Chancellor of the exchequer Rishi Sunak has announced that £280bn will be spent this year in tackling the Covid-19 while borrowing will reach a peacetime-high of £394bn in his spending review.

It came as the Office for Budget Responsibility (OBR) forecast that UK economic activity will contract by 11.3 per cent this year, the largest fall in output for 300 years. The economy is forecast to grow by 5.5 per cent in 2021 and by 6.6 per cent in 2022.

He said: “Our health emergency is not yet over and our economic emergency has only just begun.

“The economic impact of coronavirus, and the action we’ve taken in response, means there has been a significant but necessary increase in our borrowing and debt.”

He continued: “The UK is forecast to borrow a total of £394bn this year, equivalent to 19 per cent of GDP. The highest recorded level of borrowing in our peacetime history.”

Sunak added: “High as these costs are, the cost of inaction would be even worse, and we have a responsibility, once the economy recovers, to return to a sustainable fiscal position.”

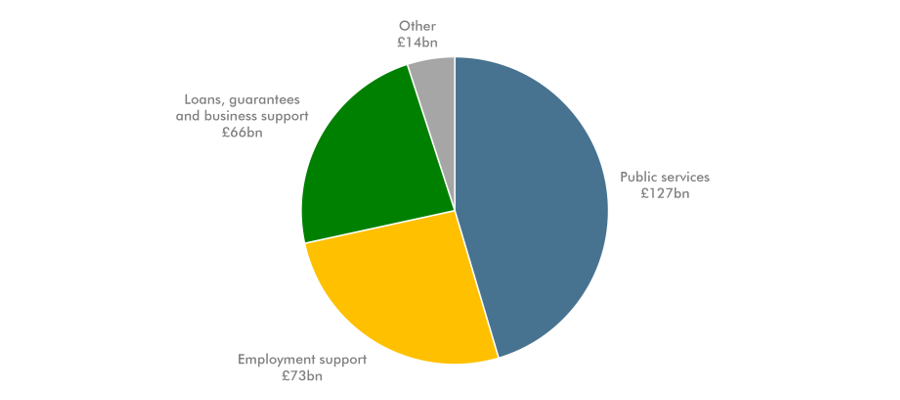

The chancellor revealed that £280bn will be provided for the pandemic response, with public services being the largest beneficiary at £127bn.

Virus related support measures in 2020-21

Source: OBR

Unemployment is also expected to rise to a peak of 7.5 per cent next spring, which would see roughly 2.6m people unemployed.

The chancellor revealed a pay freeze for millions of public sector workers, but those earning less than £24,000 will get a minimum £250 increase.

Having said that, there would be a pay rise for over 1 million people working in the NHS.

“Today’s Spending Review was a stark reminder of the long-lasting economic damage done by the Covid pandemic,” said Quilter Cheviot’s head of fixed interest, Richard Carter.

“The government looks set to borrow almost £400bn in this financial year which is completely unsustainable and will likely lead to higher taxation down the line, but those decisions will have to wait until the Spring,” he said.

“After the forecast bounce next year and in 2022, growth will fall back again just over 2 per cent, than back below 2 per cent for the next two years,” said Neil Birrell, chief investment officer at Premier Miton Investors.

“This illustrates that the scars are long lasting; the scale of debt and unemployment are fundamental to the problem,” Birrell added.

The impact this will have on individuals further down the line is yet unclear, with expected austerity measures next year to meet the growing deficit.

“The time will come when more weight is given to fiscal sustainability, but it is right that the chancellor has placed greater emphasis today on how to support the economy,” said Karen Ward, chief market strategist EMEA at JP Morgan Asset Management.

“The longer-term challenge for the chancellor will be to demonstrate that the increase in the UK’s deficit is cyclical rather than structural, but that will be a debate for another day,” Ward noted.

Despite the high level of borrowing and hit to employment, Willis Owen’s head of personal investing, Adrian Lowcock sees some optimism for UK investors.

“There are clearly still tough times ahead, but for investors it is important to remember the stock market is not the economy,” said Lowcock.

“It could be easy for investors to dismiss the UK as a region to focus on now because of coronavirus and the ongoing spectre of Brexit, but as ever, many innovative businesses in this country will thrive.”

He finished: “The top UK equity managers have proven time and again they can find these gems in the marketplace, and we expect coronavirus, while no doubt an extreme event, will not prevent them from doing so again.”