The discounts on conglomerates such as Sony and Softbank are overstated and ignore the quality of the underlying businesses within them, according to Joe Bauernfreund, manager of the AVI Global Trust.

Joe Bauernfreund, manager of the £1bn investment trust, said that by shifting out of cyclical stocks and tilting towards more quality-growth names and undervalued conglomerates was a large contributor to performance this year.

He highlighted his position in Japanese conglomerate SoftBank – headed by Masayoshi Son – with its exposure to Alibaba and pointed to its narrowing discount as a strong contributor to performance.

It came despite the negative attention it has been receiving recently over its large US equity options trade that cost the group $2.7bn in derivatives losses, which prompted the nickname “Nasdaq whale” and big write-downs following the collapse of German payment company Wirecard and US shared workspace company WeWork.

He said: “I think there’s been a lot of negative press around SoftBank ever since WeWork basically folded, the whole question marks over the Vision fund, and there has been some bad press around its ‘Nasdaq whale’ bets, but I think those are distractions, they miss the big picture.

“In terms of the overall value within SoftBank, they are small components of the value.

“The big story here is Alibaba, [which] makes up almost 70 per cent of the overall value. So, if Alibaba does well SoftBank’s NAV [net asset value] appreciates.”

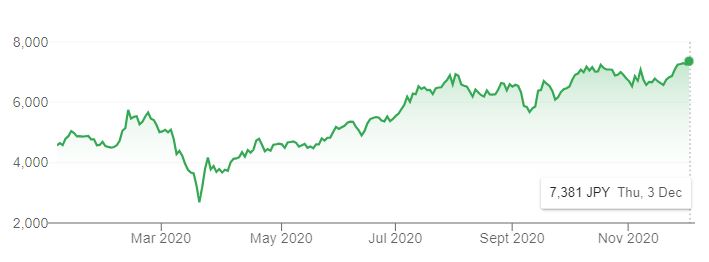

Performance of Softbank YTD

Source: Google Finance

Bauernfreund also highlighted the actions that the Japanese conglomerate is taking to narrow the discount.

He said: “Back in March and April, SoftBank was on a on a discount to its NAV of over 70 per cent. That’s just massive.

“The company has more than delivered on its promises back then to sell assets, to repay debt, and to buy back shares, as well as improve corporate governance.”

Ultimately, he believes they are headed in the right direction: “They’ve been buying back loads of shares, they’re going to be buying back plenty more over the next six to nine months, and the discount has come in from that 70 per cent to a little over 50 per cent.”

He continued: “It’s still far too wide, but it’s why we retain a position in it because on a risk reward profile, it stacks up very attractively, and we still think Alibaba, despite what’s going on recently in China with the regulators, is still a very attractive business.”

Alibaba was set to benefit from the world’s largest $37bn IPO in November but was stopped two days before it was due to list by China’s capital market regulators.

Bauernfreund also argued that within Softbank’s Vision fund has had some good results and uplift on the back of some of the structural trends that have taken place since the onset of the pandemic.

“I think there was a time last year when investors would be prepared to say the whole Vision Fund was worth zero, and I think that's overly pessimistic,” he said.

“There are some assets within there that we think are quite good with their exposure to various segments of the e-commerce and internet industry.”

Bauernfreund was also optimistic on his position in Pershing Square Holdings, which graduated to the FTSE 100 this month.

Activist investor Bill Ackman, founder and chief executive of Pershing Square Holdings, is known more recently for his big short position on corporate debt that made $2.6bn in profits during the coronavirus crisis.

Bauernfreund said: “Not only did he read the situation, but he positioned the fund to benefit from it remarkably well.

“There were people who were concerned about Covid and the impact, but didn’t actually get the trade right.”

He said: “It’s a dream for a long-term investor to have cash, when your portfolio is on sale, as it was back in March to put money back into those companies that he said he had a lot of conviction about. So, he’s navigated 2020 remarkably well.

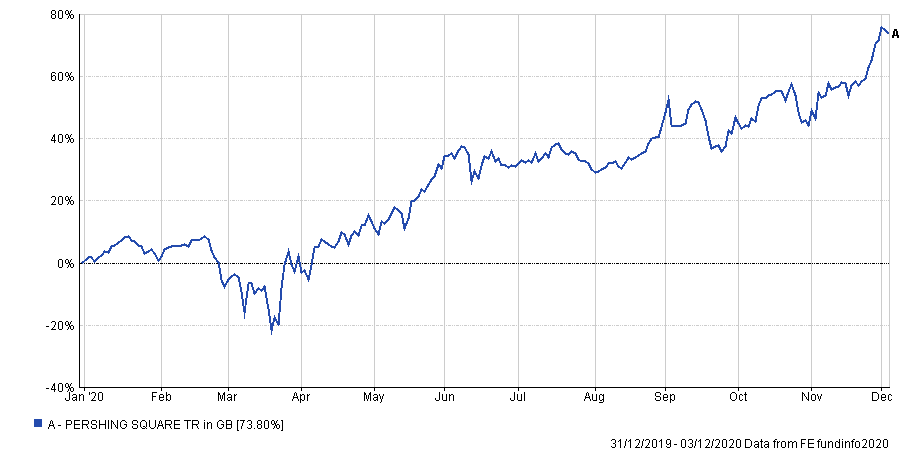

“The surprise, from our perspective, is that it still remains on a near 30 per cent discount, which I think is entirely unjustified given not only their results, but the quality of their portfolio and the quality of the management.”

“We think the companies that they own in their portfolio is a collection of high-quality businesses, that is well positioned within their respective industries to do well, with good quality management at what we think are reasonably attractive valuations.”

Performance of Pershing Square Holdings YTD

Source: FE Analytics

The upside in the NAV of Pershing Square Holdings is the key reason he is still very positive.

He said: “This is notwithstanding potential narrowing of discount, notwithstanding the potential payoff on the hedge, those are sort of just side lines, the core story here is that it’s a collection of very high-quality US-based businesses.”

Another stock that has performed well for the AVI Global Trust manager and where he continues to see upside is Sony, which the trust acquired approximately 18 months ago.

“Within Sony, there’s a collection of three or four core businesses, each of which, on a standalone basis, is a leader in its own industry,” he explained. “[And] each of which, on a standalone basis, would command a valuation when an excess of that implied by the conglomerate.”

He described it as a ‘classic conglomerate discount’, but unlike most conglomerate situations, it is a collection of high-quality market leading businesses – a gaming business, an imaging business, and a music business – all of which have proven to be extremely well-positioned during the pandemic and beyond.

“In your typical conglomerate discount situation, you tend to find one good business and one bad business,” he said. “The two outweigh each other, hence the discount.”

“What we’ve seen this year, obviously is gaming and entertainment has done particularly well, gaming in particular has done very well.”

“The image sensor business, semiconductors, chips for smartphones and autonomous driving, has done has had a more cyclical year as the world went into lockdown and productions halted or reduced, but I see a big recovery,” he finished.

AVI Global has delivered a total return of 98.64 per cent over the last five years, compared with 93.34 per cent from the average trust in the IT Global sector and 89.93 per cent from the MSCI World index.

Performance of AVI Global vs sector & benchmark over 5yrs

Source: FE Analytics

The trust is trading at a 8.4 per cent discount to NAV and has a dividend yield of 2 per cent as of 3 December 2020. It is 9 per cent geared and has ongoing charges of 0.89 per cent.