50m provision that they had on their balance sheet as a legacy that they were probably not interested in.”

Data from FE Analytics shows LF Gresham House UK Multi Cap Income has made 33.97 per cent since launch in June 2017, compared with 7.97 per cent from the FTSE All Share index and 2.95 per cent from the IA UK Equity Income sector.

Performance of fund vs sector and index since launch

Source: FE Analytics

The £79m fund has ongoing charges of 0.86 per cent and is yielding 3.16 per cent.