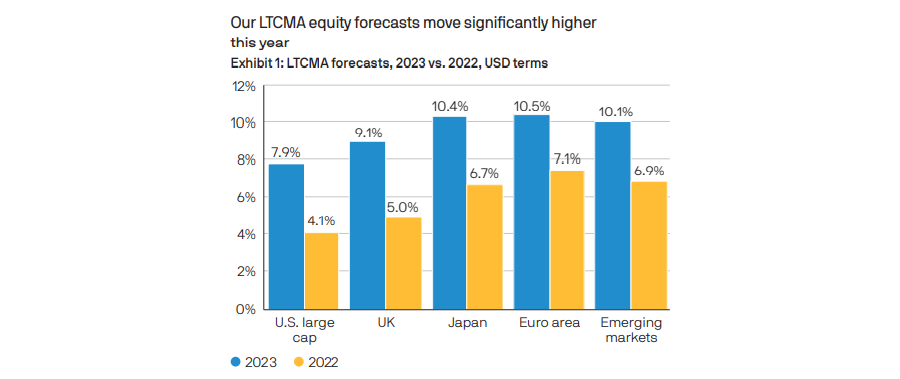

Investors are forecast to make 8.5% per year from global equities for the next decade, according to analysts at JP Morgan, as a tough year means valuation concerns are in the rear-view mirror.

Up from 5% a per year 12 months ago, the significant difference is driven by 2022’s falling markets, according to the firm’s long-term capital markets assumptions report.

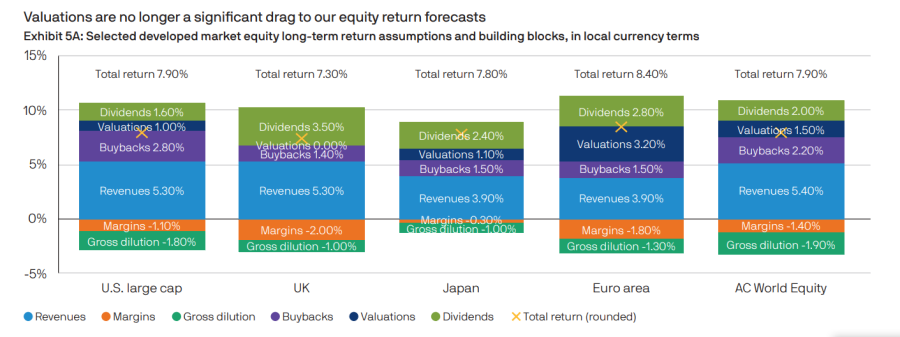

Although shares have fallen, earnings haven’t. This means that price-to-earnings (P/E) ratios are “much closer to fair value than they have been in recent years” and are no longer a headwind. However, JP Morgan did note that, in many markets, profit margins were higher than long-term estimates of fair value.

Vincent Juvyns, global market strategist at JP Morgan Asset Management, said the macroeconomic picture was also improving. “Despite near-term cyclical challenges, our inflation forecasts move only modestly higher as we see inflation cooling close to central bank targets,” he said.

Overall, valuations “look far more attractive”, with particular optimism for the US large-cap end of the market, where expectations have increased markedly from 4.1% per year to 7.9%.

One area that has given the firm confidence is US corporate profitability, which remained steady during the pandemic-led recession and again as inflationary pressures have mounted.

“This resilience validates our decision to place more emphasis on secular changes, sector composition and capital structure than on mean reversion to long-term historical averages,” the report said.

However, while large-caps should thrive, smaller companies will suffer from “less favourable sector composition” as well as the increase in companies staying private, which has “widened the quality gap”.

Elsewhere, UK stocks are expected to return 7.3% per year, up from 4.1%, thanks to a strong earnings recovery of the large energy and commodity stocks that dominate in London.

“Because the earnings recovery has been so strong, the market has significantly de-rated in P/E ratio terms and thus better valuations support our outlook,” the analysts said.

Here, smaller companies should perform better than their large-cap peers as these companies are “innovative in niche markets” with a “growing global footprint”.

Meanwhile, returns on European stocks are expected to be around 8.4%, up 2.6 percentage points on last year, although the report noted that margins are a “key detractor”. It is the largest expected returns of all developed markets, as the below chart shows.

Source: JP Morgan data as of September 30, 2022.

It highlighted that the quality of the overall market has shifted from inherently low-growth telecoms and banks towards those with better growth prospects such as luxury goods and semiconductors

“We continue to emphasise the diversification potential of European equities. European stocks depend much less on the domestic economy than investors appreciate. This is made clear by the market’s outperformance this year, even amid a European energy crisis,” said JP Morgan analysts.

Emerging market stocks are expected to beat their developed peers over the next 10-15 years however, according to the report, making around 10.1% on average, led by a resurgence in China.

The forecast annual return on equities has also had a bump for a balanced portfolio made up of 60% equities and 40% bonds. Here, expected annualised returns have leapt from 4.3% a year ago to 7.2% today.

The strong equity returns have been rebalanced based on weaker markets in 2022, but the sharp rotation in market leadership from secular growth to commodity and value stocks should reinforce to investors importance of diversification, the report said.

“Greater expected divergence among regions, countries and sectors should also support active management as part of an overall investment toolkit,” it said.

Additionally, Juvyns suggested investors should consider when they invest, noting that things may get cheaper before rebounding, as well as their diversification.

“While entry points are more attractive than they were a year ago, they could get even more attractive if the cyclical weakness of 2022 extends into 2023, as seems likely. Accordingly, investors need to consider the timing of their entry point, with an eye to how much drawdown they can tolerate in the short term,” he noted.