Shifting market conditions could give investors the opportunity to “stress-test their allocation process” and alter their long-term strategy, according to JP Morgan’s 2023 long-term capital market assumptions report.

Analysts at the firm anticipate a bounce-back in performance next year which could help investors recover some of their 2022 losses and realign their long-term plan.

Investors are generally hesitant to alter their investment process around short-term events, but now could be an advantageous time to reshuffle portfolio exposures and make the most of discounted assets before they rebound.

The report said: “A portfolio with a bias to public markets may deliver higher forward returns than at any time in more than a decade.

“Investors with capital available to deploy – either in the form of cash or from external contributions – have before them an outstanding entry point.”

Markets performed poorly this year, but volatility could be a positive sign for investors’ long-term outlook even if the short term looks bleak.

This is because short- and long-term outlooks move in opposite directions, so significant deratings across the market in the turbulent conditions of 2022 could be an indicator of better performance in future, according to the report.

It said: “Changes in short-term valuations often signal directionally opposite movements in future return assumptions. The more that short-term returns deviate from the long-term assumption, the more confident we are in our forecast of short-term outcomes.”

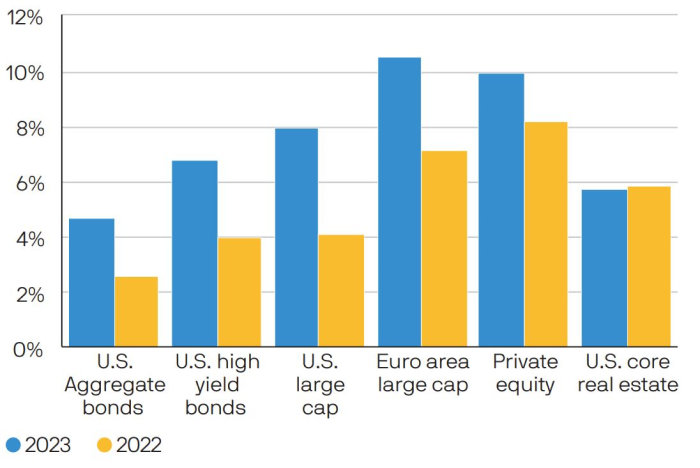

Return projections for 2023 vs 2022

Source: J.P. Morgan

As such, the report suggested investors could expect better performance in the coming year, with now presenting an attractive entry point for investors who want to buy the dip and capture the upside.

The report said: “A portfolio with a bias to public markets may deliver higher forward returns than at any time in more than a decade. Investors with capital available to deploy – either in the form of cash or from external contributions – have before them an outstanding entry point.”

Stocks and bonds are expected to be materially higher over the next 10 to 15 years and would be a natural choice for investors with a high risk tolerance.

More cautious investors, on the other hand, may be able to find decent returns for moderate risk in diversified alternatives, according to the report.

It said: “Investors should allocate as much to these assets as their liquidity budgets prudently allow. Depending on an investor’s specific return needs and risk appetite, the mix of alternative strategies may change, but the overall value of diversified alternatives is clear.”

Opportunities in the credit sector are also particularly appealing heading into 2023, with investors able to buy in at downgraded prices and relatively low volatility.

The report advised those pursuing this sector to spread risk across the different sub-sectors, from investment grade to high yield and emerging markets.

Although periods of volatility usually have a short-term impact, long-term outlooks are not immune to shifts. Many investors have a five-to-10-year horizon, which leaves a large period for market conditions to alter.

Indeed, the shift from growth-led markets to one of high inflation and rising interest rates is a dramatic change and could “drive fundamental shifts,” according to the report.

It advised investors to balance strategic patience with tactical flexibility and urged them to pay equal attention to both the short- and long-term outlook.

The report added: “We cannot yet know how long this new equilibrium may last, but it is quite possible that the effects will linger long enough to influence investment decision-making over the next several years.

“Investors can, and should, respond to the new equilibrium even if its long-term fate remains uncertain.”