Investors looking to take a position in Asia have many choices to pick from, but two trusts have caught the eye.

The £436m Aberdeen New Dawn trust has been a solid performer over the past three years, returning 51.9% to investors, yet remains on a wide discount to the total value of its underlying holdings – net asset value (NAV) – making it an intriguing option for new investors.

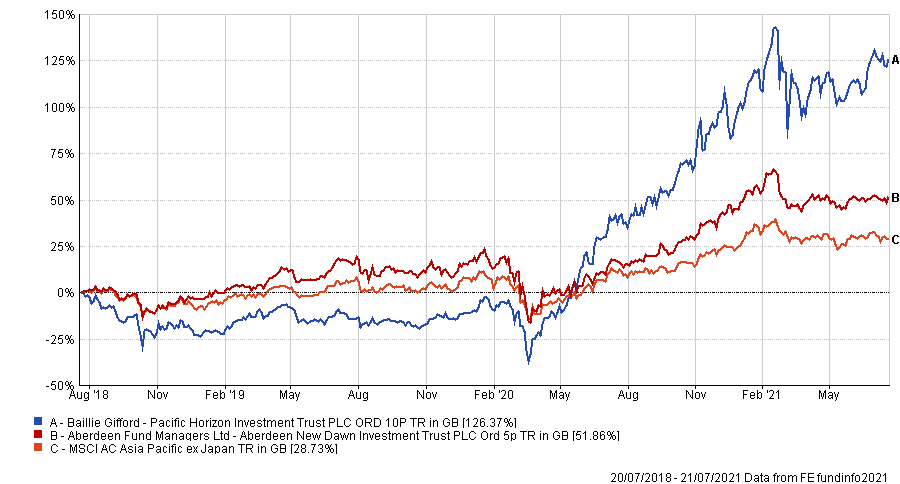

Despite being the second-best performer in its sector, its returns have paled in comparison to the £753m Pacific Horizon trust, which has made investors 126.4% over the past three years and is priced accordingly, with its shares on a premium.

Total return of the Aberdeen New Dawn and Pacific Horizon trusts against the MSCI Asia Pacific ex Japan index over three years

Source: FE Analytics

Below Trustnet asks fund pickers which portfolio is better for new investors and whether the discount or premium is a deterrent.

Mick Gilligan, head of managed portfolio services at Killik & Co said there was a big rating difference across the Asian investment trust sector, with Aberdeen New Dawn on the widest discount at 10.8%. While Pacific Horizon, managed by Baillie Gifford, was on the largest premium at 7.9%.

“Part of Pacific Horizon’s rating can be attributed to its unquoted holdings in ByteDance (TikTok) and Zomato (India’s Deliveroo) which are likely to be understated in the NAV,” he said, but added that unquoted holdings only accounted for 3% of the trust’s value in January.

As such, much of the trust’s strong performance could be attributed to its bias towards technology stocks and the two largest holdings, Sea (Singapore Tech Conglomerate) and Tata Motors which have performed strongly over the past year.

“However, this is history. What should be important to investors is the next 12 months. If the trust’s outperformance continues then the premium is justified. However, there is a clear risk here and I think the rating could come under pressure if bond yields (and discount rates) move higher,” he said.

“Aberdeen New Dawn, however, has an incentive to limit its discount to 15%, not far from the current level. So, for me, the rating disparity between the two looks too wide.”

In the trust’s annual report this month, the trust revealed it had outperformed its benchmark at both the NAV and share price level, while it also reduced its ongoing charges slightly from 1.1% to 1.09% and maintained its dividend despite a decline in revenue income.

The portfolio is managed using a team-based approach that follows a long-term, buy and hold strategy with a quality bias – defined as a preference for companies with a clear business strategy, strong balance sheets and good corporate governance.

The company achieves some exposure by investing in other funds such as the Aberdeen India Equity fund, but limits investment in other listed investment companies to 15%. This was much lower at the end of April at 2.2%.

Gearing is used selectively to enhance returns, with the trust currently 7% geared, although this is some way from its maximum limit of 25% and although there is no explicit dividend policy, the company had built up significant revenue reserves which can be drawn upon should there be a shortfall in revenue.

Darius McDermott, managing director of Chelsea Financial, said although the Pacific Horizon Trust had produced the stronger performance in the past five years, he would also side with Aberdeen New Dawn.

“Timing is everything, and given the Pacific Horizon trust is now operating at a near 7% premium we have to side with Aberdeen New Dawn as we don’t believe such a discount is warranted,” he said.

Source: The Association of Investment Companies

Thomas McMahon, senior analyst at Kepler Partners, said both had their merits, but neither were perfect. Pacific Horizon had benefited from heavily investing in e-commerce and technology, which benefited from the pandemic, but added that it was not just a one-trick pony.

“It has also tended to have a significant weighting in the materials and energy sectors, which means it has also done exceptionally well in the vaccine rally,” he said.

“Although it has done exceptionally well in recent years, the trust is trading on a significant premium, and there is obviously a risk that some of its themes have become over-heated in the short term at least.”

Conversely, Aberdeen New Dawn’s quality-growth style is tempered by a focus on valuations, which gives it more defensiveness. One aspect of this is a much higher allocation to large caps.

He recommended that the Pacific Horizon trust therefore was one for investors that had a strong view on growth and were confident that the market would continue to recover, while the Aberdeen trust was more useful for uncertain markets.

“Given the thematic and stylistic diversity, it is perhaps easier to see environments in which Pacific Horizon would do very well or very badly, while Aberdeen New Dawn is likely to be more resilient in tough economic times – which could well be on the cards in the next stage of the recovery from the pandemic,” said McMahon.