Petrofac, which designs, builds and operates energy facilities, was the most shorted stock on the London Stock Exchange in November. Last month at least 7.5% of Petrofac stock was in the hands of short sellers, a significant increase from 2.7% in October.

The share price has fallen 70% this year but most of that downward trajectory occurred since 9 August when shares in the oil services company were worth 87.5p. Since then, Petrofac shares plummeted to 17p on 1 December.

The oil price has headed south since late September, pulling Petrofac’s shares down with it.

Total return of Petrofac shares versus the oil price in sterling this year

Source: FE Analytics

Markets have been concerned for some time about Petrofac’s weak operating profitability and high leverage.

Nonetheless, as Fitch Ratings pointed out on 27 September (when it revised Petrofac’s outlook to stable from negative) the oil services company has a strong book of new orders and a healthy pipeline of prospects.

Fitch stated: “We expect significant backlog growth to help gradually improve the group's weak operating profitability, which has been affected by low activity and ongoing completion of the legacy projects disrupted by the pandemic.”

The outlook has darkened since then. On Friday 1 December, broker Berenberg placed Petrofac under review, describing the oilfield services company as “precariously positioned” due to a “liquidity crisis”.

Financing facilities of about $250m are due to mature in October 2024, Berenberg warned. "In a worst-case scenario, Petrofac may be forced to renegotiate its financing agreements, potentially leaving shareholders significantly diluted,” analysts said.

On Monday 4 December, Petrofac disclosed that it will not meet its cash targets for this year due to delays in collecting advance payments for new contracts secured in 2023.

Petrofac’s management team is considering selling non-core assets to strengthen its balance sheet and is holding talks with investors to take a non-controlling position in parts of its business portfolio. The share price rallied on this news during Monday morning trading.

Tareq Kawash, group chief executive of Petrofac, said: “We are working hard to address short-term liquidity challenges and strengthen the financial position of the group.”

GLG Partners, Millenium Capital Partners, Helikon Investments, Astaris Capital Management, Tages Capital, TFG Asset Management and Whitebox Advisors all disclosed to the Financial Conduct Authority in November that they were shorting Petrofac.

Elsewhere, fashion companies ASOS and Boohoo, DIY giant Kingfisher and financial services companies Hargreaves Lansdown and abrdn were also amongst the most shorted stocks in November. Hargreaves Lansdown fell out of the FTSE 100 at the end of last month.

Other stocks under pressure from short sellers last month included green hydrogen specialist ITM Power, flooring company Victoria, Energean Oil & Gas and Primary Health Properties.

November was not a good time to bet against equities in general, even though some individual names had a tough time. The FTSE 100 posted strong gains in November as risk-on assets rallied in expectation that central banks have reached the peak of their hiking cycle.

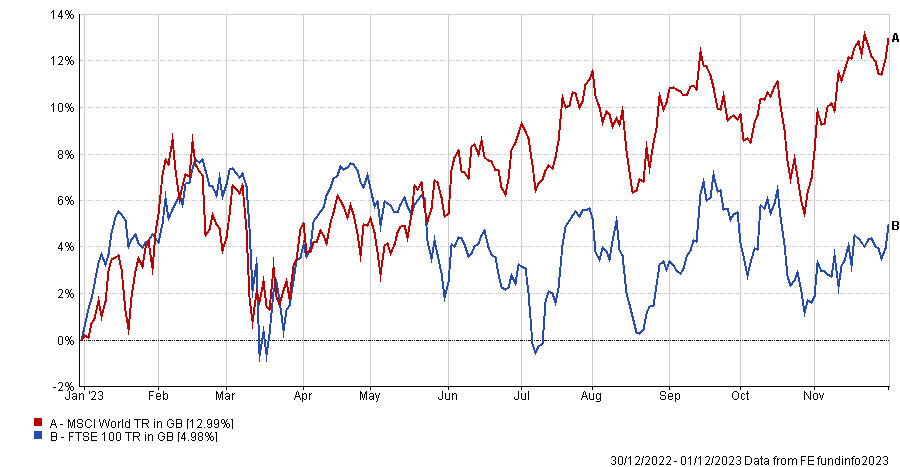

Total returns of FTSE 100 and MSCI World this year

Source: FE Analytics