For investors seeking a concentrated play on US equities, Baillie Gifford American proved to be the favourite choice among experts, who preferred it to another similar strategy, JPM America Equity.

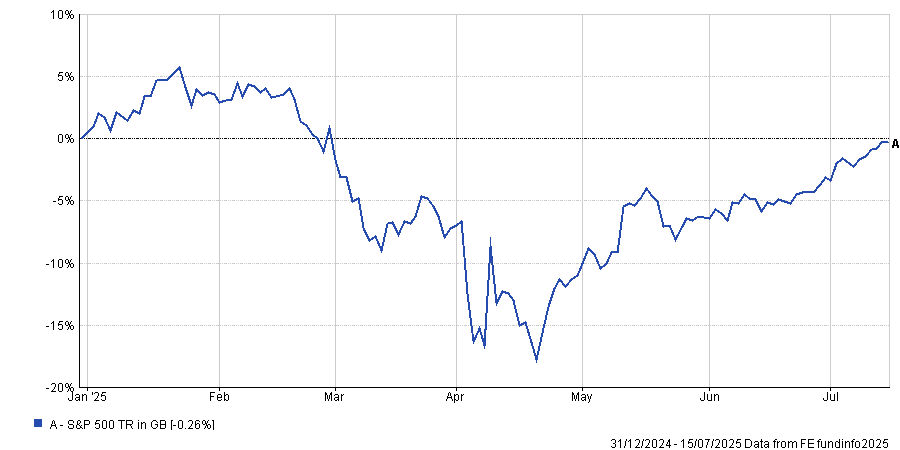

Choosing an active fund in the US has been challenging this year, with US erratic trade policies spurring market volatility. However, investor confidence seems to be gradually making a comeback, with the S&P 500 recently recovering from its lows earlier this years, as seen in the chart below.

Performance of the S&P 500 year to date

Source: FE Analytics. Total return in sterling.

While it remains to be seen if this recovery can last, there are several popular funds in the IA North America sector for investors hoping to play on a potential rally.

The £3bn Baillie Gifford American and £6.4bn JPM America Equity are among the most frequent choices, being in the top quartile for assets under management in the sector.

Both are run by teams of four managers, including FE Fundinfo Alpha managers Tom Slater (Baillie Gifford) and Jonathan Simon (JP Morgan). Both have a relatively high-conviction approach, with 42-53% of their entire portfolio invested in just their top ten holdings.

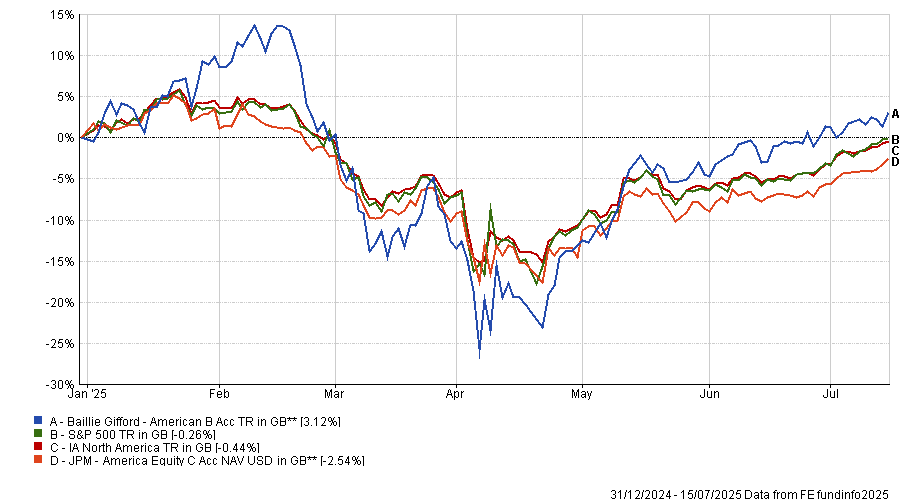

Despite these similarities, they have performed very differently so far this year. The Baillie Gifford fund has delivered a top-quartile return of 3.1% in the IA North America sector this year. By contrast, the JPM Fund has posted a negative return of 2.5% over the same period.

Performance of the funds vs the sector and benchmark in 2025

Source: FE Analytics

Below, Trustnet asked fund pickers which strategy they favoured for their US exposure, or any alternatives they preferred instead.

Rob Morgan, chief analyst at Charles Stanley Direct, chose the Baillie Gifford American fund for “doing something truly different to the competition”.

Of the two strategies, it is the “punchier, more high-conviction option” with a focus on identifying a relatively small number of transformational, high-growth companies.

“Those familiar with the Baillie Gifford style will not be surprised to see a trademark high active share and a relatively low turnover of holdings that tend to be kept for the very long term,” Morgan said.

However, this makes stock selection critical, he noted. With the 10 largest holdings representing such a large portion of the portfolio, underperformance in these stocks can be a major headwind for returns.

For example, Baillie Gifford American is up 389.6% over the past decade, the sixth-best result in the IA North America sector during this period. Over the past five years, however, it is up just 18.9%, the third-worst performance in the peer group.

As a result, while the Baillie Gifford strategy is his preferred choice, it's probably best suited as a satellite holding, Morgan concluded.

Darius McDermott, managing director at Chelsea Financial Services, also favoured the Baillie Gifford strategy.

Its “out-and-out” growth strategy aims to find transformational companies, such as Cloudflare and DoorDash, and hold them from early in their development.

Despite having high conviction in their holdings, the managers are very adaptable and will not hesitate to sell out of underperforming companies, McDermott explained.

“If a company’s growth potential fades, they reassess or exit. It’s about owning not just good companies, but the best”.

This is “not your typical core US fund”, he continued, “but for the right investor it can be a powerful growth engine – especially when complemented by an S&P 500 index fund”.

For Carly Moorhouse, senior fund analyst at Quilter Cheviot, there is no clear winner between these two strategies, due to their very different exposures.

While both emphasise bottom-up stock selection, JPM America has two managers running the growth sleeve of the portfolio, while the other two managers run the value side. The resulting blended approach to US exposure is more consistent and generally less volatile, making it a much better core allocation for investors. On the other hand, Baillie Gifford’s higher-growth approach generally leads to “superior outcomes over the long-term” but comes at the cost of significant short-term volatility.

As a result, she argued they occupied very different roles within a portfolio, making deciding between the two very challenging.

Tom Bigley, investment fund analyst at interactive investor, pointed investors towards a passive allocation to the market through the Invesco S&P 500 Equal Weight ETF.

Every stock in the exchange-traded fund is equally weighted at 0.2% of the portfolio, meaning that a name like Apple has the same weight in the portfolio as the smallest stock in the index.

This offers size-neutral exposure to the US market and provides access to “smaller stocks and stocks with lower valuations, thus providing a better diversified approach to investing in stocks which could lead to higher returns”.

With an ongoing charges figure (OCF) of 0.2%, it is “competitively priced” and offers a way of gaining exposure to the US market while avoiding a more high-conviction approach.