Funds that invest in commodity stocks and countries that are exporters of raw materials have held onto their position as 2022’s best performers as inflation continues to run rampant, FE fundinfo data shows.

While stocks and bonds have endured a rollercoaster ride over the year to date, most of the funds in the Investment Association universe are sitting on losses. However, those focusing on commodities are among the few exceptions to this as commodities have been one of the few areas of the market to continue rising.

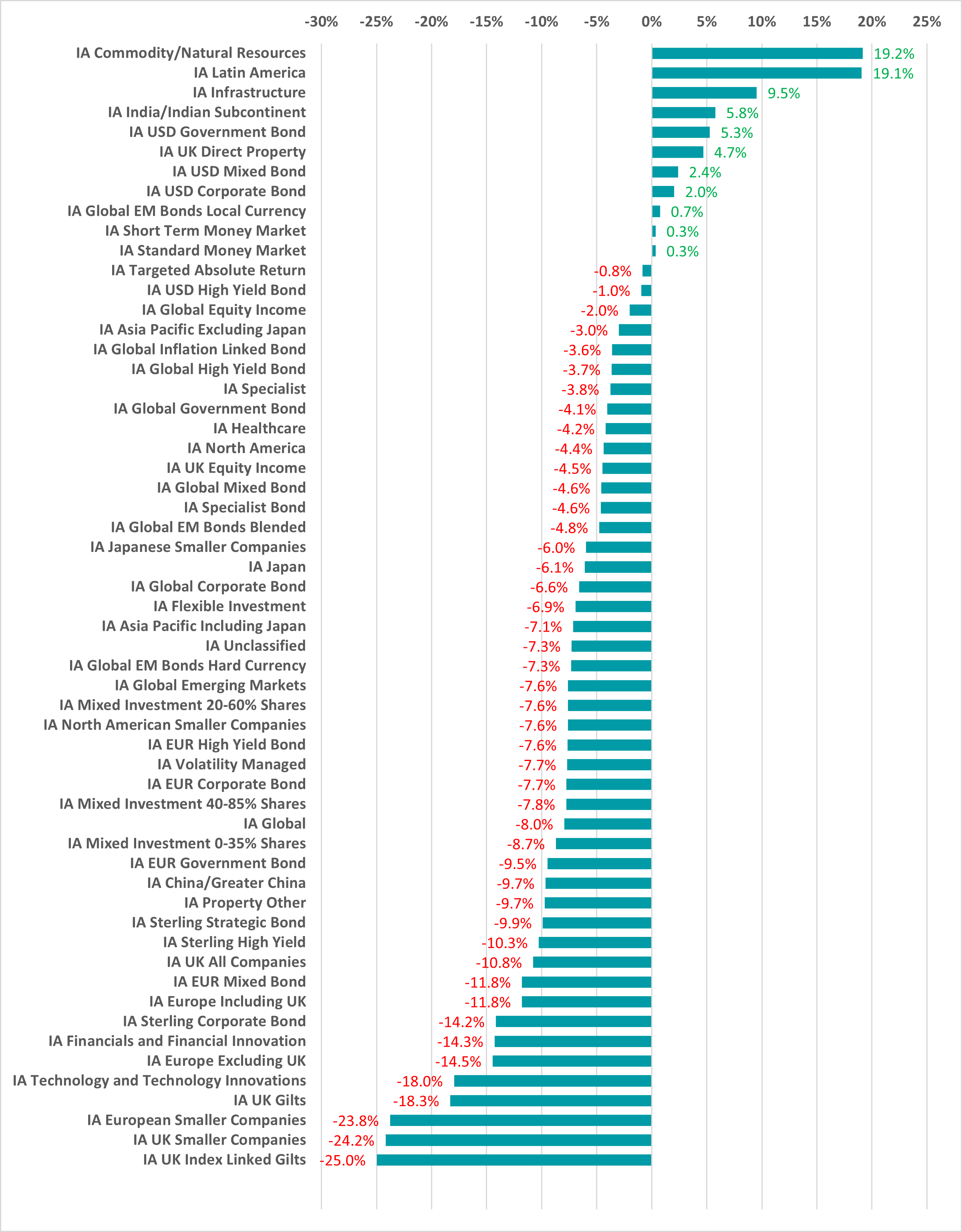

As the chart below shows, the IA Commodity/Natural Resources sector has made the best average return over 2022 so far (up 19.2%), closely followed by IA Latin America (19.1%).

Performance of Investment Association sectors over 2022

Source: FE Analytics

Of course, this is down to surging commodity prices caused by post-pandemic supply bottlenecks and the war between Russia and Ukraine. Commodity stocks are natural beneficiaries of higher prices, as are the commodity-exporting nations of Latin America.

This theme has been evident across 2022. Indeed, the IA Commodity/Natural Resources and IA Latin America have been the top two year-to-date winners in almost every month of the year so far. The only exception was 2022 to the end of June, when Latin America funds were in third place.

IA Infrastructure funds have been another consistent performer this year, again because of the inflationary backdrop dominating markets. Infrastructure is seen as another classic inflation hedge and has been one of the few areas of the market to hold up in 2022.

In general, however, the year-to-date story remains a negative one for funds. Just 11 of the Investment Association’s 57 sectors have made a positive average return for the first eight months of 2022 (and two of these are the cash sectors).

Gilts and smaller companies funds continue to sit at the bottom of the performance rankings – the average funds in the IA UK Index Linked Gilts, IA UK Smaller Companies and IA European Smaller Companies sectors are down more than 20% this year.

When it comes to individual funds, only 783 of 5,030 – or 15.6% of the industry – have made a positive total return this year. More than double this – 1,682 funds, or one-third of the industry – lost 10% or more in the first eight months of 2022.

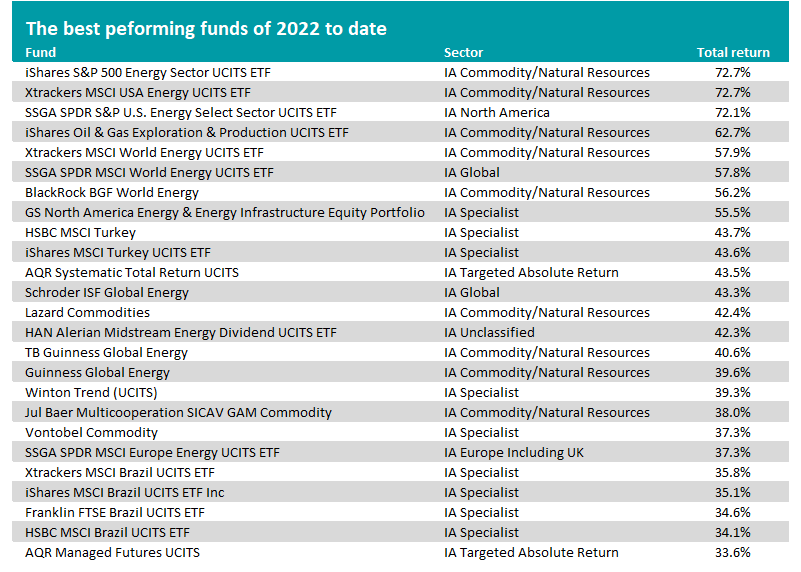

Source: FE Analytics

The 25 with the highest year-to-date returns can be seen in the table above, but it is little changed from the ones of previous months.

Funds that invest in energy stocks have made the year’s highest returns, which is to be expected when energy commodities such as gas and oil have shot up in price. Gas has jumped again in recent days after Russia's state-owned energy firm Gazprom closed its main gas pipeline to Europe.

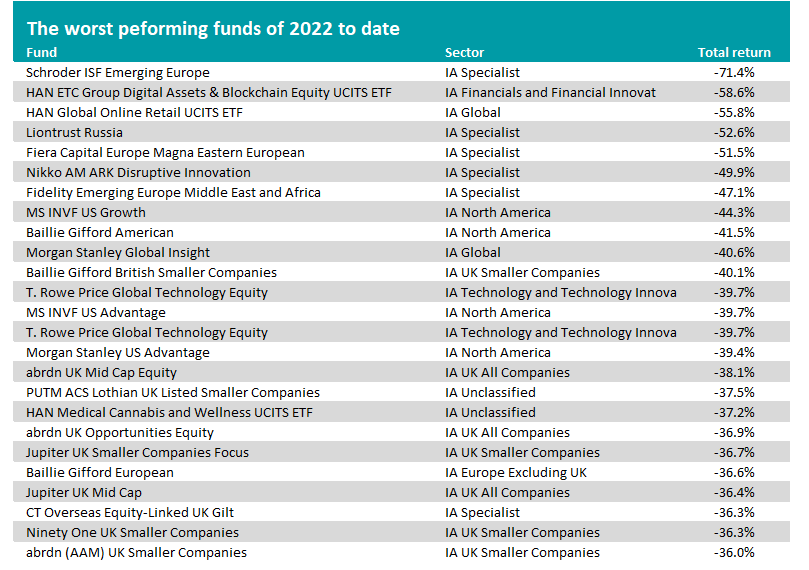

And the bottom of the performance table holds to the theme of previous months as well, with the heaviest losses coming from eastern European funds and those that focus on growth stocks.

Eastern European funds have tanked after Russia was frozen out of financial markets following its invasion of Ukraine.

Growth stocks, especially those in the tech space, have suffered as central banks lifted interest rates to curb inflation. Higher rates make investors less willing to pay lofty valuations for the future earnings of growth companies, which brought their previously meteoric returns crashing down.

Source: FE Analytics