It has been a tough year for investors and trusts have not been spared. Of the 49 sectors in the Association of Investment Companies universe, only 10 have made a positive return in 2022 so far.

Returns have been asymmetric as well. While the best sector (IT Leasing) is up 18.4%, the worst (IT Growth Capital) has more than halved in value, losing 52.3%.

Laith Khalaf, head of investment analysis at AJ Bell, said: “At times of deep uncertainty like this, contrarian investors might be thinking about going bargain hunting.

“It’s often rewarding in markets to be greedy when others are fearful, though given the current fears stalking the market have unpredictable political, economic and monetary dimensions, it’s probably a good idea to hedge your bets by drip-feeding money into the market gradually, perhaps through a regular savings plan.”

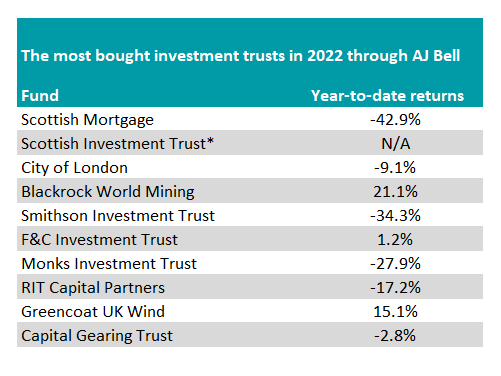

So far this year, those that have bought into investment companies have spread their risk, according to AJ Bell. The list of the platform’s top-10 most bought trusts below is a large range of names.

Source: FE Analytics and AJ Bell. * Scottish Investment Trust was merged into the JP Morgan Global Growth & Income trust in November 2022.

The inconsistency shows a couple of trends, namely investors trying to buy into falling trusts in the hope of picking up a discount (Scottish Mortgage), moving into hot new areas that are performing well (BlackRock World Mining), or trying to take evasive action and divert into safer strategies (Capital Gearing).

For bargain-hunting investors in the first camp, Khalaf said there were three options that could be worth a look. First was the £438m abrdn UK Smaller Companies Growth Trust, run by the soon-to-be retired FE fundinfo Alpha Manager Harry Nimmo and fellow Alpha Manager Abby Glennie.

“UK smaller companies are having a horrible year, but their long-term performance potential is appealing, especially when allied with some canny active management which sorts the wheat from the chaff,” said Khalaf.

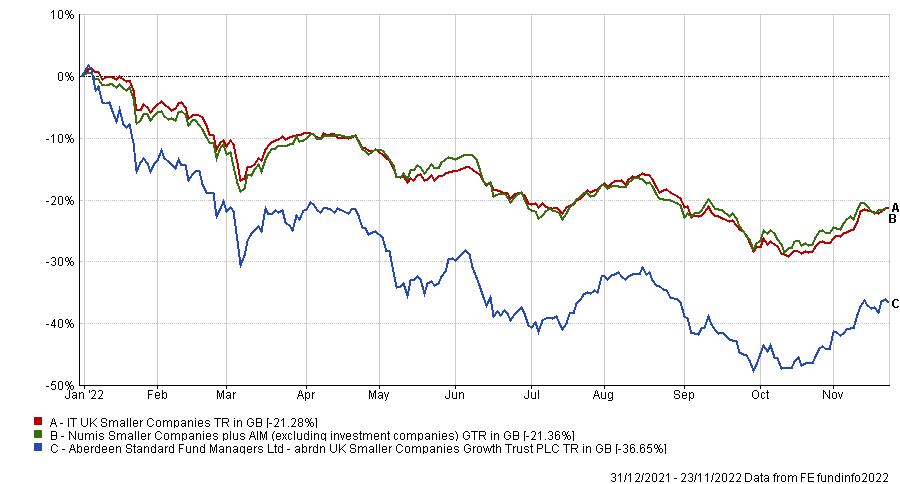

The trust is currently on an 11.5% discount to its net asset value (NAV) after suffering a 36.7% loss so far in 2022, more than 14 percentage points more than its Numis Smaller Companies plus AIM ex Investment Companies index and average IT UK Smaller Companies peer. This could make an attractive entry point.

Total return of trust vs sector and benchmark over YTD

Source: FE Analytics

The trust looks for companies with strong growth characteristics and robust balance sheets and is fairly concentrated with around 60 stocks. However, being invested in smaller companies does mean it comes with higher risk attached, Khalaf noted.

Second on the list was Fidelity Special Values, headed by FE fundinfo Alpha Manager Alex Wright. Another UK proposition, Khalaf said that the approach means the portfolio is full of “unloved or overlooked companies” that could be poised for a recovery.

“This can be a higher risk approach so it isn’t for the faint-hearted, but the fund is well diversified with around 100 holdings, invested across the market cap spectrum,” he said.

Shares of the £910m trust are on a 5.2% discount, despite sterling performance. Indeed, this year it is down just 6%, which is some way short of the FTSE All Share’s 0.7% gain, but significantly better than the IT UK All Companies average peer’s 18% loss.

Total return of trust vs sector and benchmark over YTD

Source: FE Analytics

Overall it means the trust has been the best performer in the eight-strong sector over one, five and 10 years, and is second over three years.

Turning to a more global outlook, another worth considering is The Bankers Investment Trust, which invests across the globe with a focus on both raising dividends and capital growth.

The trust has increased its payout for 55 years, making it one of the AIC’s ‘Dividend Heroes’ and currently yields 2%.

This year the trust has fallen 15.3%, slightly above the IT Global sector average of 17.6%, and its shares now stand at a discount to NAV of 7.2%.