Less than half of active equity funds beat the market in the opening three months of 2021, Trustnet research has found, as last year’s winning managers handed back some of the strong outperformance of 2020.

While last year created some unprecedented issues for investors to navigate – namely a pandemic, a lockdown of the global economy, massive amounts of fiscal and monetary stimulus, and the announcement of effective vaccines – it ended up being a fairly decent year for active managers.

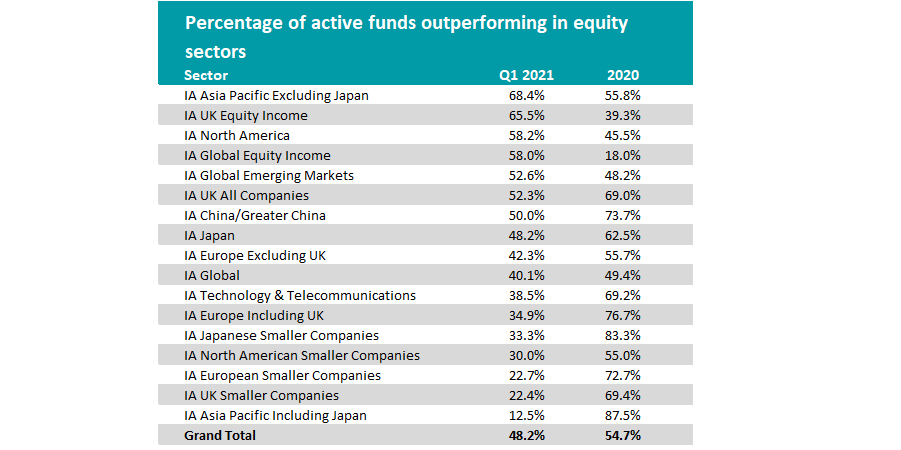

Research by Trustnet shows 54.7 per cent of the funds in the Investment Association’s 17 pure equity sectors outperformed their benchmark (or the most common index in the peer group if they chose not to have specified benchmark) during 2020.

This represented a slight fall from 2019, when more 60 per cent of active funds were able to beat the index, but was it much better than 2018, when around two-thirds of active managers underperformed.

However, the opening quarter of 2021 has seen the relative performance of active funds slip a little further – over the January to March period, only 48.2 per cent of equity funds were ahead of the market.

The table below shows the percentage of funds in each of the 17 equity sectors that outperformed in Q1 2021 and the whole of 2020, ranked by the Q1 2021 result.

Source: FE Analytics

There are some obvious reasons why active funds might have seen a weakening in their outperformance of the market – with the biggest being the rotation from growth to value that is currently playing out.

Growth stocks have led the market for much of the past decade as they benefitted from low interest rates and lacklustre economic growth, causing many active managers to take significant weightings in them.

Their outperformance continued in 2020 as some growth stocks – especially those in the tech space – were seen to be ‘coronavirus winners’ benefitting from trends such as working from home, e-commerce and digitisation.

However, the start of the coronavirus vaccine rollout prompted a significant shift in markets as investors started pricing in the impact of a surge in econmic growth once economies opened up from lockdown measures and the risk that inflation could rise. This environment favours previously unloved value stocks, which tend to be more linked to the strength of the wider economy.

But while the proportion of active funds outperforming the index has eased a little in 2021 so far, there are some areas where they have strengthened.

In the IA Asia Pacific Excluding Japan sector, 68.4 per cent of active funds beat the index over the first quarter – up from 55.8 per cent in 2020. The best funds over that three-month period were Federated Hermes Asia ex Japan Equity (up 13.02 per cent), TT Asia Pacific Equity (10.87 per cent) and Robeco Asian Stars Equities (8.61 per cent).

However, the biggest improvement in active equity funds came from the IA Global Equity Income sector. Last year, only 18 per cent of its members beat the index as companies across the world slashed their dividend payouts in the pandemic to protect their balance sheets.

But over 2021 so far, 58 per cent of funds are ahead of the benchmark – an improvement of 40 percentage points – as investors warm up to signs that dividends will be resumed in 2021. Schroder Global Equity Income (up 11.91 per cent), Aptus Global Financials (11.16 per cent) and Courtiers Global (ex UK) Equity Income (10.87 per cent) are some of the IA Global Equity Income funds with the strongest outperformance.

A similar expectation has seen a big increase in the number of IA UK Equity Income funds that are outperforming this year. Here, TM RWC UK Equity Income (up 17.05 per cent), Courtiers UK Equity Income (13.58 per cent) and Jupiter Income Trust (12.96 per cent) have performed strongly.

Only five Investment Association (IA) sectors had a greater proportion of active funds outperforming in the first quarter than in 2020: the three mentioned above are joined by IA North America (which has historically been a tough market for active managers) and IA Global Emerging Markets.

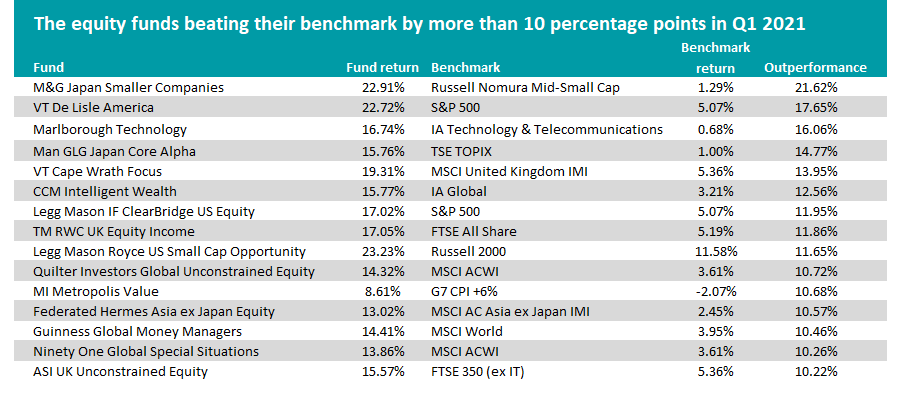

Looking across all 17 equity sectors, the table below reveals the 15 funds that beat their benchmark by more than 10 percentage points in 2021’s opening quarter.

Source: FE Analytics

Many of the funds on the list follow the value style of investing and have benefitted from the recent rotation in market leadership.

VT De Lisle America, Man GLG Japan Core Alpha, VT Cape Wrath Focus, TM RWC UK Equity Income, MI Metropolis Value, Federated Hermes Asia ex Japan Equity, Ninety One Global Special Situations and ASI UK Unconstrained Equity are just some of the funds that are known for a value approach and have generated some of the highest outperformance in 2021 so far.

Looking outside of these 15 funds shows that other value offerings like Schroder Global Recovery, Dodge & Cox US Stock, M&G North American Value, Dimensional International Value, TM CRUX UK Special Situations, ES R&M Global Recovery, LF Lightman European, Jupiter Global Value Equity and VT Tyndall North American are riding high at the moment.

Conversely, the bottom of the relative performance table for the equity sectors shows funds such as Morgan Stanley US Advantage, Baillie Gifford American, Liontrust UK Smaller Companies, Comgest Growth Japan and Baillie Gifford Long Term Global Growth Investment.

These funds are better known for investing in quality-growth stocks, which have delivered them some handsome long-term returns but have caused them to struggle more over the short term.