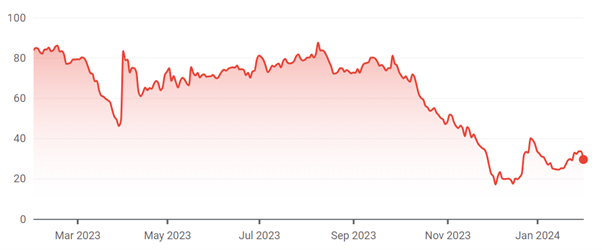

Beleaguered Scottish investment firm abrdn has been caught in the crosshairs of short sellers since its share price fell off a cliff last summer. It faced renewed pressure after announcing a “new transformation programme” two weeks ago to restore its core investments division to profitability by cutting costs.

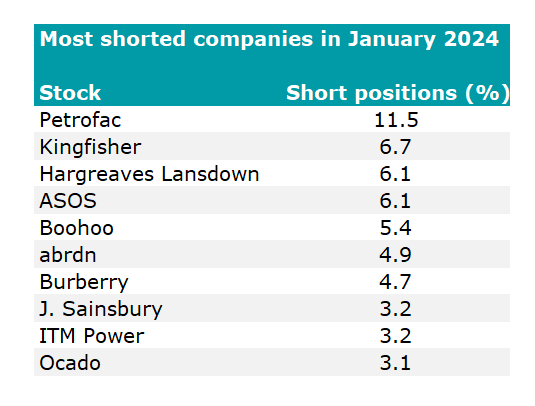

Hedge funds and asset managers disclosed short positions to the Financial Conduct Authority (FCA) worth 4.9% of abrdn’s share capital last month. The lion’s share was down to BlackRock, which has short positions worth 2% of abrdn’s share capital. Hedge funds GLG Partners, Samlyn Capital, Millennium International Management and Qube Research & Technologies are also shorting abdrn.

Investors withdrew £12.4bn from abrdn’s products during the second half of 2023, the firm revealed in a trading update on 24 January 2024. As a result, abrdn plans to axe 500 jobs and slash costs by at least £150m on an annualised basis by the end of 2025. The firm ended last year with £495bn of assets under management.

Stephen Bird, chief executive officer, said: “The board and I are committed to taking these significant cost actions now to restore our core investments business to a more acceptable level of profitability.” Most of the cost cutting will be implemented this year.

The Edinburgh-based firm has three divisions – investments, adviser and personal wealth. Investments is the problem child, facing “structural headwinds”, according to abrdn’s January trading update.

“High inflation and geopolitical uncertainty continued the trend to cash and de-risking of client portfolios,” abrdn stated. “Outflows were driven by equities and fixed income, reflecting the challenging market environment and our exposure to Asia and emerging market solutions.”

Bird even considered disposing of the investments arm last June – an idea that was quashed by abrdn’s board. Instead, the firm sold its US private equity and venture capital business to HighVista Strategies and its European private equity capabilities to Patria Investments. Earlier last year, the group sold its discretionary fund management businesses, abrdn Capital, to LGT.

On the other side of the table, abrdn’s US subsidiary bought four closed-end funds from Macquarie and First Trust Advisors last year and acquired Tekla Capital Management, a healthcare fund management business in Boston.

Despite these moves, abrdn’s share price nosedived from £2.36 on 27 July to £1.51 on 4 October 2023 after its results for the first half of 2023 showed a pre-tax loss of £169m and £4.4bn of outflows. The firm was demoted from the FTSE 100 to the FTSE 250 index at the end of August for the second time in 12 months.

Share price of abrdn over 1yr

Source: Google Finance

According to a Barclays survey of independent brokers, eight have a sell rating for abrdn, five are neutral and one broker has a buy rating.

The Scottish fund manager is the UK’s sixth most shorted stock, ranked by the percentage of its share capital in the hands of short sellers.

Short sellers placed larger bets against Petrofac, which designs, builds and operates energy facilities. It was by far the most unpopular UK-listed company last month, with 11.5% of its share capital in the hands of short sellers.

Petrofac was followed by DIY giant Kingfisher, which overtook investment platform Hargreaves Lansdown, which is in third place – down one spot from last month. Retailers ASOS and Boohoo round out the top five, with the firms also trading places over the course of the past month.

The UK’s most shorted stocks as of 31 January 2024

Source: Financial Conduct Authority

Petrofac’s shares had been falling since late September but they started to climb back after the energy services provider announced a new project on 20 December 2023. This was the second project for Petrofac and Hitachi Energy within a $14bn multi-year agreement with TenneT, a transmission system operator, to expand offshore wind capacity in the North Sea.

Share price of Petrofac over 1yr

Source: Google Finance