In volatile markets, the appeal of long/short funds is easy to understand: they offer a way to make money not only when shares rise, but also when they fall.

They do this by taking both ‘long’ positions – buying stocks they expect to go up – and ‘short’ positions, where they profit if a share price drops. That gives them the potential to deliver returns when traditional funds struggle and to offer some protection during market sell-offs.

Some investors are paying renewed attention to long/short funds as a tool for diversification and downside defence. Managers like Rupert Silver and Ben Newton of the Credo Dynamic fund have added to their exposure, as they recently told Trustnet, citing low correlations and diversification benefits.

But long/short investing is a complex and often misunderstood space. Performance varies widely and many funds fail to deliver on their promise. So when do these strategies actually work, what are the pitfalls and how can investors identify the managers who get it right?

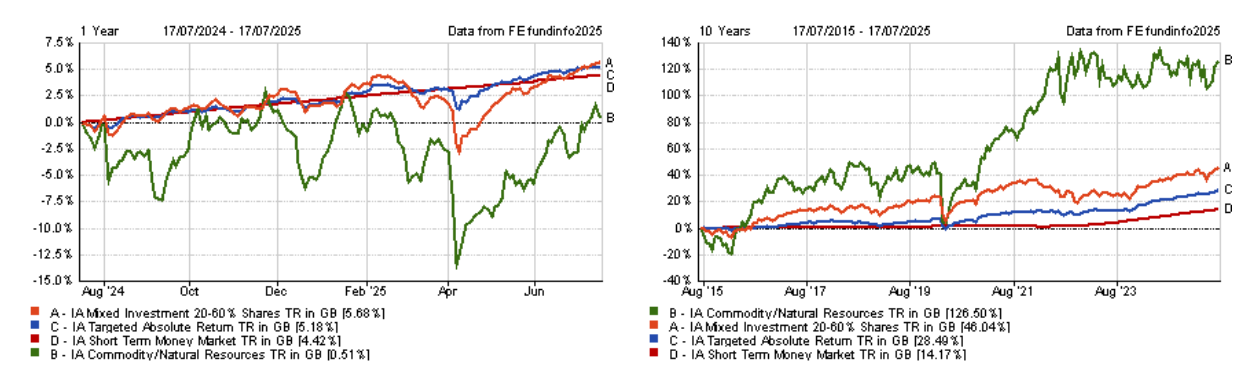

Performance of alternative sectors over 1 and 10 years

Source: FE Analytics

Joe Richardson, discretionary investment manager at Dennehy Wealth, has recently introduced a long/short allocation into the firm’s model portfolios for the first time in years, a move driven by the current backdrop.

“In the current environment – volatility, geopolitical tension, wars, tariffs and broader shifts in the global order – we think there's a role for certain absolute return style funds,” he said.

Still, he warned that a long/short allocation “certainly isn’t core” to Dennehy Wealth’s process. When included, allocations are small – a single-digit percentage of the portfolio.

Richardson also avoids having multiple long/short strategies as it can add unnecessary complexity. “Our primary defence with our process remains our stop-loss strategy rather than relying too much on long/short funds for a defence,” he explained.

One reason for caution was the mixed track record across the sector.

“In our experience very few managers deliver consistently,” he said. “The short book actually becomes more of a drag than a help providing alpha. It takes a skilful manager with a repeatable process for these types of funds to really do well over time.”

That concern is echoed by Andrius Makin, senior portfolio manager at Killik, who said long/short strategies can in theory provide balance in changing economic conditions, but this often breaks down in practice.

In strong equity markets, the short book can work against you, he explained. “We’ve actually started to trim some of those positions down. We’ve still got them in the portfolio, but we’re finding that the short book is just leaking so much performance. The trade-off just isn’t worth it.”

His team still uses long/short exposure selectively, but with careful sizing and upper limits. “We’re absolutely fine with certain funds costing performance, but we just have upper limits on how much of a drag that can be,” he said.

Makin also pointed to costs as a factor limiting their use. “These types of funds tend to be more expensive, so you really need conviction that the play is right for the portfolio – because you’re also losing money on the fees,” he said.

Chris Metcalfe, chief investment officer at iBoss, has seen both the promise and the pitfalls of long/short investing across several market cycles. For him, it comes down to clarity in the process and trust in the manager.

“You should always be able to explain to clients what it is you’re holding and why. We were struggling to explain why [a previous fund] wasn’t working. We listened to the managers, had updates and were trying to understand: why is what you’re doing now not working, when it was working before?,” he said.

“In the end, what we’ve decided and learned over the years is that we prefer more vanilla approaches.”

Some long/short strategies are difficult to understand because there are “very few ways to compare two funds in the absolute return sector”. In equity long-only sectors, it’s about which stocks a manager is holding and why. In the absolute return space, everybody’s got a different way of doing it, “almost regardless of the investment aim,” said Metcalfe.

So simple is the way to go. “With a simple long/short fund, you know the outcome is going to be: which longs worked, which shorts worked and the dates when bought and sold,” he said.

This might be difficult to assess for someone who doesn’t have access to the managers, but there is one positive indicator that even retail investors can look for – manager tenure.

In his guide to pick fund managers, Metcalfe invited investors to look for managers who get “most things right, most of the time”, the longer the period to assess that, the better – especially, he stressed, in the absolute return space.

“You’ve just got to look at a single track record and say: has this journey been long enough for the mangers to prove themselves? And is it a journey I could accept going forward?”