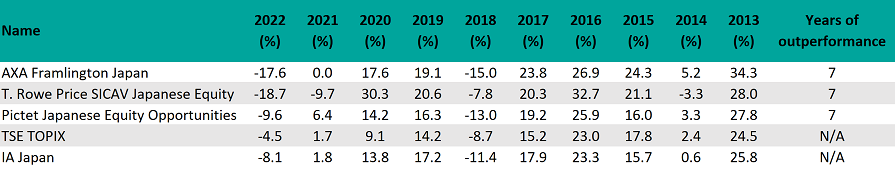

AXA Framlington Japan, T. Rowe Price SICAV Japanese Equity and Pictet Japanese Equity Opportunities are the most consistent IA Japan funds of the past decade, beating the most common benchmark in the sector – the Topix – and their peer group composite in seven of the past 10 calendar years.

However, all three funds underperformed the Topix last year, and the first two fell behind the index in 2021 as well.

Performance of funds vs sector and index

Source: FE Analytics

Of the 51 funds in the sector with a track record long enough to be included in the study, one more – LF Morant Wright Japan – also beat the Topix in seven of the past 10 calendar years, but could only beat the sector average in five of these.

Of the three most consistent funds, AXA Framlington Japan made the highest total return over the 10-year period, with gains of 170.8%.

The fund is run by Chisako Hardie, who invests in long-term growth businesses. She acknowledged the recent underperformance, saying: “Although the past few years have been challenging for our small/mid-tilted growth-style portfolio, we remain confident about the long-term direction of these businesses and believe the current situation could offer investors great entry opportunities.”

Hardie remained confident, however, noting that Japan’s corporate strength has changed over the past few decades from an export-orientated mass-production model to higher added-value products such as advanced materials and devices.

“Accordingly, the social and corporate structure and mindset have also shifted, creating a large number of innovative companies in the technology and service sectors,” the manager said.

“This fact is not well known to a majority of global investors because many of these are small domestic businesses and it is not easy to get to know them. As such, these stocks tend to be left significantly undervalued for their growth potential.”

Hardie said the only way to unlock this value is through building relationships with “generally reticent” management teams to gain a full understanding of their business models and strategies.

The £71m AXA Framlington Japan fund has an ongoing charges figure (OCF) of 0.85%

T. Rowe Price SICAV Japanese Equity invests in companies where manager Archibald Ciganer believes growth is underpriced. Two-thirds of the portfolio is invested in stocks that have a secular tailwind, with competitive advantages stemming from brands, technology and industry positioning.

The remaining third is invested in stocks that are undergoing transformation, either through restructuring or a strategy change. It has above-average exposure to mid and small caps.

The analysts at FE Investments said that stock selection has consistently been the key driver of outperformance since Ciganer began managing the fund.

“When he took over as portfolio manager in 2013, he increased the portfolio’s exposure to growth companies, reduced the number of stocks and increased exposure to smaller companies,” they said.

“This has been positive as the fund’s alpha generation relative to the benchmark has improved considerably. The fund would be best suited to a portfolio with a long-term investment horizon as well as one that can tolerate medium to high volatility levels.”

However, they said the fund’s lower exposure to traditional cyclicals has acted as a headwind while these areas have led the market since the send of 2020. The fund was also exposed to supply chain issues last year through its large allocation to industrials and it fell 18.7%.

Overall though, it made 154.5% over the 10-year period in question. The €750m fund has an OCF of 0.88%.

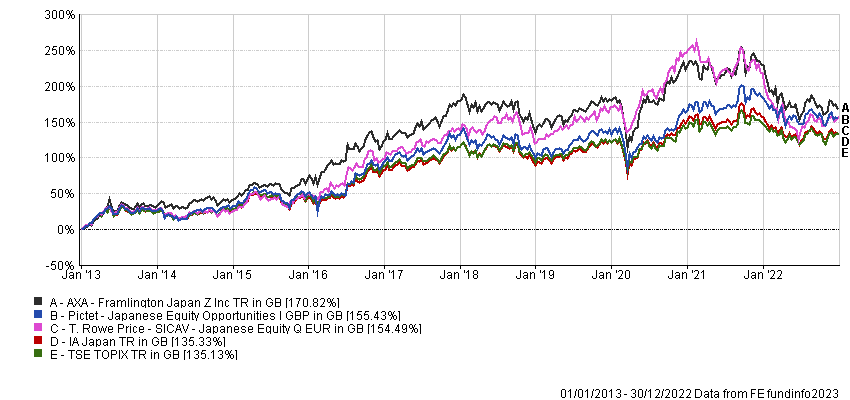

Performance of fund vs sector and index over 10yrs

Source: FE Analytics

Source: FE Analytics

T. Rowe Price also runs an onshore version of the strategy which has assets of £211m and ongoing charges of 0.89%.

Pictet Japanese Equity Opportunities has been headed by Adrian Hickey since 2006, although the firm’s wider Japan team, split between Tokyo and London, also provides investment ideas.

Sam Perry, a member of this team and co-manager of the Pictet Japanese Equity Selection fund, said this allows them to have “multiple eyes on every opportunity” and stops the individuals from “getting bamboozled by our own bright ideas”.

For example, Perry described himself as a deep value investor, while some of his colleagues are more growth focused. This results in a relatively style-agnostic strategy, which helps to explain the consistency of the fund’s performance

“We're not value junkies, we're not growth junkies, we just want the valuation upside,” he added, although he said the team is currently more optimistic on typical growth stocks, as the value trade appears to be “overdone”.

Pictet Japanese Equity Opportunities made 155.4% over the 10-year period in question. The £1.2bn fund has an OCF of 0.89%.