This year is shaping up to be another poor one for active funds after many failed to protect their investors as well as trackers in the first half’s sell-off and are now lagging behind in the following bounce, research by Trustnet shows.

Going into 2022, some argued that active funds will return to the fore as shifting market dynamics – such as the tussle between growth and value stocks for leadership – meant stock selection and the ability to move away from a benchmark would start to drive performance.

There is also the common view that active funds are better suited to protecting investors during market downturns, as they are not obliged to track an index and can move into areas of perceived safety.

However, the sell-off that dominated the opening half of 2022 – driven by surging inflation, rising interest rates and Russia’s invasion of Ukraine – saw active funds post heavier losses than their passive counterparts, according to FE fundinfo data.

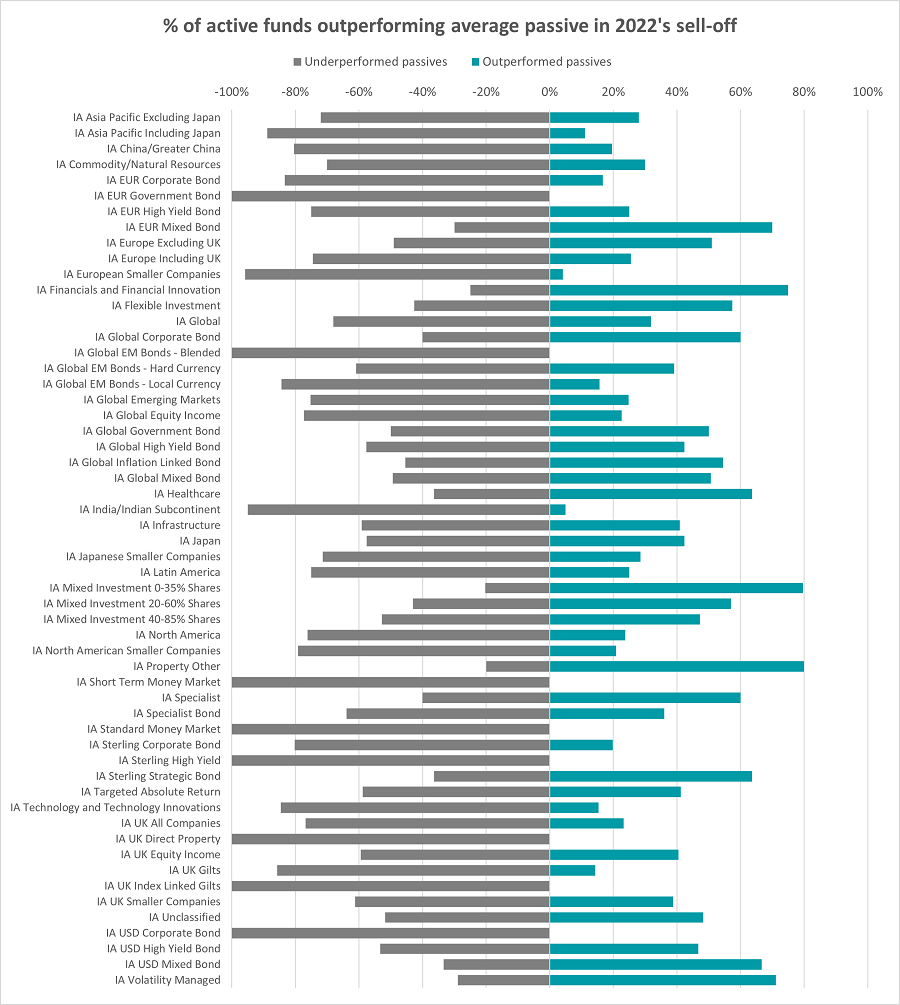

Source: FinXL. Based on total return in sterling between 1 Jan and 30 Jun 2022

The chart above shows what proportion of active funds made a lower return than the average index tracker in their sector (the grey line) in the first six months of 2022 versus those that outperformed passives (the blue line).

There’s a lot of information in that chart, but the highlights are that 57.8% of active funds in the Investment Association universe made a lower return than the average passive in their sector during the opening six months of 2022.

There are eight sectors were every single active fund failed to beat the average tracker, including IA Sterling High Yield and IA UK Direct Property. Another 33 sectors – among them IA UK All Companies, IA Global Equity Income and IA North America – saw more than three-quarters of active funds fall behind passives in the sell-off.

In total, 40 of the 57 Investment Association sectors we looked at had more than half of their active members lag behind trackers in the six months to the end of June. IA Global, the most popular sector, saw 68.1% of its active funds underperform.

The best showings from active funds came from the IA Property Other, IA Mixed Investment 0-35% Shares and IA Financials and Financial Innovation peer groups, where 75% or more of funds made a better return that their tracker peers.

After selling off for the opening six months of 2022, markets have rebounded since the start of July but it seems that active funds have failed to capitalise on this.

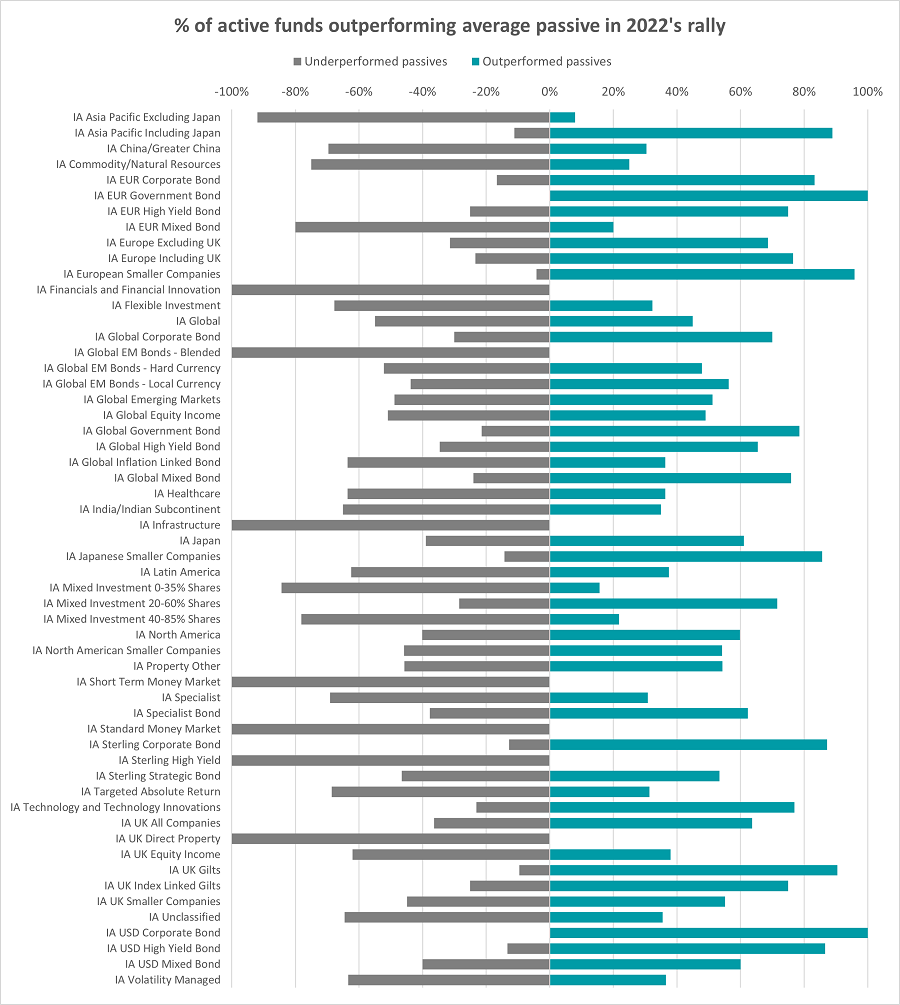

Source: FinXL. Based on total return in sterling between 1 Jul and 18 Aug 2022

Overall, the picture has improved on the 2022’s first half but only vey slightly.

Since 1 July, 55.2% of active funds have made a lower return than their sector’s average tracker. But that’s not much of an improvement on the 57.8% that underperformed in the first half and still means that most active funds were unable to beat passives.

There are seven sectors where every active fund has fallen behind in the rally, including IA Infrastructure and IA Financials and Financial Innovation, which have been gaining more attention from investors as inflation and interest rates continue to rise.

And 27 sectors have more than half of their members falling behind passives. This is a better result than for the first half, when 40 underperformed, but includes popular sectors such as IA Global, IA UK Equity Income and IA Mixed Investment 40-85% Shares.

Some 15 sectors had at least three-quarters of active funds beating the average tracker in the rally but most were relatively off-the-radar fixed income peer groups. IA Sterling Corporate Bond, IA Technology and Technology Innovations and IA European Smaller Companies were the more mainstream sectors where most active funds have outperformed.