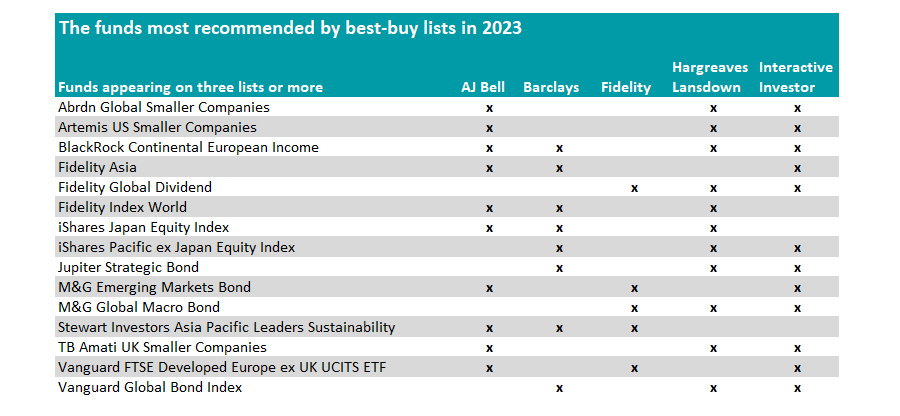

Fidelity Asia, Jupiter Strategic Bond and Artemis US Smaller Companies are among the most recommended portfolios across the UK’s main fund platforms.

Looking across all funds on the recommended lists of Hargreaves Lansdown, AJ Bell, interactive investor, Fidelity and Barclays, 15 appear on three or more lists with one – BlackRock Continental European Income – appearing on four lists.

Source: Trustnet

Many of these funds have been top performers over the long term, with only one – Vanguard Global Bond Index – in the fourth quartile over 10 years.

Analysts at Hargreaves Lansdown said the passive remained on its Wealth List, however, as “the team have a good record of tracker fund investing and its simple and low-cost approach should help it mirror the performance of its benchmark”.

All funds apart from the Vanguard FTSE Developed Europe ex UK UCITS ETF have a 10-year track record, with the European tracker clocking in eight years so far.

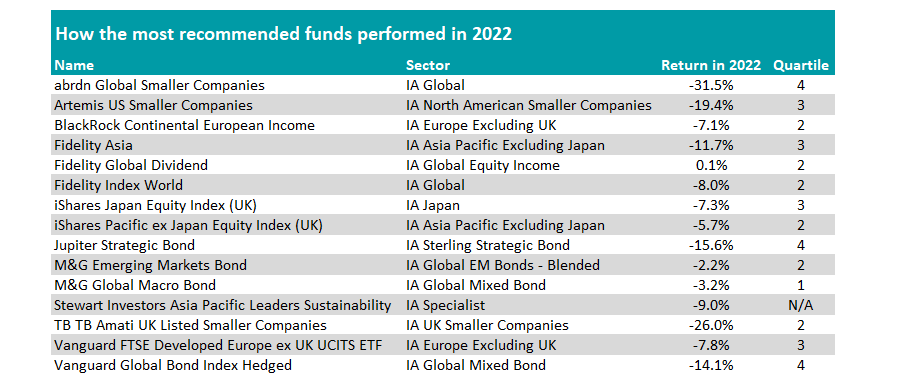

Despite excellent long-term track records, however, investors following the analyst hive mind in 2022 would have struggled.

Seven of the funds on the list were in the third quartile or worse among their sector peers in 2022 –half of the total once the Stewart Investors Asia Pacific Leaders Sustainability is removed as the IA Specialist sector is too broad to have quartile comparisons.

Jupiter Strategic Bond made a loss of 15.6%, placing it in the fourth quartile of the IA Sterling Strategic Bond sector.

Barclays Smart Investor analysts said: “What we like about the Jupiter Strategic Bond fund is the manager has no constraints, which means he has full freedom to invest in any part of the bond market and seek out the most attractive investment opportunities.

“This flexibility also enables the manager to seek shelter in more defensive areas of the market, when the outlook for bonds is more challenging. And behind this process is an experienced team which helps keep the level of risk in check and aims to ensure returns are consistent.”

Source: FE Analytics

Vanguard Global Bond Index also underwhelmed in 2022, down 14.1% – a bottom-quartile effort in the IA Global Mixed Bond sector, although as a passive fund it has no say in whether it outperforms its peers.

The abrdn Global Smaller Companies fund was the other bottom-quartile performer, making a 31.5% loss versus the IA Global sector’s average fall of 11.1%.

Despite the poor year, AJ Bell analysts rate the fund. “The strategy benefits from the longevity of the investment process, which has been in place for around two decades, initially with a focus on UK small cap equities,” they said.

“The discipline of that investment process is equally impressive. Additionally, the breadth of resource, wealth of knowledge and expertise in the small cap team is another redeeming feature,”

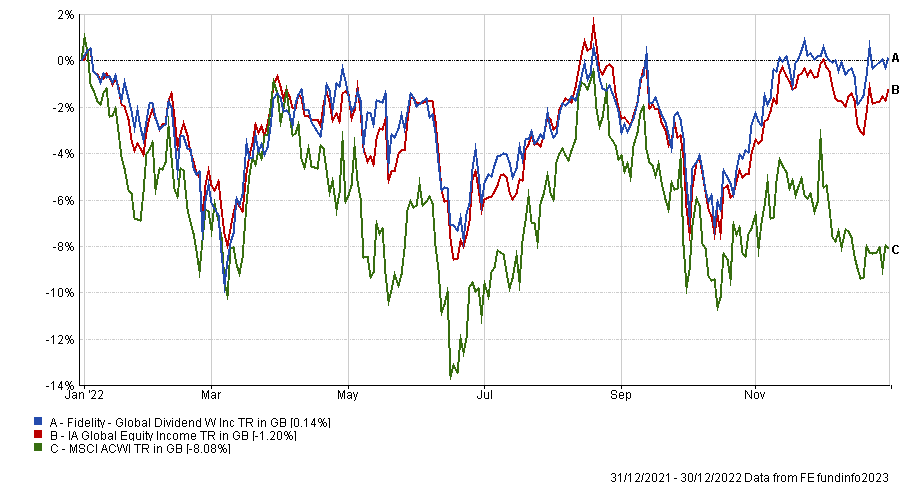

Across the list, only the Fidelity Global Dividend made a positive return on the year, up 0.1%. It was one of seven funds that made an above-average return versus its sector peers, beating the IA Global Equity Income sector by 1.3 percentage points.

Total return of fund vs sector and benchmark in 2022

Source FE Analytics

Analysts at interactive investor said: “Although its history does not span a full market cycle, the fund has been a solid performer, generating outperformance in more difficult markets, while keeping up in strongly rising markets.

Manager Dan Roberts’ approach should benefit when quality, defensive large companies do well. The approach struggled in 2021, when it was among the worst in the sector, but held up strongly in 2022.

However, the fund was not able to break into the top quartile of its sector. The only portfolio on the list able to boast that particular feat was the M&G Global Macro Bond run by Jim Leaviss.

Despite making a 3.2% loss, the fund was one of the better performers in the IA Global Mixed Bond sector, which struggled last year as rising interest rates and inflation meant investors looked towards safer options such as cash and government bonds.

Analysts at Fidelity said the fund is flexible and can invest across multiple regions, noting that “investment experience is vital” in this field.

“The manager is one of the most senior bond investors at M&G and this fund is his main focus. He is surrounded by a team of experienced investors and has extensive support analysing the borrowers the fund lends to,” they noted.

“The fund is flexible and should perform differently from more traditional bond funds. It could appeal to investors who are nervous about the outlook for bond markets but still seek some fixed income exposure.”