A resilient US economy, strong earnings and attractive yields are luring investors back into risk assets this year – but iBoss chief investment officer Chris Metcalfe thinks they need to do more than just go long equities and bonds.

“We still think there’s potential for a Liz Truss moment in the US,” he said.

Metcalfe argued that neither the current nor likely future US administrations have any credible plan to address the debt burden. With bond markets functioning as one of the few remaining guardrails on fiscal policy, the risk of a destabilising sell-off remains elevated – even if it hasn’t yet materialised.

“There’s no playbook for this. We can’t say, ‘the last time the debt pile was this percentage of GDP, the outcome was X’ because we’ve just never been here,” he said. “There are a lot of very smart people with opinions, but they’re all sort of guessing.”

That unpredictability, Metcalfe warned, was evident during a brief bout of US bond volatility in April that reminded him of the UK’s 2022 gilt crisis.

“Trump is absolutely capable of pitching something that will scare the bond market to death – and he’s proved he’ll do whatever he needs to get his way. One of the few guardrails we’ve got left is the bond market.”

The risk of a bond market shock is especially dangerous given how few investors appear positioned for one. While the 10-year treasury yield might look attractive at 4.3%, it might “go all over the place”, Metcalfe said.

“For active managers, that might be a chance to trade it – but for a long-term investor, you could easily end up where you started, but with a lot more risk on the journey,” he argued.

iBoss has kept duration short in recent years, even when yields appeared to offer a compelling entry point. “We didn’t like where rates were, so we went short, but at least we understood why they were where they were,” Metcalfe said.

“That’s not the case now. We don’t know how markets will react to another spending round or a trade war escalation.”

With that level of uncertainty, Metcalfe believes diversification beyond traditional long bond positions is essential as “you can’t just go long bonds and expect to be protected”.

“You’ve got to look at where else the risk is coming from and how to manage it,” he said. “That means proper diversification and looking seriously at alternatives.”

In iBoss’s core multi-asset portfolios, this has led to a shift towards active bond funds and a growing role for alternative fixed income, including emerging market debt. The firm’s allocation to active strategies has risen from around 72% to 78% in the first half of the year, its highest historical level.

One area where passive vehicles are “virtually absent” is fixed income, Metcalfe said. “There are still opportunities, but you need genuinely active managers who can move their portfolios around and take risk.”

Metcalfe sees active management as essential in this environment, not only in bonds but across asset classes: “Passive worked when all you needed to do was be long US, long tech, long Nvidia. That’s not the case now.”

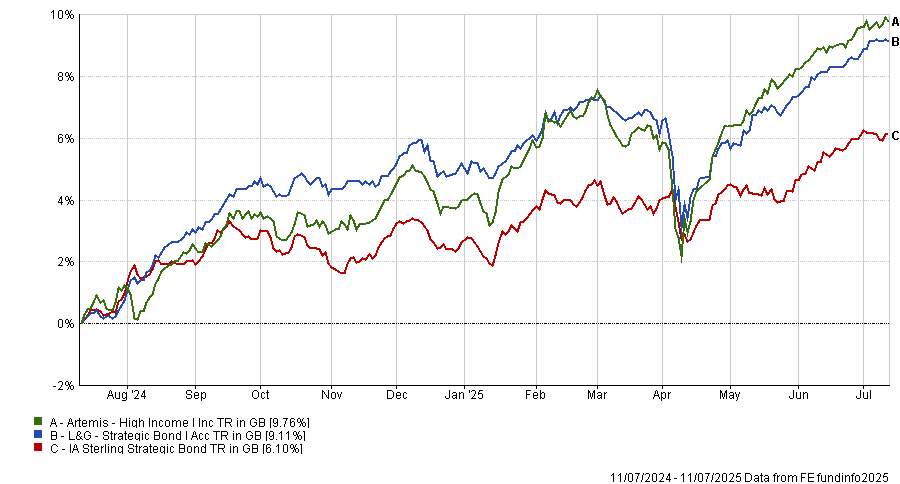

Among the managers iBoss is currently backing, Metcalfe singled out the fixed income teams at Artemis, Legal & General and Vontobel as standout performers.

“The L&G Strategic Bond team has done really well and has proved to be quite nimble,” he said. “The fund has been a core part of our portfolios.”

He also pointed to Artemis High Income, a multi-asset strategy using both bonds and equities, as a key addition, with a highlight being that its equity portion is managed by Ed Leggett. Metcalfe said: “He’s doing a fantastic job with his UK equity fund, and that quality carries over into this strategy.”

Performance of funds against sector over 1yr

Source: FE Analytics

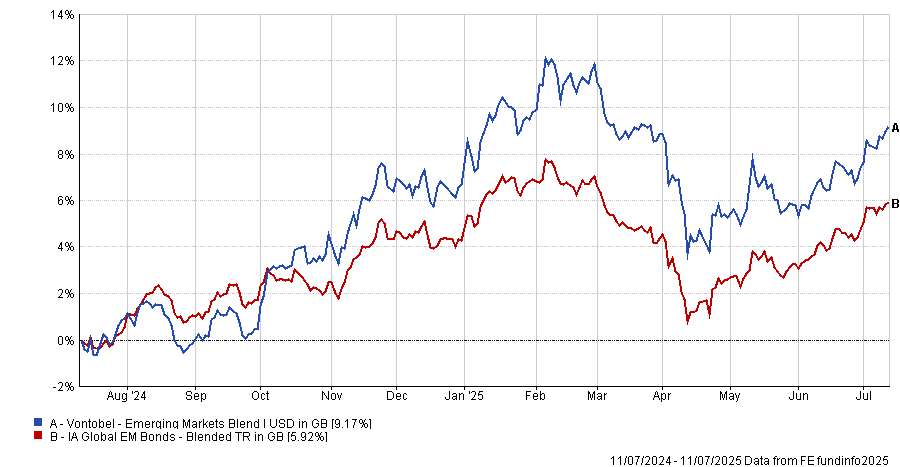

On the emerging market side, iBoss recently added the Vontobel Emerging Market Blend fund, favouring its high-conviction, active style. With an ongoing charges figure of 0.82%, “it’s not cheap”. “But you can see what you’re paying for. These are super-active managers, not just charging for fancy offices,” Metcalfe explained.

Performance of fund against sector over 1yr

Source: FE Analytics

Although inflation seems to have come down from its peaks, Metcalfe is not convinced that long-duration assets are safe just yet.

“A couple of years ago, rates were so low there was nothing to play with,” he said. “Now, the situation’s reversed – there are big macro shifts happening every day, and we’ve got Trump re-dealing cards each morning.”

That backdrop, which Metcalfe described as “not a normal cycle” and “uncharted territory”, calls for caution, selectivity and constant monitoring.

Ultimately, he sees the bond market as both a source of opportunity and a potential catalyst for disruption – particularly if policy missteps shake confidence.

“We’re not saying there’s going to be a repeat of the UK’s crisis,” he finished. “But there’s still a chance of something similar in the US. And if that happens, the consequences will be a lot bigger.”