The past year has been a tough one for investors, no matter how tolerant of risk they might be, but with the ISA deadline looming many will now be thinking about where to put their cash to work.

Below, AJ Bell head of investment research Alena Kosava suggests funds for investors with cautious, balanced, adventurous and income portfolios.

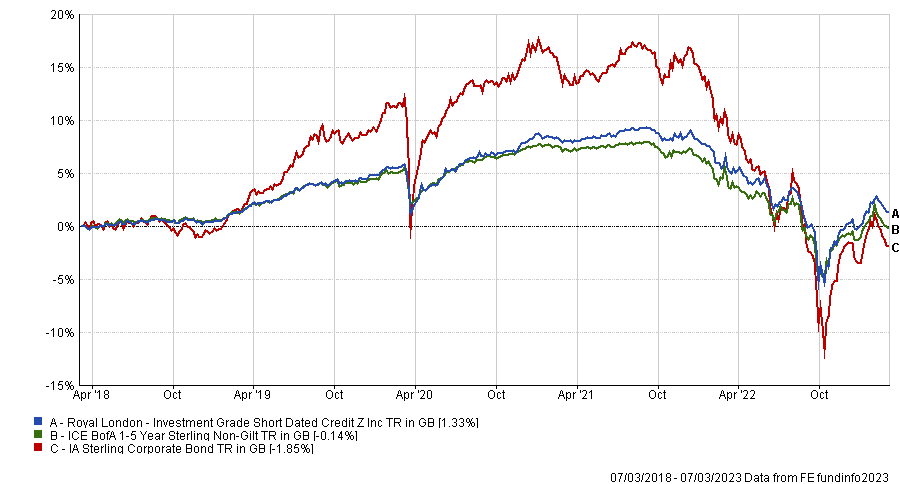

Cautious investors: Royal London Investment Grade Short Dated Credit

Fixed income was one of the worst parts of the market to own in 2022 after rising interest rates caused investors to flee the asset class. However, Kosava believes bonds now offer reasonable levels of income and highlighted Royal London Investment Grade Short Dated Credit as a pick for cautious investors.

Performance of fund vs sector and index over 5yrs

Source: FE Analytics

“While high inflation remains a feature of markets, we are starting to see disinflation come through. Interest rates are still expected to increase, but likely at slightly a slower pace,” she explained.

“With the backdrop for bonds turning more positive, investors should consider exposure to this area of the market as part of a diversified portfolio. Keeping duration short can dampen volatility in times of market dislocations amid rising bond yields as well as offer capital protection.”

Royal London Investment Grade Short Dated Credit’s performance in 2022 highlights this point: while the IA Sterling Corporate Bond sector was down 16.1%, it lost just 7.8% - ranking it 14th out of 102 funds – with significantly less volatility than its average peer.

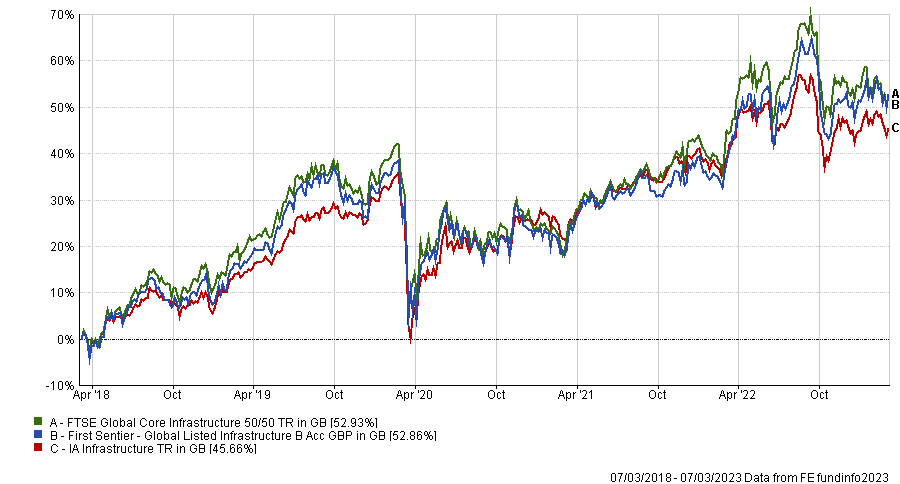

Balanced investors: First Sentier Global Listed Infrastructure

For those with more balanced portfolios, Kosava likes First Sentier Global Listed Infrastructure, which is managed by an experienced team in Australia that has been “at the forefront of infrastructure investing for many years”.

Performance of fund vs sector and index over 5yrs

Source: FE Analytics

“As the prospect of recession is staring investors in the face, the importance of portfolio diversifiers in the form of real assets such as high-quality infrastructure has been clearly illustrated. Whether it is through energy needs, distribution networks or communication services, infrastructure is a key part of a fully functioning economy,” the analyst said.

“Due to the ongoing war in Ukraine, the importance of energy security and independent infrastructure assets also came to the fore. The First Sentier Global Listed Infrastructure fund looks to provide exposure to all of these areas and more in a global portfolio of infrastructure companies.”

Kosava pointed out that around 40% of the portfolio is in energy-related companies, offering exposure to companies leading the energy transition, while other holdings are critical distribution infrastructure such as railroads and toll roads.

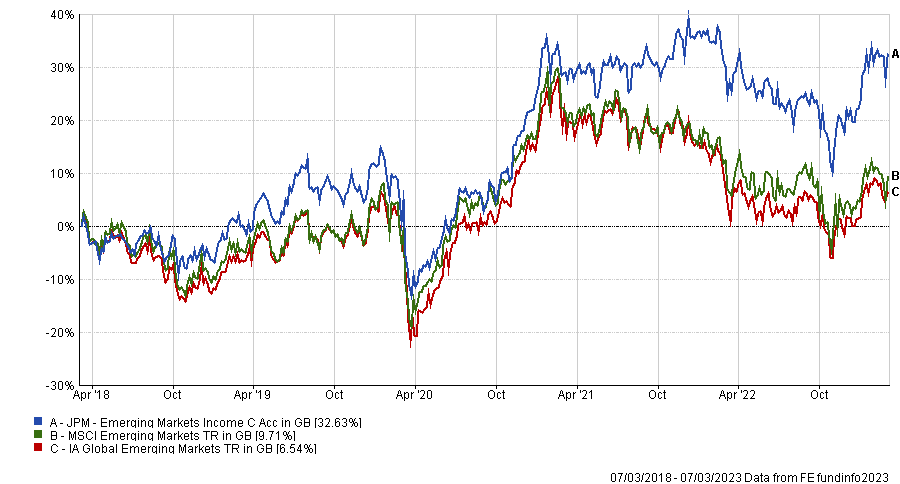

Adventurous investors: JPM Emerging Markets

Emerging markets have struggled in recent years but Kosava noted that this is largely down to falls in Chinese assets, on the back of zero-Covid lockdowns, tension around Taiwan, regulatory crackdowns and other issues. Despite this, adventurous investors should consider holding something like the JPM Emerging Markets fund.

Performance of fund vs sector and index over 5yrs

Source: FE Analytics

A number of factors now look supportive of emerging market equities, she added, such as China’s decision to end its zero-Covid policy, scope for some countries to ease monetary policy (having tightened quicker than the developed world) and the likelihood for a pullback in the US dollar. The long-term outlook for China is also positive, with the country expected to become the world’s largest economy within the next decade.

“JPM Emerging Markets offers broad exposure to emerging markets, with a core allocation to China. The managers access ample analyst resource allocation towards greater China and considerable presence on the ground,” she said.

“The fund currently carries a slight underweight to China and is overweight in Hong Kong and India while carrying greater exposure towards financials, technology and consumer staples relative to the wider market.”

Income seekers: JPM Emerging Markets Income

For income seekers, Kosava stuck with an emerging markets strategy run by JPM Morgan Asset Management and pointed investors in the direction of JPM Emerging Markets Income.

Performance of fund vs sector and index over 5yrs

Source: FE Analytics

She said: “An equity income approach at the current juncture appears attractive, offering some cushioning in the form of regular dividends. Yielding 4%, the fund aims to provide a portfolio designed to achieve income while participating in capital growth over the long term.

“This is a credible emerging market income strategy with a breadth of analytical support combined with a dedicated portfolio management team focusing on the income consideration. Diversified across 90 names, the fund offers sufficient compositional breadth, while ensuring diversity of drivers underpinning its dividend.”