The growing risk of a global recession is now the biggest worry of fund managers, according to Bank of America, as concerns mount that a “fast and furious” Federal Reserve will derail economic growth with tighter monetary policy.

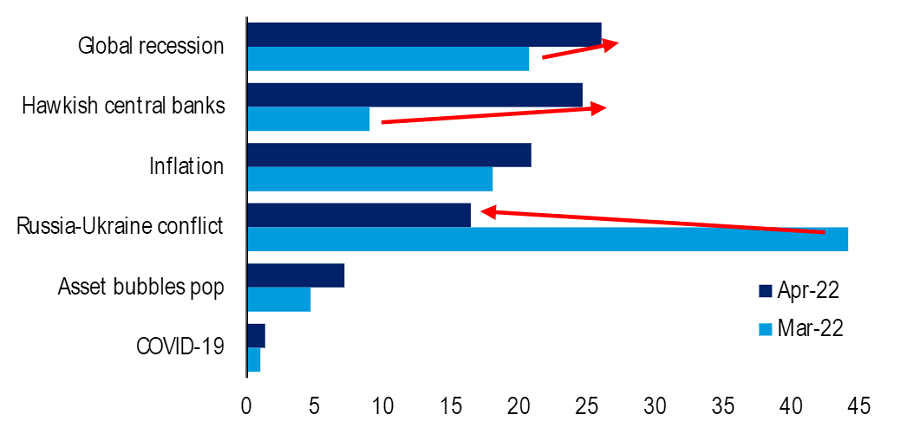

The closely watched Bank of America Global Fund Manager Survey found that 26% of asset allocators said the most serious risk in the market at the moment is ‘global recession’ while another 25% cited ‘hawkish central banks’.

With inflation coming in third place, the Russia/Ukraine conflict – which was seen as last month’s largest risk by a significant margin – has become the fourth most serious concern after being chosen by 16% of fund managers.

What fund managers consider to be the biggest tail risk

Source: Bank of America Global Fund Manager Survey, April 2022

Investor sentiment on the global economy was described as “bearish” by Bank of America. A net 71% of asset allocators are now expecting a weaker economy over the coming 12 months, the lowest ever level recorded in the survey (which goes back to 1995).

Part of this nervousness stems from the Federal Reserve’s plan to hike interest rates. Managers now think the central bank will lift rates between six and eight times this year (up from less than four times in the previous survey) and expect the tightening cycle to be finished in the first half of 2023.

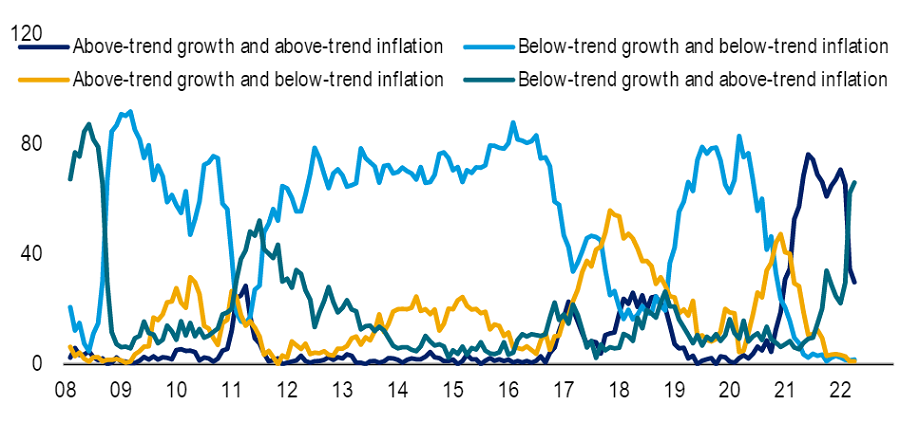

Two-thirds of fund managers are expecting the global economy to go through a bout of stagflation – or below-trend growth and above-trend inflation. This is the most since August 2008, when the world was dealing with the global financial crisis.

Some 30% are anticipating boom conditions of above-trend growth and inflation while only 1% expect the ‘Goldilocks’ scenario of above-trend growth combined with below-trend inflation.

How fund managers believe the global economy will trend in the next 12 months

Source: Bank of America Global Fund Manager Survey, April 2022

That said, investors have moved towards risk assets in April, albeit from “depressed levels”. The allocation to equities increased, with the proportion of managers’ saying they are overweight stocks increasing by 2 percentage points to a net 6%.

But this is 0.9 standard deviations below the long-term average proportion of fund managers being overweight equities.

“The disconnect between global growth and equity allocation remains staggering,” Bank of America’s analysts said. “Investors got slightly more bullish on equities. Though still at depressed levels, equities are nowhere near ‘recessionary’ close-your-eyes-and-buy levels.”

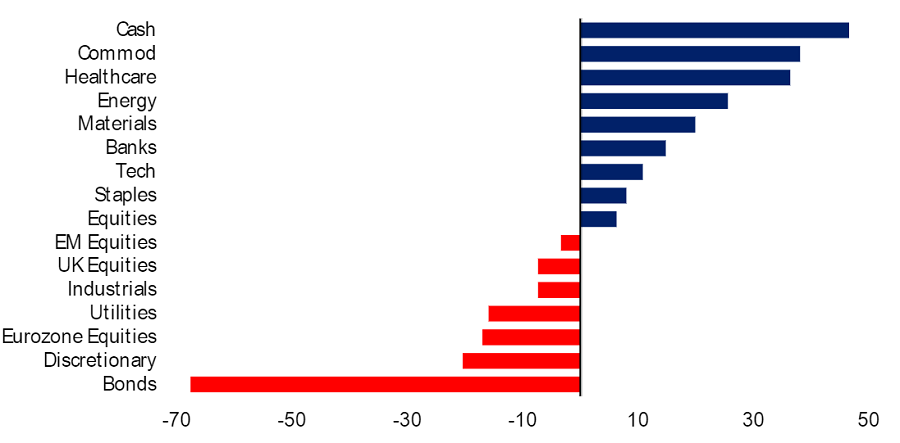

Investors’ absolute net % overweight

Source: Bank of America Global Fund Manager Survey, April 2022

The above chart shows the current overweights and underweights of the fund managers who responded to the survey. They are very long cash, commodities, healthcare, energy and materials while shunning bonds, consumer discretionary and the EU.

Indeed, the allocation to commodities stands at a 38% overweight, the highest on record in the history of the survey. This reflects the surge in commodity prices that have taken place in recent months, although the survey did find that managers also consider long commodities to be the most crowded trade in the market at present.

In terms of where they are currently invested relative to the past 10 years, fund managers are most overweight commodities, Reits, cash and healthcare stocks. The heaviest underweights versus history are to the EU, industrials, bonds and emerging markets.

Bank of America Global Fund Manager Survey polled 292 asset allocators who run a total of $833bn. The survey was carried out between 1 and 7 April.