Investing in themes has gained in popularity especially since the rise of exchange-traded funds (ETFs), which allow investors to quickly move in and out of positions and so play specific areas of the market.

A growing number of investment houses have also started to offer mutual funds with a thematic focus, offering portfolios that are aligned with the convictions or ethical preferences of their clients.

But not everyone is convinced that this type of vehicles does investors any good.

Alex Savvides, manager of the JOHCM UK Dynamic fund, said that investors shouldn’t give in to pressures to invest in a certain way.

“In the retail world that we're in, there's pressures to chase thematic ways to invest. People want to follow environmental, sustainability and governance (ESG) principles, to be global, high quality or super-high growth,” he said.

“This is sponsored by investment banks that produce thematic research, but it generates a huge misallocation of capital.”

This isn’t to say that there aren’t good themes around.

“Robotics, AI, batteries, electric vehicles, decarbonisation and renewable power might all be good areas to look at. But just because there's a growth theme, it doesn't mean that you're going to make money out of it.”

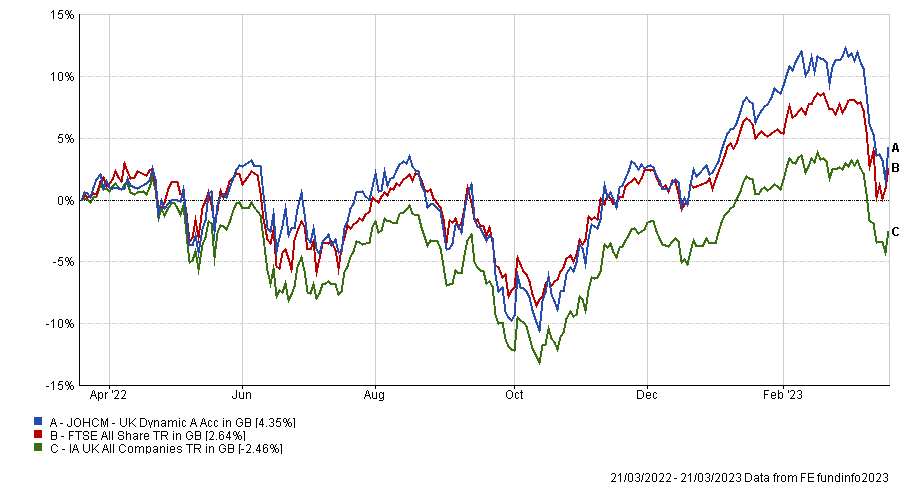

Performance of fund over 1yr against sector

Source: FE Analytics

On his point of misallocation of capital, Savvides also identified “a general lack of focus on valuation nowadays. Price, however, is the key definer of the value that the investment will generate”.

“The pendulum has swung too far and will have to come back, because everyone loses money when they don't focus on the right things. When they've lost enough money, they'll stop doing it.”

He took the UK market, which continues to suffer greater outflows than the rest of the world, as an example.

“The UK market is 25% smaller than it was five or 10 years ago. No one's launching new UK products, they’d get laughed out of town. Pretty seasoned UK fund managers are going through hurdles to generate new business that are not put on a johnny-come-lately thematic fund or johnny-come-lately sustainability fund.”

“I think it speaks of misallocation of capital and a misunderstanding of how you make money,” he concluded.

In a recent Trustnet feature, other reasons why people dislike investing in one theme emerged, including the fact that, being constrained to a small part of the market, thematic funds end up buying companies that will be competing with one another, and by the time an asset class has enough momentum to warrant its own specialist portfolios, it is often nearing maturity.

On the other side of the debate Steve Freedman, sustainability and research manager for thematic equities at Pictet Asset Management, said, at a time of intense macroeconomic, financial and geopolitical uncertainty, thematic approaches that emphasise the exposure of companies to long-term megatrends “are a useful way of distinguishing the news from the noise and avoiding the pitfalls of short-term approaches”.

A number of structural factors suggest that a valuation premium for thematic stocks is justifiable, he argued. For example, thematic stocks provide a different set of factor, industry and style exposures, which benefits from diversification. Additionally, investor demand for solution-oriented business models in relation to global challenges is a feature that is here to stay.

“But despite the increased interest in thematic investments, since 2010 their relative valuation versus broad equity markets has aligned with history on comprehensive measures, including enterprise value to EBIDTA and price earnings to growth ratios,” he said.

“In 2022, underperformance brought valuations back in line even further, which is reassuring for investors who are looking for an interesting entry point.”

Freedman did take Savvides’ point that thematic portfolios will have to pay closer attention to valuations, however.

“Going forward, with a larger investor base, it is important that valuation considerations become a central component of thematic investing. Thematic investing can be accomplished at a reasonable price and investors can integrate this aspect into their manager selection framework, which is supportive of active management approaches to thematic investing, rather than passive ones.”

“Stock selection based on fundamental future-orientated research and valuation is key. Backward-looking index exposures can often favour past winners, which tends to not work as well for thematic portfolios that are typically exposed to long-term, future growth,” he concluded.