Fundsmith Equity could be the perfect foil for a recession and could do doubly well if interest rates start to fall, according to experts, but will struggle if a value rally returns.

The behemoth fund was the most sold fund in the IA Global sector in the first half of the year despite adding £2bn through returns as investors withdrew £558m between January and June.

As it is the UK’s largest active global fund, high level of inflows and outflows by monetary amount are to be expected.

It is still exceptionally well owned by investors and experts suggest holding on to Terry Smith’s flagship portfolio as it is likely to do well in a recessionary environment.

This is due to its mega-cap, quality-growth style bias and large exposure to consumer staples and healthcare sectors, which have historically been resilient in market downturns.

Rob Morgan, chief analyst at Charles Stanley, said: “The mix of businesses in the portfolio should be relatively resilient in the event of a recession.

“In addition, should interest rates fall in that scenario, investors may be increasingly willing to pay up for resilient growth companies.”

However, Morgan warned that the fund could underperform in the short-term if a low-quality rally occurs on the back of a benign ‘soft landing’ scenario.

A soft landing scenario would mean that central banks managed to get inflation under control while avoiding a recession.

Ben Yearsley, director at Fairview Investing, agreed, nothing that the fund has a low allocation to financials with nothing in banks and has no exposure to energy businesses. Therefore, it would not do well when these sectors lead the market.

The manager, Terry Smith, previously explained why he does not invest in banks: “Firstly, I never invest in anything that requires leverage to make an adequate return. Banks have a very small amount of equity to support their balance sheet.

“Next, despite this massive leverage and the risk which accompanies it, returns from the banking sector are inadequate.

“Finally, surely there must be some good banks to invest in which are better than the average? That brings me onto another problem: systemic risk. Even if the bank you are invested in is well run it can still be damaged or destroyed by a general panic in the sector.”

There are other reasons investors may be wary, other than the fund’s lack of exposure to certain areas of the market. While acknowledging the “incredible returns” since launch, James Yardley, senior research analyst at FundCalibre, highlighted some issues with the fund.

He said: “Firstly it is an expensive fund in the current market. Secondly the fund is exceptionally large and is experiencing some redemptions although these are relatively small.

“Whilst this isn't much of an issue for Fundsmith, given it invests almost entirely in mega-caps and has always done so, it does mean it is slightly constrained and is unable to buy into mid- or small-caps even if the manager wanted. A smaller fund is almost always easier to manage.”

In the past, Smith argued that the fund is relatively cheap once transaction costs (which are not calculated as part of the ongoing charges figure) are taken into account and that the total charge is in-line with rivals.

Yardley also said that, whilst remaining strong, performance has ben a little weaker and that some rivals with similar strategies have outperformed it.

He added: “Nevertheless, it is quite harsh to dump it when it's really done nothing wrong.”

Indeed, investors should not be put off by any of the above, most experts agreed, with AJ Bell head investment analysis Laith Khalaf noting that the fund should do well over the long term and remains a good choice.

Morgan and Yearsley also do not see any reason to sell Fundsmith Equity, but highlighted that there alternatives for those concerned.

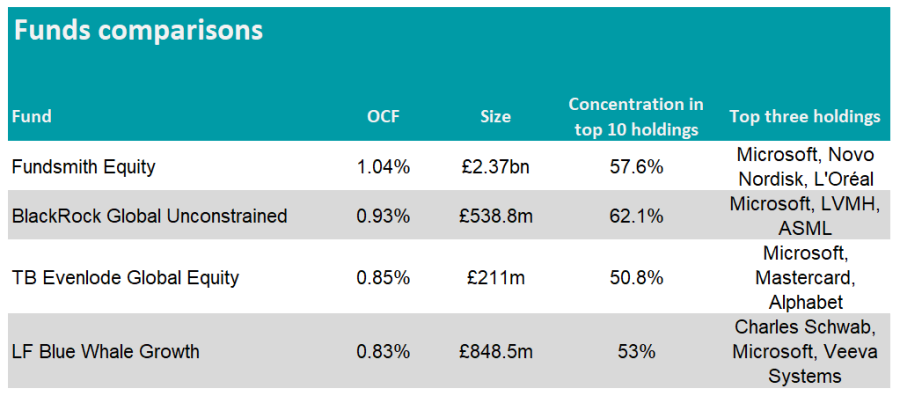

Alternatives

While Fundsmith has an enviable track record, the experts said investors could look at three recently launched funds as alternatives – all of which have outperformed Smith’s portfolio since their respective launches.

Funds comparison

Source: FE Analytics

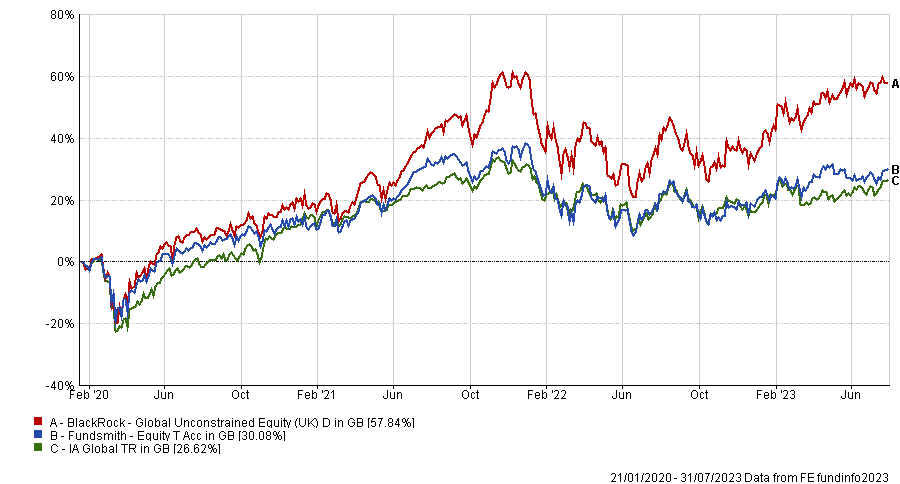

Both Morgan and Yearsley suggested BlackRock Global Unconstrained, managed by FE fundinfo Alpha Manager Michael Constantis and Alister Hibbert.

Performance of funds vs sector and benchmark since launch of BlackRock Global Unconstrained

Source: FE Analytics

Morgan said: “The manager searches for the growth compounders of the coming decade and beyond with no regard for any benchmark. It is likely to be more volatile, however, given the very high conviction approach.”

BlackRock Global Unconstrained has 62.1% in its 10 largest holdings, compared with 57.6% for Fundsmith Equity.

Yardley also suggested TB Evenlode Global Equity, highlighting that the fund is similar in but smaller and cheaper than its behemoth rival. Since its launch in 2020 the fund has made 38.3%, while the average IA Global peer has gained 26.7% and Fundsmith Equity is up 24.4%.

Yearsley’s selection was LF Blue Whale Growth, a fund that “arguably” has a slightly higher emphasis on growth than Fundsmith. This bias has helped the portfolio to a 91.8% return since launch in 2017, beating Smith’s fund by 9 percentage points. Both remain comfortably ahead of the average global rival, which has made 57.1% over this time.

Performance of funds vs sector and benchmark since launch of LF Blue Whale Growth

Source: FE Analytics

Rather than suggesting alternatives, Khalaf suggested holding it alongside other global funds with a distinct investment style, suggesting that diversifying across different managers was a better choice than trying to find an alternative to the long-term star.

“In the global sector they might consider holding Fidelity Global Special Situations and Schroder Global Equity Income alongside Fundsmith as these offer complementary investment styles,” he said.