Investors pulled money out of equity funds in October as fears over rising inflation and interest rate hikes dented sentiment, data from Calastone has shown.

The latest edition of the Calastone Fund Flow Index also shows this was driven by redemptions from passive funds – which suffered their worst month on record for outflows as investors continued to favour active strategies.

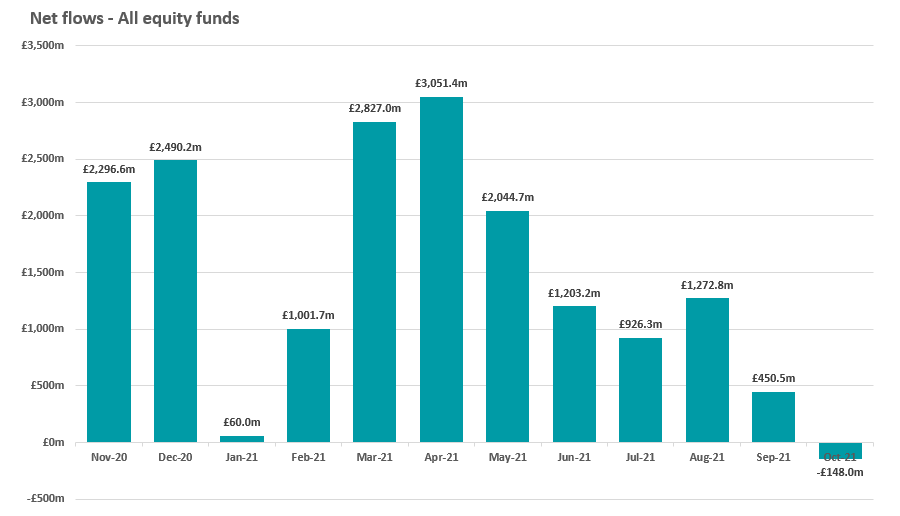

A net £148m flowed out equity funds in October. Although this appears small amid total trading volume of £20.5bn for the month, it marked the first net selling of equity funds in 15 months.

Edward Glyn, head of global markets at Calastone, said: “Share prices globally had a pretty good month in October after a shaky September, so it’s perhaps surprising that investors pulled money from a rising market.

“They have some good reasons to be nervous. Spiking inflation and higher bond yields are bad news for the valuations of growth companies. The net outflow we saw in October was by no means a rout, however and it may simply point to modest profit taking at a time of record share prices.”

Source: Calastone

The brunt of the month’s selling was borne by passive funds, which were hit with a record outflow of £709m.

Global trackers fared worse with £716m being pulled out while UK-focused passive funds were the second-worst hit with a net outflow of £226m. Flows for passives were negative across all major geographies except emerging markets and Asia Pacific. There were also net inflows in nicher regional areas that reduced the overall total.

The past year has seen somewhat of a reversal of the long-term shift towards passive, Calastone’s data showed. Passive funds took more money than active in almost every month for 2.5 years up to November 2020 but active funds have outpaced trackers in 10 of the 12 months since then.

“Investors have lost interest in passive funds over the past year, but October was the first month on record when outflows from passive funds were larger than inflows to active ones,” Glyn said.

“Some of this relates to concerns over equity prices – passive funds tend to do worse than active ones when markets fall.”

However, the rise of investing to environmental, social and governance (ESG) principles is also a factor.

Most ESG funds are actively managed and have been “the runaway success story” among active funds as responsible investing gains traction.

The Calastone Fund Flow Index showed £568m was put into active ESG funds in October, bringing the 2021-to-date total for inflows into this category to £8bn.

October’s inflow to ESG was so large, it offset outflows from other active funds that did not have ESG mandates, meaning active funds overall benefitted from a net inflow of £561m last month.

“With climate change dominating the headlines, and with some of the world’s most polluting industries taking a large share of global (and especially UK) market capitalisation, investors are perhaps realising that passive funds often don’t meet their growing need to align their investments with their world view,” Glyn finished.

“This is likely to change as the passive fund industry launches more funds that track ESG benchmarks – we are already seeing that – but for now, the active industry is streets ahead.”