Investors are missing out on an attractive asset class by ignoring private assets, according to Ben Conway, chief investment officer at Hawksmoor.

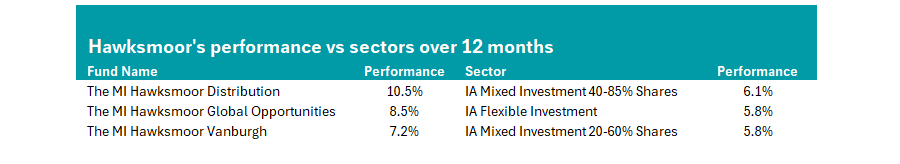

Conway runs the firm’s multi-asset range: the Hawksmoor Vanbrugh, Distribution and Global Opportunities funds. Over the past year, these funds posted top-quartile performances in the IA Mixed Investment 20-60% Shares (Vanbrugh), IA Mixed Investment 40-85% Shares (Distribution) and IA Flexible Investment (Global Opportunities) sectors.

Source: FE Analytics

Exposure to private assets ranges from 22% to 30%, which is high relative to Hawksmoor’s history, Conway said. The Hawksmoor team allocates to private assets through investment trusts, which have narrowed their discounts recently and contributed to the strong performance.

Conway explained that Hawksmoor’s private asset exposure is currently dominated by private equity, infrastructure and renewable energy: “Private assets are made up of two main parts: there are the ones that return enhancers and the return diversifiers”.

Private equity is a great example of a return enhancer, he explained.

Additionally, despite strong long-term performance, many private equity trusts are on discounts to their net asset value (NAV), making them very attractive from a valuation perspective.

As an example, last week he pointed to private equity trust Oakley Capital, which is on a 28.2% discount to NAV despite outperforming its average peer in the IT Private Equity sector by more than 50 percentage points over the past five years.

Performance of Oakley Capital vs sector over 5yrs

Source: FE Analytics

However, while private equity boosts return, it does not offer much in the way of diversification, Conway explained. If a portfolio is primarily composed of liquid securities, such as bonds or equities, adding private credit or equities means it is exposed to many of the same risks.

As a result, the things that will make private equity do well or badly are the same things that will make listed equities perform well or badly.

“Don’t be under any illusions, you aren’t diversifying anything by holding just private equity or private credit,” he said.

As a result, the Hawksmoor team also has a significant allocation towards renewable infrastructure trusts.

Conway said these are much stronger diversifiers because the circumstances that make a renewable trust a good investment are almost completely different from what drives equities and bonds.

Holding these types of assets alongside private equities is important if investors want to be truly diversified, Conway explained.

However, while Conway is generally bullish on private assets, “it’s impossible to own everything” and so Hawksmoor’s allocation towards property is significantly lower than usual.

Real estate used to be a large position, but strong performance has narrowed the discounts in many property investment trusts. As a result, despite “plenty of opportunities” still being available in the sector, as valuation-focused investors the Hawksmoor multi-asset team started redistributing some of their capital.

In public markets, there is a high level of “valuation dispersion” where assets of similar quality are being valued extremely differently.

“You can have a large-cap business doing one thing and a small-cap business doing the same thing, but because so much money has gone into large-caps, the small business is at a material discount,” he said.

This is because the market values “liquidity above all else”, which has pushed investors into large-caps at the expense of small-caps.

While this is occurring in both equity and credit markets, equity markets offered the most exciting opportunities, Conway said.

“Even in the US, despite being an expensive market, we see smaller companies and small cap funds trading very cheaply relative to their history,” he explained.

While the team is generally bullish towards smaller companies across regions, including in Europe, Asia and the US, the UK is “the best opportunity for value dispersion” in public markets.

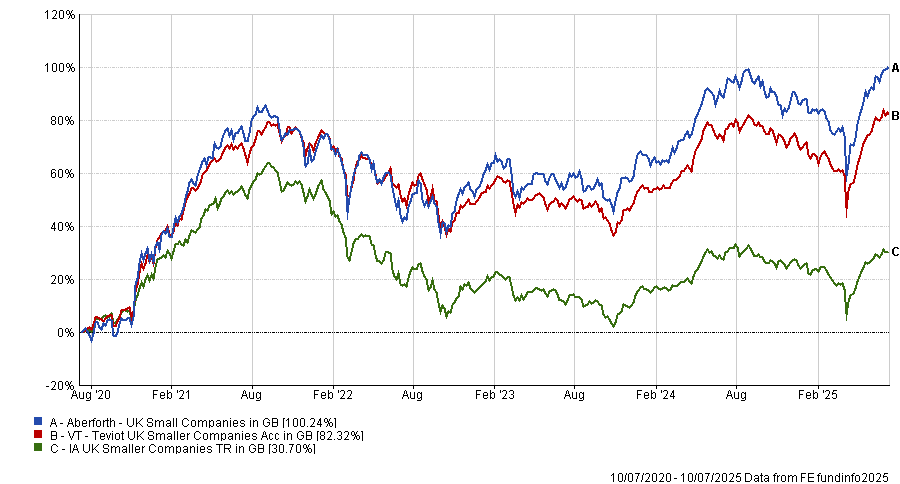

The domestic market is “spoilt for choice” on talented managers who are constructing portfolios of very high-quality companies, trading at extremely low valuations. While there are plenty of examples, he highlighted Teviot UK Smaller Companies and the Aberforth UK Small Companies as great examples.

While both have different approaches, he praised the managers for “buying good companies growing at the right price”, whether that means a company that’s growing quickly or one that’s incredibly discounted.

As a result, both funds have performed very well over the past five years, with Aberforth up by 98.2% and Teviot up by 82.3%, both of which are top-quartile results in the IA UK Smaller Companies sector.

Performance of Aberforth UK Small Companies and Teviot UK Smaller Companies vs sector over 5yrs

Source: FE Analytics

“Another way of parking that argument is that I’m enormously bullish on active management in equities, because high valuation dispersion shows you there are clear opportunities,” Conway said.

While credit is also experiencing this dispersion, spreads on corporate bonds are currently near all-time lows, meaning it’s generally “not worth taking that extra risk” for limited pickup. As a result, most of the team’s fixed income allocation is in government bonds.