BlackRock’s bullish view on equities and its asset allocation strategy will be guided by its expectations of lower interest rates with higher inflation, the BlackRock Investment Institute has revealed.

This ‘new nominal’ theme implied that central bank responses to bond yields and rising inflation will be more muted than in the past – keeping nominal long-term yields low and real yields negative.

The investment think tank said the trend of falling inflation and interest rates that has dominated over the last four decades was unlikely to continue.

Instead, a more relaxed attitude towards debt deficits and new policy paradigms mean that central banks will now try to overshoot inflation targets to make up for past misses.

But markets have not “bought the narrative” and are still pricing in central banks rising rates quicker than what the Federal Reserve’s new policy framework implies, the think tank said.

This new, more muted monetary response to inflation going forward is the main reason why it expects a higher inflation regime in the medium term.

“We see any bond yield rises driven by inflation, rather than policy hikes, making the unique environment that we have called ‘the new nominal’ constructive for equities,” the team explained.

Even after a strong rebound from the equity market’s lows of March 2020, the strategists still prefer to tilt their portfolios towards stocks over credit and government bonds on a strategic basis.

This is because they see equities as more attractive than credit and government bonds in this new nominal investment environment.

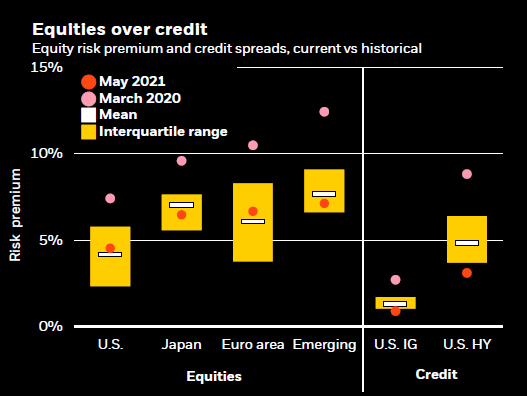

Rupert Harrison, multi-asset head of research for diversified strategies at BlackRock, said: “We see the equity risk premium – our preferred gauge of equity valuations that accounts for changes in interest rates – as in-line with historical averages.

“This suggests the asset class is not overvalued. By contrast, credit spreads are near historically tight levels.”

Equity risk premiums & credit spreads relative to historical means

Source: BlackRock Investment Institute

Harrison said the team does not agree with the narrative that higher long-term yields signal bad news for equities.

“Rising yields should not matter for equity valuations if they are due to the return of term premia – the compensation investors demand for holding riskier longer-term bonds – rather than expectations of a higher policy rate path,” he explained.

He believes the higher excess return that investors will demand in a backdrop of a strong economic restart are not enough to challenge current equity valuations.

“Even after the recent Fed shift, we’re still in a very different policy and rates regime,” he added. “That’s a reason we still like equities.”

BlackRock’s investment think tank also underscored the importance of the interaction of monetary and fiscal policy to determine the potential of future rate hikes.

“We see a strong incentive for policymakers to keep interest costs low to manage surging debt burdens that were necessary to cushion the impact of the Covid shock,” it said.

With this backdrop, the BlackRock team revealed that it is staying pro-risk on both a longer-term strategic view as well as a tactical six to 12-month view.

One notable change the investment giant revealed was that it has upgraded its overweight stance on European equities: “We upgraded European stocks on the back of the broadening restart. We see a sizeable pickup in activity helped by accelerating vaccinations.

“Valuations remain attractive relative to history and investor inflows into the region are only just starting to pick up. In our tactical views, we have leant further into cyclicality by upgrading Europe to an overweight and upgrading Japan to neutral.”

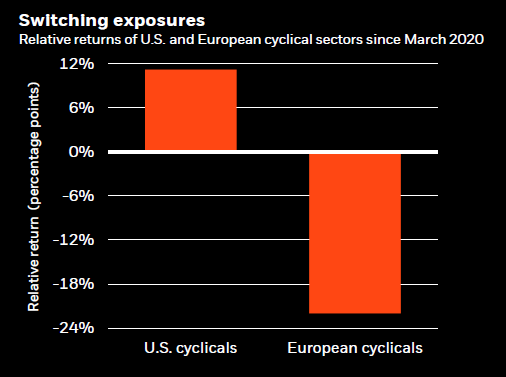

The team noted how cyclical sectors in Europe such as technology and financials have lagged their US peers since last March.

Performance of US and European cyclical sectors since March 2020

Source: BlackRock Investment Institute

It also pointed out that these two sectors make up about one fourth of the size of the overall benchmark index.

The team continued: “We believe these sectors could be well positioned to play catch up as the restart broadens beyond the US.

“The same has been true for the emerging market world. Yet we are more cautious on EM equities and local currency debt on a tactical horizon, and have downgraded both to neutral.”

The think tank said the primary reasons for this downgrade was due to greater volatility around the US dollar and Federal Reserve policy. It also highlighted the risk of slower growth in China.

When it comes to US equities, it said it had taken a more “selective” approach. It trimmed its stance from overweight to neutral and revealed that it favours sectors “with the potential to deliver consistent earnings growth”.